By David Bautz, PhD

OTC:MSCLF

READ THE FULL MSCLF RESEARCH REPORT

Financial Update

Raises Gross Proceeds of $55 Million to Advance Lead Compound to Clinical Trials

On My 17, 2023, Satellos Biosciences Inc. (OTC:MSCLF) announced it closed an equity offering in which it raised gross proceeds of $55 million from the issuance of 110 million equity securities at $0.50 per common share or pre-funded warrant (70,297,220 common shares and 39,702,780 pre-funded warrants). The following funds participated in the offering: Avidity Partners, Qiming Venture Partners USA, Perceptive Advisors, Soleus Capital, FMB Research, Allostery Investments, and other leading healthcare specialized institutional investors. The net proceeds of the offering will be utilized to advance the company’s lead program for a small molecule to treat Duchenne muscular dystrophy (DMD) through preclinical studies, IND submission, and Phase 1 studies.

1Q23 Financials

On March 29, 2023, Satellos announced the closing of its previously announced non-brokered private placement offering of 10% unsecured non-convertible debenture units for gross proceeds of CAD$2.385 million. A total of 2,385 units were issued in the offering, with each unit comprised of: 1) CAD$1,000 principal amount of unsecured non-convertible debentures of the company, and 2) common shares in the company (“bonus shares”) equal to CAD$100 divided by CAD$0.355 (closing market price of the common shares on the TSX Venture Exchange on March 15, 2023. An aggregate of 671,825 bonus shares were issued in connection with the offering.

On May 30, 2023, Satellos announced financial results for the first quarter of 2023. Net loss for the first quarter of 2023 was CAD$1.7 million compared to CAD$2.1 million for the first quarter of 2022. The decrease in net loss was primarily due to reduced spending on professional fees, G&A, and stock-based compensation. R&D expenses net of refundable tax credits were $0.72 million for the first quarter of 2023 compared to $0.70 million for the first quarter of 2022. The increase was due to increased R&D contractor activity.

As of March 31, 2023, Satellos had approximately CAD$3.0 million in cash and cash equivalents. As mentioned above, subsequent to the end of the quarter the company raised gross proceeds of $55 million. Following the financing, we estimate that the company has approximately 112.8 million common shares outstanding and, when factoring in stock options and warrants, a fully diluted share count of 169.1 million.

Business Update

Preclinical Data for SAT-3153 Presented at MDA Conference

In March 2023, Satellos announced the presentation of preclinical proof-of-concept data for its lead development compound, SAT-3153, at the Muscular Dystrophy Association Clinical and Scientific Conference. The company had previously announced the designation of SAT-3153 as its lead development candidate. SAT-3153 is a protein kinase inhibitor that targets a particular protein in the Notch signaling pathway (codenamed “K9”). Following results obtained through genetic ablation of K9, Satellos hypothesized that targeting K9 could modulate asymmetric muscle stem cell division. Since K9 is already the target of other pharmaceutical interventions in a different disease setting, Satellos was able to synthesize existing K9 inhibitors to test the hypothesis. These studies showed that inhibiting K9 resulted in modulation of muscle stem cell division, enhanced muscle regeneration, and increased muscle mass/function.

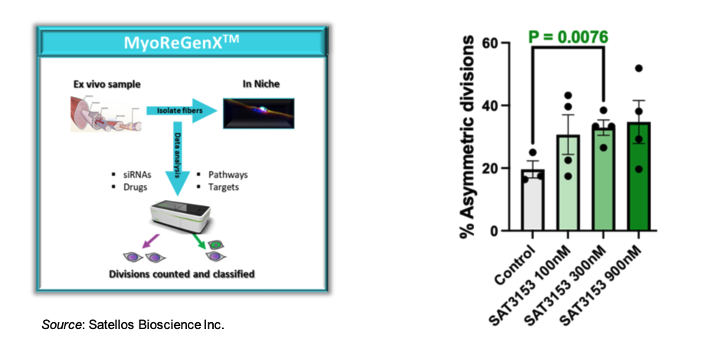

A copy of the company’s presentation at MDA 2023 can be found here. The following graph shows that SAT-3153 restores muscle stem cell polarity and asymmetric divisions in a cell-based assay. The figure on the left describes the company’s MyoReGenX™ system, in which muscle fibers are cultured and treated with investigational compounds to determine their effect on cell division. The graph on the right shows a dose-dependent increase in the percentage of asymmetric cell divisions with increasing concentrations of SAT-3153.

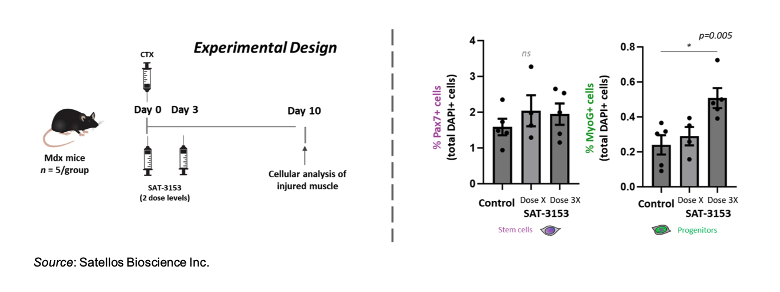

SAT-3153 is also able to restore asymmetric division in vivo. The following figure shows an experiment in Mdx mice, which are used as a model for studying Duchenne muscular dystrophy (DMD). Mice were administered SAT-3153 on Day 0 and 3 following an injection to induce cardiac cell injury and cellular analysis was performed on Day 10. The figure on the right shows that SAT-3153 does not change the number of stem cells, however it does significantly increase the number of progenitor cells.

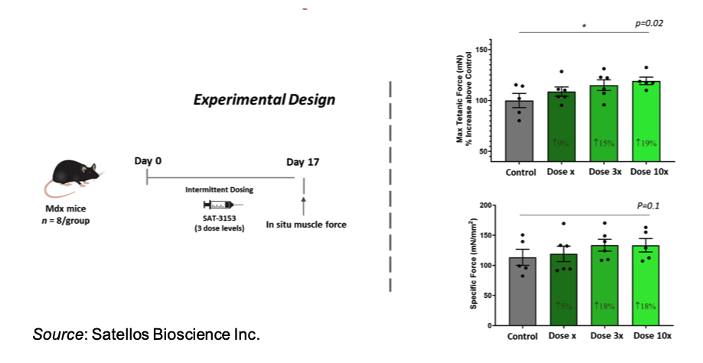

Lastly, the increase in progenitor cells is accompanied by an increase in muscle force. SAT-3153 was given at various doses on different dosing schedules and the maximum muscle force was then measured. The results show that SAT-3153 increased specific muscle force in a dose dependent manner, indicating that the muscle being regenerated is functional.

These results are very encouraging and suggest that SAT-3153 is able to recapitulate the results seen upon genetic ablation of K9 and that the drug is having a positive effect on muscle stem division. We look forward to additional updates from the company as it works toward an IND filing in the first half of 2024.

Conclusion

The $55 million financing for Satellos is an exciting development for the company and secures the capital necessary to carry SAT-3153 through pre-clinical development and into Phase 1 clinical studies. We continue to anticipate an IND filing in the first half of 2024 for SAT-3153 such that a first-in-human Phase 1 study can be initiated in the second half of 2024. We had previously accounted for an expected large financing in our model, thus our valuation remains at $0.70.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.