By Lisa Thompson

NASDAQ:NETE

READ THE FULL NETE RESEARCH REPORT

Mullen and Net Element (NASDAQ:NETE) released their S-4 merger document and we expect the deal to close sometime in Q3 or later, pending shareholder approval at a meeting still to be scheduled. A capital raise is expected simultaneously. After the merger, all that should be left in the public company will be Mullen’s EV business. The dealerships are not included. The payment processing business will be removed from the entity. After the merger the company plans to trade under the ticker MULN.

Overview of Reverse Merger Transaction with Mullen Technologies

Net Element and Mullen have a definitive deal for a triangular reverse merger with Mullen Technologies, a private company based in California. The closing of the transaction is conditional on SEC, shareholder and NASDAQ approval, and the completion of a capital raise of $10 million. The definitive merger document along with the Form S-4 and preliminary proxy statement has been issued and the scheduling of the shareholder’s meetings will be done shortly after the SEC deems the S-4 effective.

Net Element shareholders are expected to own at minimum 15% of the surviving company. If Net Element provides additional capital to Mullen in the way of notes, Net Element shareholders are entitled to an additional equity.

At Net Element’s current fully diluted enterprise value of $64 million (using a $11.15 stock price) and a 15% holding, this puts the entire valuation of Mullen Technologies at $427 million.

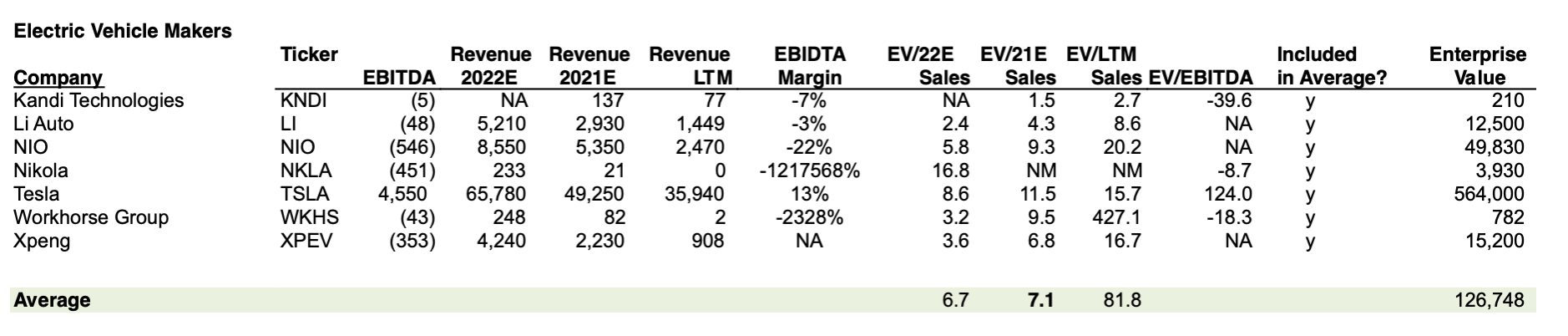

Until then, we can look at the valuations of other EV companies and (taking out Nikola), they trade at an average of 7.1 times 2021 sales. If Mullen can produce and sell 5,000 MX-05 SUVs at $55,000 per car that is revenue of $275 million and 200 Dragonflys at $150,000 add another $30 million. This adds to a conservative $305 million. 7.1 times that is an enterprise value of $2.2 billion by 2023. Keep in mind the company should need at least another $400 million to get there and we expect much of that could be loans.

So rather than $64 million, Net Element’s 15% could be worth $325 million in 2023 or $62.50 per share. Discounting 30% that for risk, dilution and time, we could easily see a current share price over $30 per share once the deal closes.

In the S-4 there is a description of how the fairness opinion was calculated. The author used three methods, although we have no idea what the revenue and EBITDA assumptions were. The author conclusions were that Net Element stock could be worth:

• It was calculated that Net Element’s enterprise value per share was $46 using publicly available revenue and EBITDA estimates compared with an average of recent SPAC transactions,

• Using established public auto companies comparables, it was determined the average EV/sales multiple was 3.5 times and the average EV/EBITDA was 15 times. Applying that to Mullen’s expectations yielded a discounted $45-$117 and $37-$98 per share using the two methods respectively.

An average of all three methods gives a mid point of $64.80 per share.

As of April 30, 2021, Mullen’s cash and cash equivalents amounted to $241,771 and its total debt amounted to $33 million, of which approximately $10.0 million will convert into shares of Series C Preferred Stock at the time of the merger. Mullen owed $3.8 million to the IRS and other tax jurisdictions related to payroll taxes and sales and use taxes. Mullen has agreed to sell $20 million of convertible notes (which will convert into Series C Preferred Stock immediately prior to the merger) and warrants to an unaffiliated investor immediately prior to the merger, the notes are convertible into Series C Preferred Stock at a per share conversion price of $.06877 and the warrants exercisable at $0.6877. In addition, Mullen expects to enter into an agreement with Esousa to provide a $30.0 million equity line of credit to it immediately after. Net Element may also raise additional capital prior to the merger to provide liquidity.

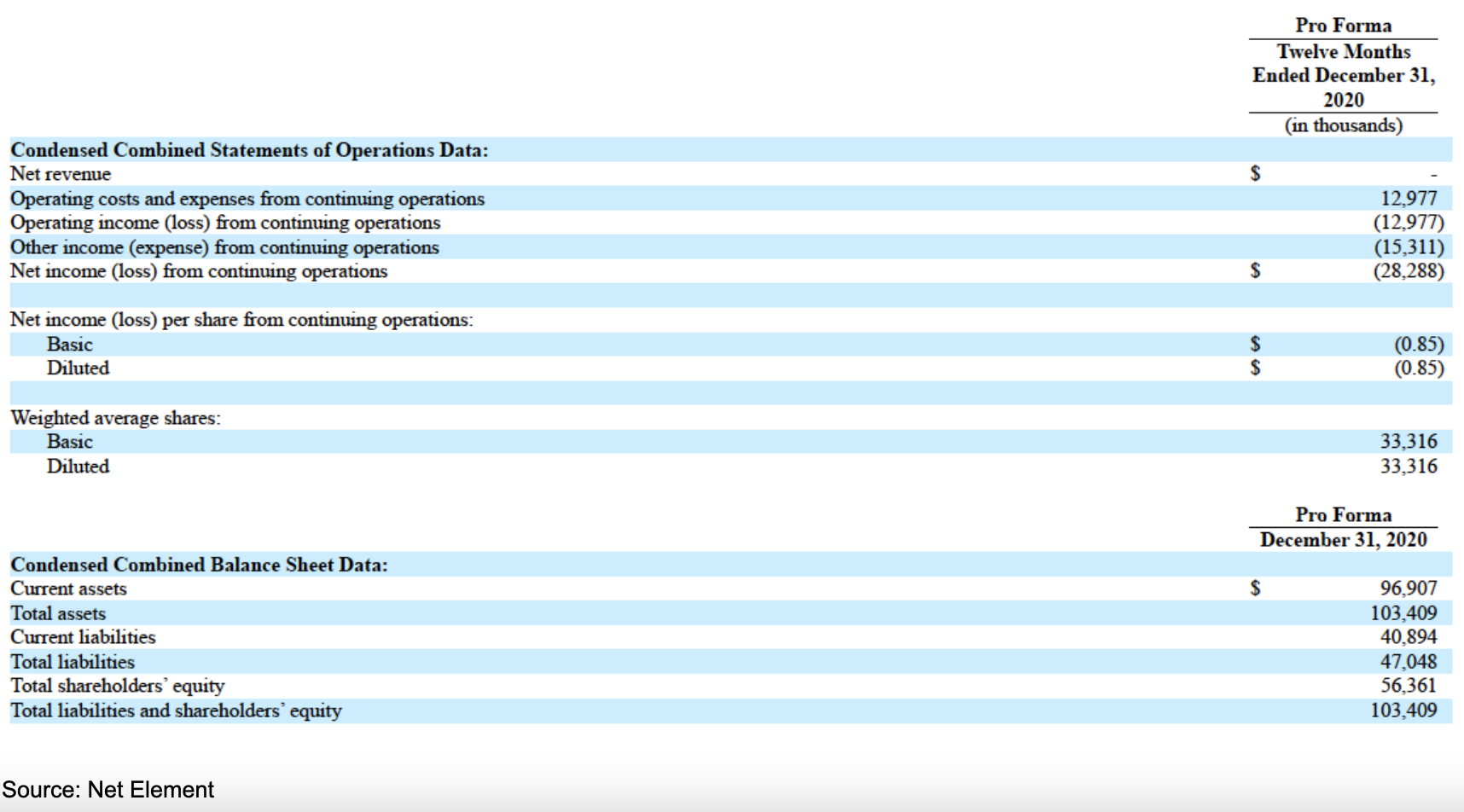

On a pro forma basis, Mullen would have looked as follows with a loss for 2020 of $28.3 million and liabilities of $47 million.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $40,000 annually for these services. Full Disclaimer HERE.