By Lisa Thompson

OTC:NEXCF

READ THE FULL NEXCF RESEARCH REPORT

NexTech (OTC:NEXCF) actually had a better quarter than we estimated with revenues virtually at the number is had been touting for bookings for Q4. Some of the confusion was from the difference between bookings and revenues and some by the fact that the company has changed the definition of bookings to exclude the eCommerce business going forward. The bookings number reported for Q4 2020 of $2.5 million now refers to just the AR business. In Q4 2020, eCommerce had an excellent Christmas with its sales up 88% from last year and going by cost of sales as an indicator, almost double its sales from Q3 2020. On the earnings call management let us know to expect another record revenue quarter in Q1 2021—surprising given it is sequentially after the Christmas quarter, and the large portion of sales from eCommerce in Q4 2020. The company is already at a $28 million revenue run rate.

NexTech said it plans to double its sales force in Q2, which has already been increased over the past few months with heavy hitters across the globe. After six months from hire, salesmen typically hit their strides and we should see results from here on out from previous hires.

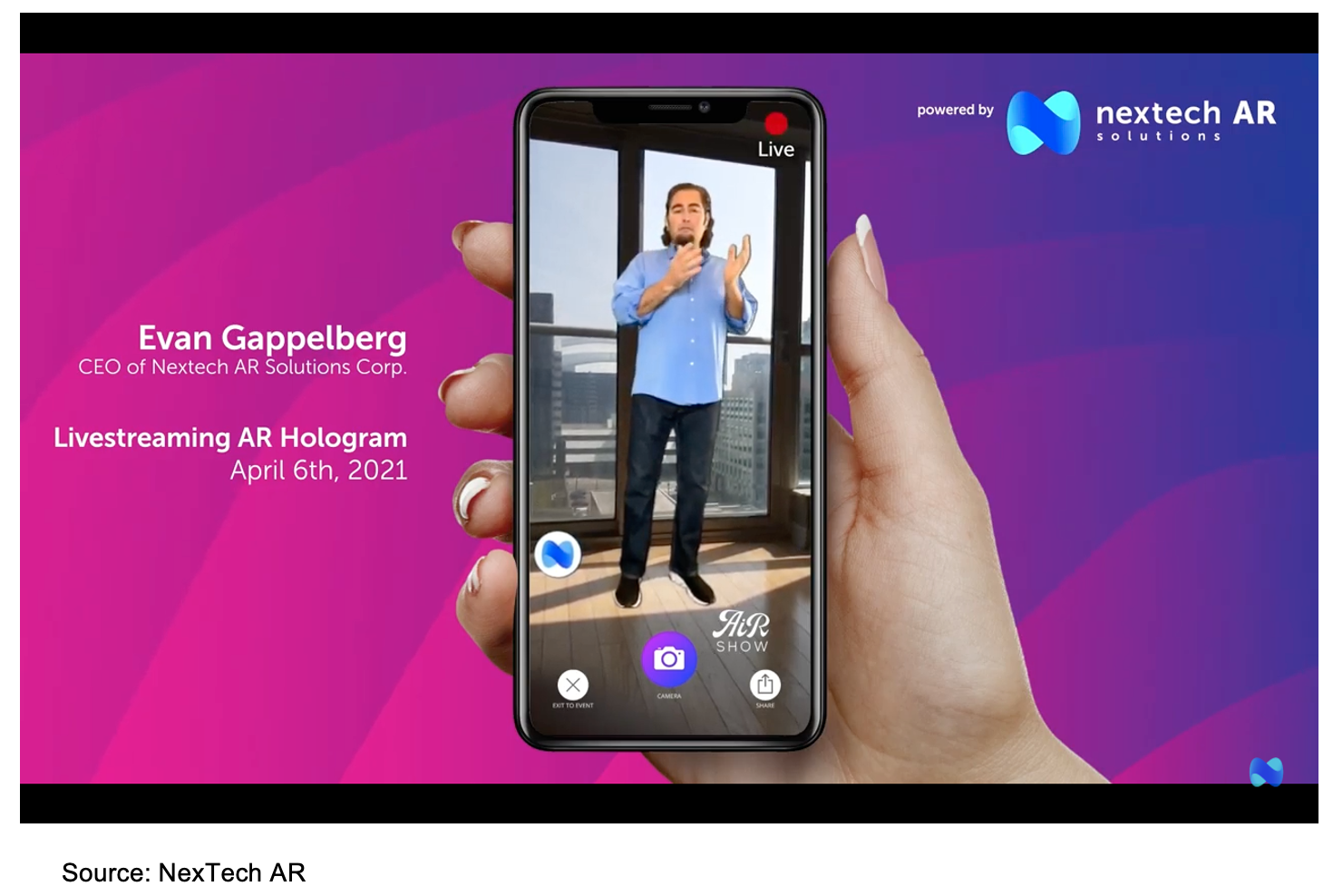

In addition to the remote conference business, we are looking for the company to start to sell AR ads on its ad network and to monetize its hologram technology. As a result the percent of revenues from AR products will grow as the year progresses and should easily reach management’s stated projection of 50% of total revenues for the year.

We are raising our revenue estimate for the year to $40 million and believe the company is well on its way to meeting or beating that. Our initial revenue estimate for 2022 is $67 million.

Q4 2020 Results

For the fourth quarter, NexTech announced revenues of $7.0 million, up 181% over last year and 50% sequentially. For the first time, the company gave segment breakdowns. These three segments are for eCommerce, Technology Services, and Renewable Software Licenses. The first is from product sales, primarily the vacuum business. It contributed $4.6 million in the quarter compared to $2.4 million a year ago, up 88%. Technology services are the revenues from everything that was not product sales minus revenues booked from software licenses, which are all from Jolokia who may contract with customers for longer than a single event. For example, a trade show would sign a contract for a show plus keeping the show up and available for a number events after the show occurred. In the quarter, $1.8 million of revenues came from Jolokia according to the SEDAR filing. This was 26% of sales compared to 21% of total sales in Q3 2020.

Gross margins were 48.2% of revenues or $3.4 million compared to 66.4% and $1.7 million a year ago and 63.4% or $3.0 million in Q3 2020. The decline in margin was due to product discounts during the competitive Christmas season as well as compensation associated with virtual events.

Operating expenses were $10.8 million compared to $8.3 million last year’s four month quarter. Of this, $1.3 million stock-based compensation compared to less than $84,000 last year. For the first time the company broke out stock-based compensation on the income statement, which renders operating categories unable to be compared to previous periods.

The operating loss was $7.5 million compared to $6.7 million a year ago and $4.7 million in Q3 2020. The net loss was $7.3 million versus $6.7 million and EPS loss was $0.09 compared to $0.12. Primary shares outstanding were 74.7 million for the period, up 38%.

The company showed an operating cash flow loss of $4.6 million for the quarter and free cash flow usage of $5.7 million. With $20 million currently in the bank, the company has plenty of runway at this cash burn level. The company has no intention of becoming cash positive for the foreseeable future.

Balance Sheet Update

NexTech ended the December quarter with $10.7 million in cash, $2.5 million in Bitcoin, working capital of $13.6 million, and no debt or convertible debentures. As of April 15, 2021 there were 81,407,809 primary shares outstanding. The fully diluted share count using the treasury stock method is now approximately 84.4 million shares. The company raised money in April and now has approximately $22 million in cash and is operating at approximately a $2 million per month cash burn rate.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $40,000 annually for these services. Full Disclaimer HERE.