By Lisa Thompson

OTC:POETF | TSX:PTK.V

READ THE FULL POETF RESEARCH REPORT

POET (OTC:POETF) (TSX:PTK.V) is exhibiting at the virtual OFC convention and investors are encouraged to sign up to visit the exhibits and see POETs products and its newly produced introduction video (https://youtu.be/9bdx5XdEbYo) where the new interposer is shown and the company’s strategy is described.

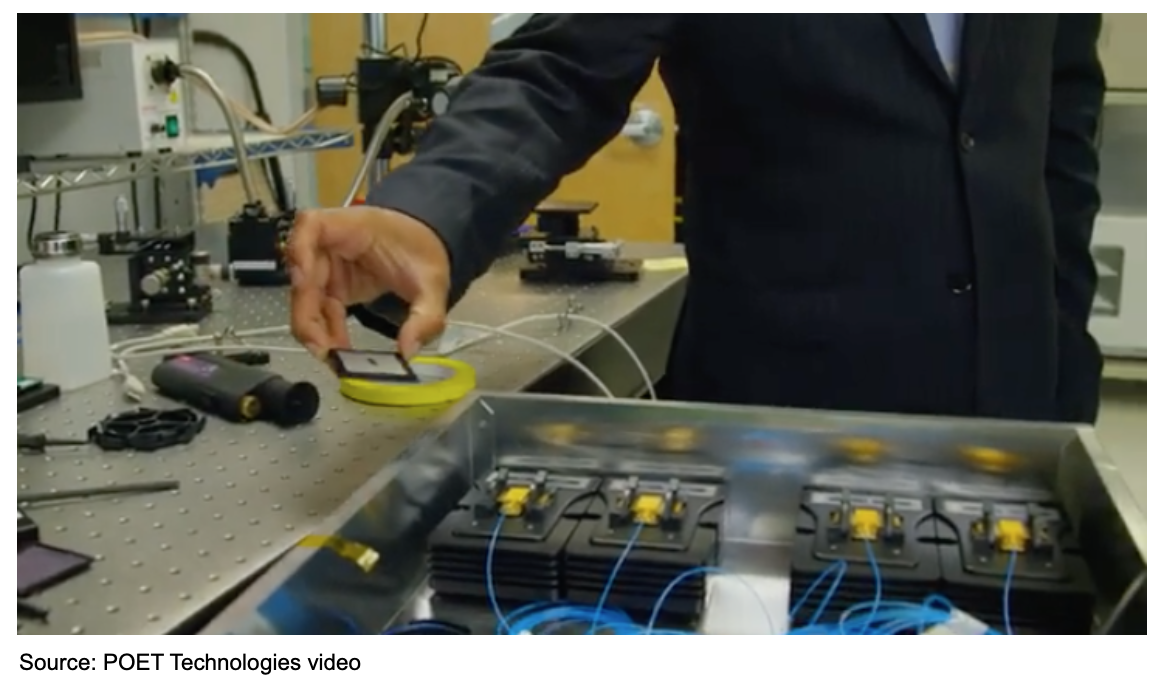

Figure 1: The POET Interposer Shown Next to the Components it Replaces

At the show the company announced that samples of its 100G and 200G CWDM4 Optical Engines will be available beginning in early July. POET also announced it would soon be offering 400G DR4 and FR4 transmit and receive optical engines and that samples of its receive optical engine will be available in September. Samples of the transmit engine, based upon high power CW (continuous wave) lasers and silicon photonic modulators, will be available beginning in Q4 2021.

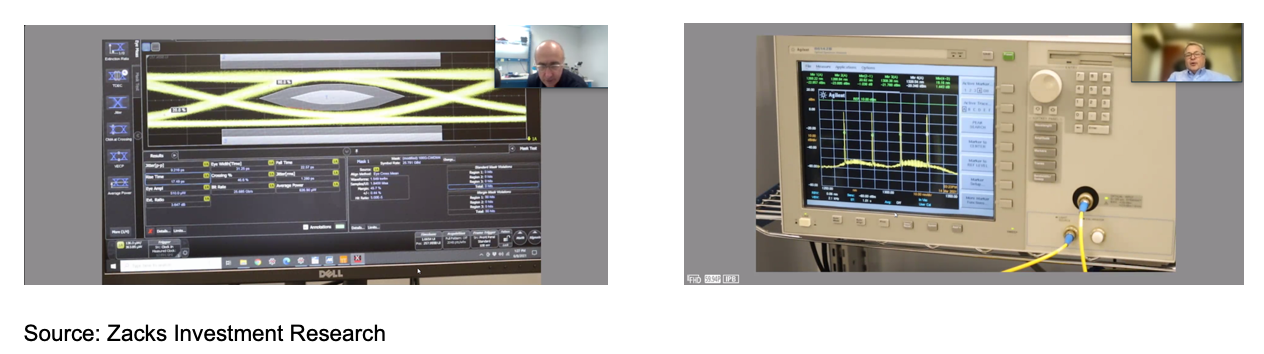

We saw the company’s live demo at the virtual Exhibition at the Optical Fiber Conference (OFC) and the company shows its product working and meeting and exceeding the standards required for multisource agreements. It also shows it registers a dynamically generated eye margin of 45%, proving few errors are generated. POET’s advantage is its lower cost as well as its smaller size---four of its interposers can fit in the same space as competitive solutions.

Q1 2021 Earnings Report

POET spent less than we expected in Q1 2021 in R&D. In Q1 2021, POET operating expenses increased to $3.9 million this year from $$3.3 million in Q1 2020, and decreased $895,680 sequentially with all of it being in R&D. In its filing POET stated it will invest approximately $6 million in development and engineering programs in the next three quarters to produce prototype samples of 100G and 200G optical engines in several configurations, including customized designs for specific customers or applications. Plus it will invest approximately $7 million in development and engineering programs over the next four to six quarters related to its 400G optical engine designs and fabrication. Most of this spending will be for salaries.

In Q1 2021, the company paid $235,000 in interest expense, slightly less than Q4 2020 last quarter and since it has fewer convertible debentures outstanding, we expect that to continue to decline.

The net loss was $4.5 million up from a profit of $5.0 million from continuing operations in Q4 2019. The profit was from the sale of DenseLight in last year’s quarter. This resulted in an IFRS loss per share of $0.02 per share and a non-IFRS loss of $0.01 per share, compared to a profit of $0.02 and non-IFRS breakeven quarter last year. Shares outstanding increased 1.9% to 293.9 million. As of March 25, 2021 there were 339.8 million shares outstanding, or 404 million shares fully diluted.

Balance Sheet

POET Technologies ended the March quarter with $23.5 million in cash and $1.2 million in convertible debentures. Working capital was $20.4 million.

On February 11, 2021 POET sold 17.6 million units at CN$0.85 per unit, to raise gross proceeds of up to $15 million. In addition POET received $8,477,826 from the exercise of stock options and warrants during the quarter and $2.3 million worth of POET’s convertible debentures were converted into common stock.

If the company burns $3.5 million per quarter, that should get it six or seven quarters of runway even without any revenues. That would be to the end of 2022 by which time we expect it to be generating meaningful revenues. Any revenue between now and then will get it even further. There are now 344 million primary shares outstanding and 399 million fully diluted, as well as 73.1 million warrants and options outstanding that are in the money, which could raise an additional $25.5 million dollars. The company expects that at the least the $0.52 warrants which expire November 2nd will bring in an additional $6.3 million. It believes that it needs approximately $30 million in cash to get through the next two years.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $40,000 annually for these services. Full Disclaimer HERE.