By Ronald Wortel, MBA, P. Eng.

OTC:GOTRF

READ THE FULL GOTRF RESEARCH REPORT

Goliath Resources (OTC:GOTRF) provides investors with exposure to gold, silver, and copper resource exploration, as well as leverage to an increasing in-ground inventory with discovery upside, during a gold price market that has reached new all-time highs. The downside is limited by the expected significant positive news flow ongoing in 2026.

Since our last update, the Company completed more than 64,000 m providing infill, depth, and lateral testing of the Surebet prospect. Positive results are being released with 88 of 105 holes remaining. Now raising C$23 million at premiums to fund the 2026 drill program.

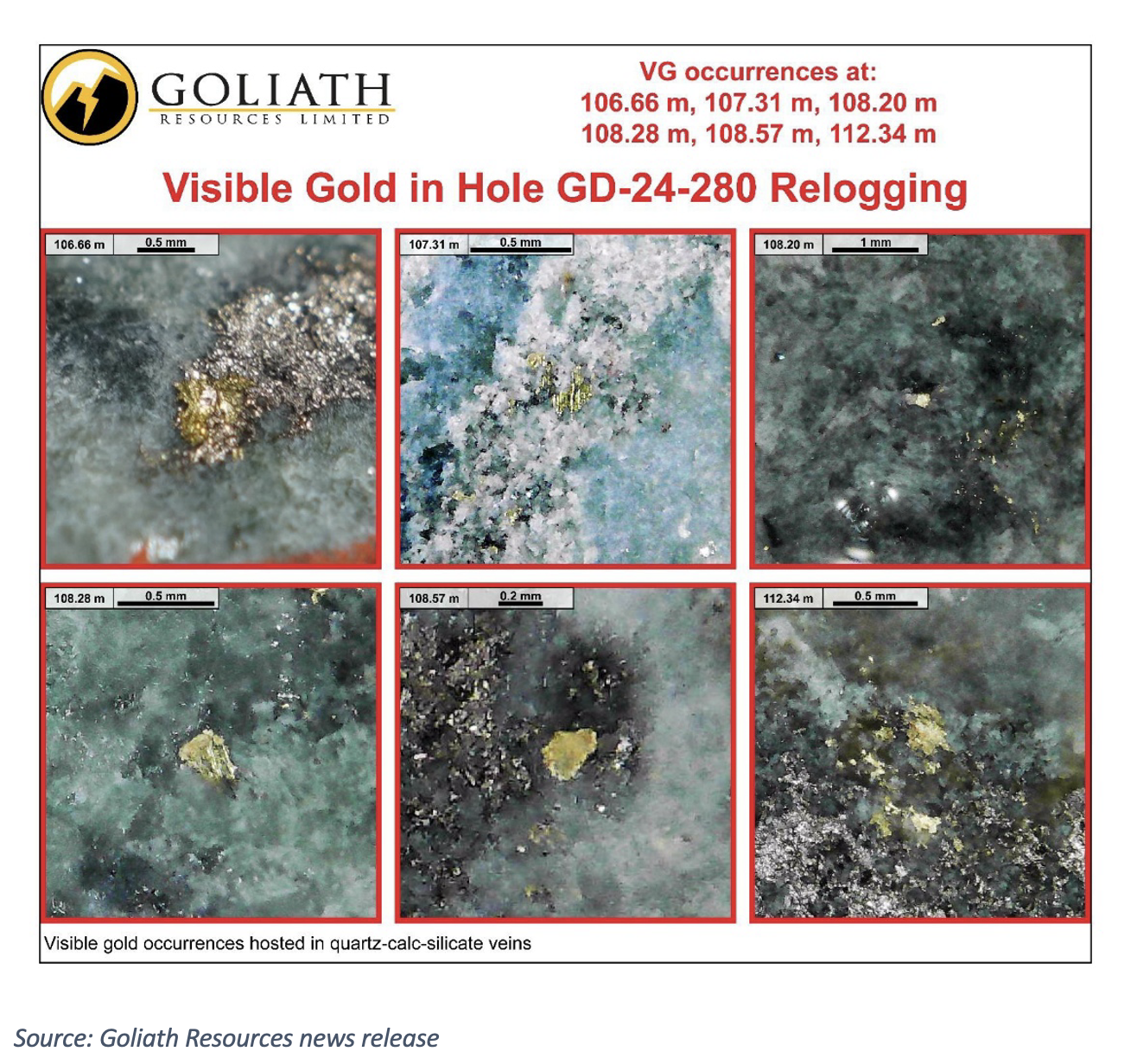

Goliath Resources’ Surebet Discovery continues to deliver high-impact results, confirming its status as a premier high-grade gold system in British Columbia’s Golden Triangle. The 2024–2025 drill programs yielded a 94% and 76% visible gold intersection rate, respectively, with 100% of holes intersecting quartz-sulphide mineralization. Key intercepts include 132.93 g/t GoldEq over 10.00 meters (Bonanza Zone), 12.03 g/t GoldEq over 10.00 meters (RIRG dykes), and 10.60 g/t Gold over 22.82 meters (calc-silicate breccia). The mineralized footprint spans 1.8 km², remains open, and includes 12 stacked veins and four Eocene-aged dykes. Metallurgy confirms 92.2% gold recovery, including 48.8% free gold via gravity. A new magmatic-source model across three rock packages enhances tonnage potential and supports future resource definition. These results materially de-risk the project and position Goliath for valuation uplift.

Our new fair market value for the stock is given as US$4.90, a change of US$0.86 from our last report based on these factors. This valuation represents a 159% premium on the current market price of US$1.89.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.