By David Bautz, PhD

NASDAQ:EPIX

READ THE FULL EPIX RESEARCH REPORT

Business Update

IND Cleared to Start Phase 1 Clinical Trial of EPI-7386

On March 31, 2020, ESSA Pharma Inc. (NASDAQ:EPIX) announced that the company filed an Investigational New Drug (IND) application with the US FDA and on April 30, 2020, the company received clearance from the FDA to initiate a Phase 1 clinical trial of EPI-7386 for the treatment of metastatic castration-resistant prostate cancer (mCRPC).

We anticipate the Phase 1 clinical trial enrolling approximately 18 patients who are resistant to second-generation anti-androgens therapies (e.g., enzalutamide) to evaluate the safety, pharmacokinetics, and maximum-tolerated dose of the compound in multiple-dose escalations. It will encompass a standard 3+3 trial design (three patients enrolled per dose cohort) with an estimated 10 patients being enrolled in the dose expansion cohort.

The primary objective of the dose escalation portion is to establish the safety and efficacy of EPI-7386 with the secondary objective being to determine the maximum tolerated dose and the recommended Phase 2 dose. In the dose expansion portion of the trial, the primary objective will be to further evaluate the safety, tolerability, and preliminary anti-tumor activity of the recommended Phase 2 dose.

The company is also planning to initiate a combination trial with EPI-7386 and a ‘lutamide’ (enzalutamide, apalutamide, or darolutamide) in mCRPC patients due to the robust preclinical data showing increased activity with combination therapy. We estimate that the company is fully financed to conduct all three trials (the dose escalation trial, the dose expansion trial, and the combination trial).

Background on EPI-7386

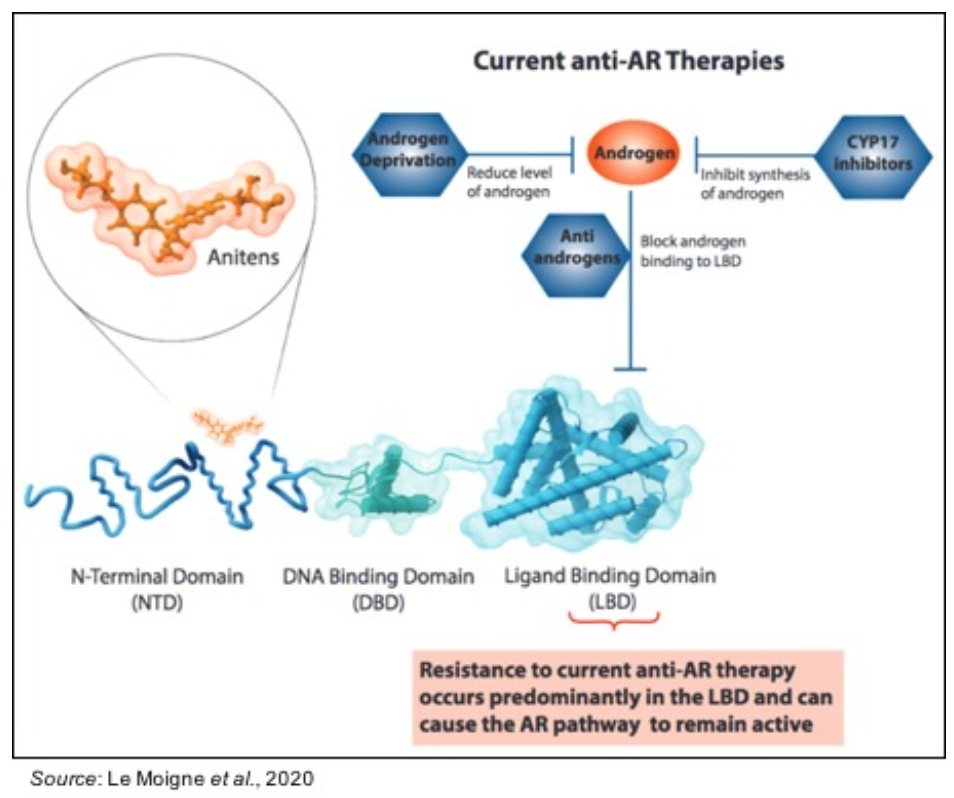

EPI-7386 is a next-generation ‘aniten’ compound that disrupts the androgen receptor (AR) signaling pathway through a unique mechanism of action that targets the N-terminal domain (NTD) of the AR, which is in contrast to the ligand-binding domain (LBD) of the AR that is targeted by all other AR-directed prostate cancer treatments. The following graphic, from a poster presented at the 2020 ASCO GU conference, shows where anitens bind on the AR compared to currently available anti-AR therapies, which fully differentiates anitens from other prostate cancer therapies that target the AR.

ESSA had previously tested a first-generation aniten compound, EPI-002, in a Phase 1 clinical trial in patients with mCRPC that were progressing after abiraterone or enzalutamide with serially rising PSAs (NCT02606123). While EPI-002 was shown to be safe and well tolerated, the compound exhibited a short half-life and minimal therapeutic exposure that led to suboptimal results. Therefore, ESSA embarked on a new discovery effort that ultimately led to EPI-7386, which has a number of positive attributes compared to EPI-002, including:

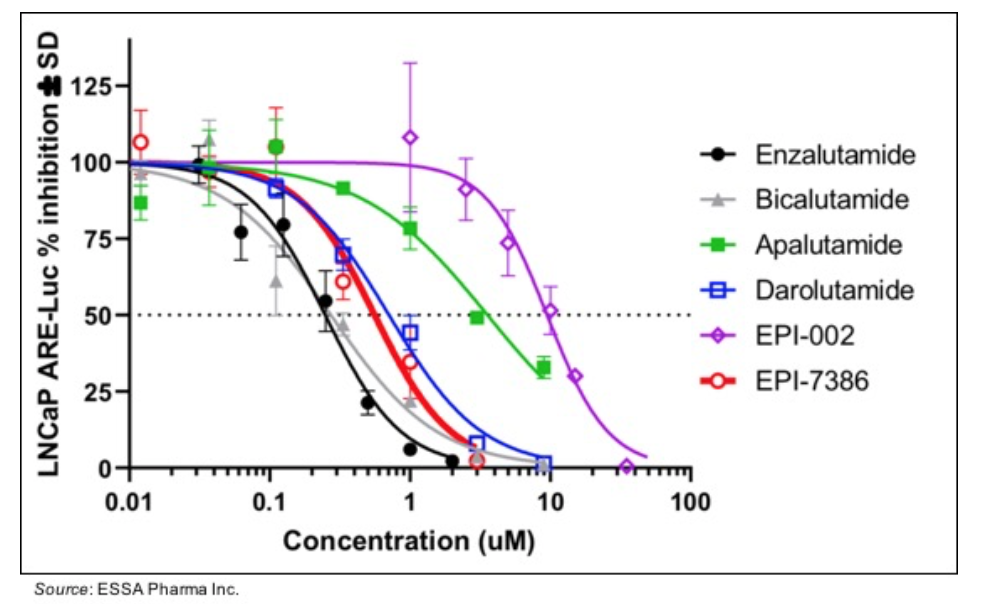

• Increased potency: the following chart shows a cellular inhibition assay in which various AR antagonists were tested along with EPI-002 and EPI-7386. The results show that EPI-7386 has a similar IC50 value compared with enzalutamide, bicalutamide, and darolutamide while EPI-002 had an IC50 value 20X higher than EPI-7386.

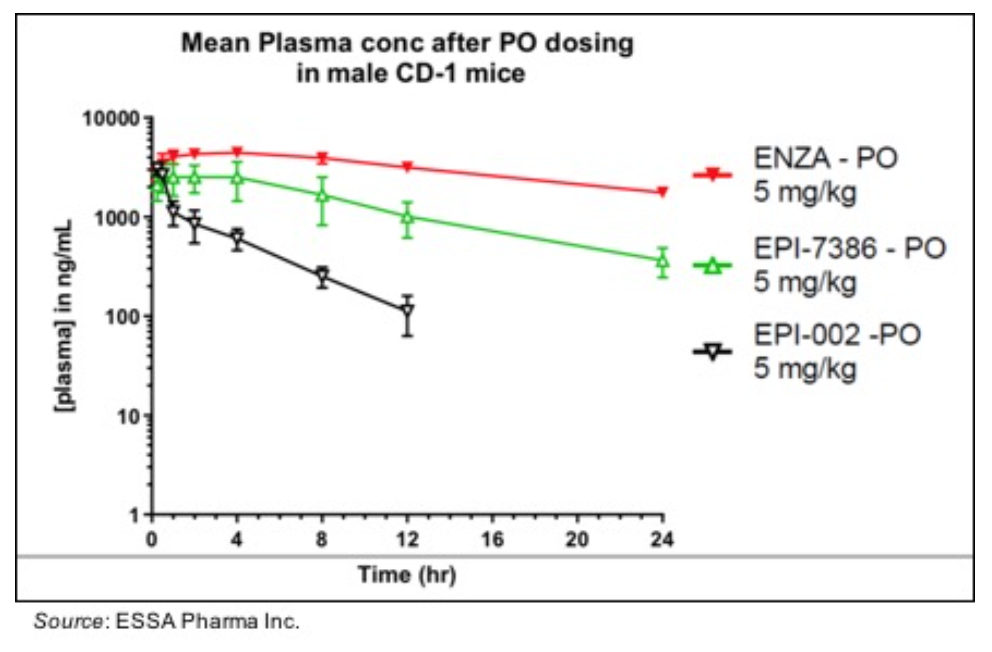

• Reduced in vitro metabolism: EPI-7386 exhibits in vitro hepatocyte stability that is approximately 10X greater than EPI-002 based on half-life and similar to what is seen with enzalutamide. In addition, the following graph shows that the PK profile in mice for EPI-7386 is similar to enzalutamide while EPI-002 showed a rapid reduction in plasma concentration over 12 hours.

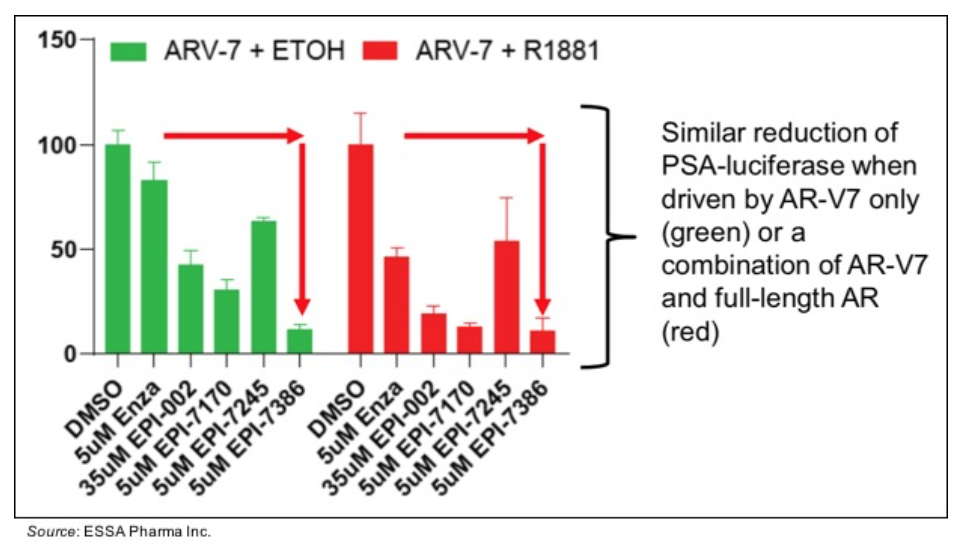

• Activity against AR-V7 in in vitro models: The following chart shows the results of an AR activity assay in which PSA is coupled to a luciferase reporter and tested against enzalutamide, EPI-002, and next-generation aniten compounds including EPI-7386. The assay was performed using the AR splice variant AR-V7, which shows androgen-independent activity (green bars), and using a combination of AR-V7 and full-length AR (R1881). The results show that EPI-7386 inhibits the activity of both full-length AR and the AR-V7 splice variant. This is in contrast to enzalutamide, which only shows activity against the full-length AR (red bars) but not against AR-V7, where activity is similar to that seen with only vehicle (DMSO) present.

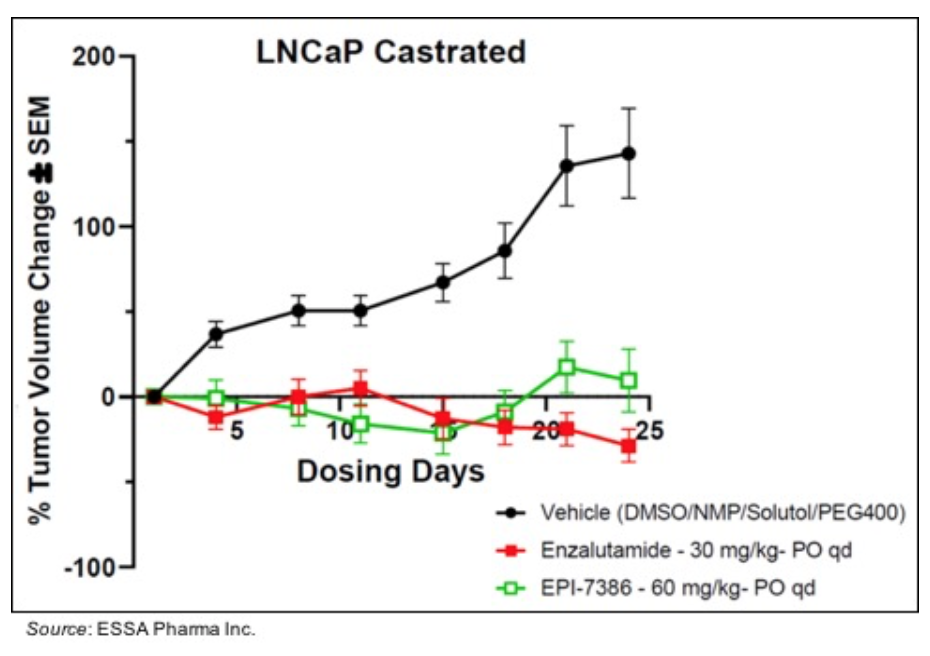

• Similar activity to enzalutamide in LNCaP xenograft models: The following graph shows the activity of both EPI-7386 and enzalutamide in an LNCaP xenograft model, which is driven by a full-length AR. Both drugs similarly inhibit the growth of the tumor in that model.

• Enhanced activity in VCaP xenograft model: The VCaP model is initially driven by full-length AR but is then followed by AR-V7-driven growth. The following graph shows that EPI-7386 shows significant and sustained antitumor activity in this model, while enzalutamide treated tumors show resistance to treatment after day 24. Interestingly, the combination of EPI-7386 and enzalutamide shows even greater activity than either drug on its own.

Financial Update

On May 7, 2020, ESSA Pharma announced financial results for the second quarter of fiscal year 2020 that ended Mar. 31, 2020. The company reported a net loss of $9.4 million, or $0.45 per share, for the second quarter of fiscal year 2020 compared to a net loss of $3.4 million, or $0.54 per share, for the second quarter of fiscal year 2019. R&D expenses for the three months ending Mar. 31, 2020 were $4.6 million compared to $1.5 million for the three months ending Mar. 31, 2019. The increase was primarily due to preparing the IND application for EPI-7386, preparatory clinical costs, manufacturing costs, and non-cash share-based payments. G&A expenses for the three months ending Mar. 31, 2020 were $4.9 million compared to $1.8 million for the three months ending Mar. 31, 2019. The increase was primarily due to non-cash share-based payments.

As of Mar. 31, 2020, ESSA Pharma had approximately $39.9 million of cash and cash equivalents. During the second quarter of fiscal year 2020 the company entered into an Open Market Sales Agreement with Jeffries LLC, in which ESSA may sell up to $35 million in common stock in ‘at-the-market’ transactions. As of Mar. 31, 2020, ESSA had approximately 20.8 million shares outstanding and when factoring in stock options and warrants the fully diluted share count of 38.2 million.

Valuation

We value ESSA using a probability adjusted discounted cash flow model that takes into account potential future revenues for EPI-7386. We model for ESSA to partner the asset and to receive a 15% royalty on net sales.

For EPI-7386, we estimate that the company will initiate a Phase 1 trial in 2020, a Phase 3 trial in 2023, and file for approval in 2025. While the opportunity could exist for accelerated approval with exceptional results, we believe our timeframe is a bit more conservative of an estimate. For the initial indication, which is patients with mCRPC who are no longer responding to anti-androgen therapy, we estimate there are approximately 30,000 in the U.S. and 80,000 in the E.U. who would be eligible for treatment based on the number of deaths attributed to prostate cancer each year. While this represents a potential billion-dollar opportunity on its own, we believe the much larger opportunity exists in combination therapy with earlier stage patients. We estimate there are approximately 160,000 patients who have either non-metastatic CRPC, metastatic hormone sensitive PC, or ADT-failing metastatic CRPC. When including these patients in our model we believe EPI-7386 could achieve peak sales of $4 billion worldwide. Using a 35% chance of approval along with a 13% discount rate leads to a net present value for EPI-7386 of $316 million. Combining the net present value of EPI-7386 with the company’s current estimated cash balance and dividing by an estimated fully diluted share count of 38.2 million leads to a valuation of approximately $10.50 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $30,000 annually for these services. Full Disclaimer HERE.