By John Vandermosten, CFA

NASDAQ:LGND

READ THE FULL LGND RESEARCH REPORT

Ligand Pharmaceuticals, Inc. (NASDAQ:LGND) held its 2025 analyst day on December 9th, 2025, at the Harvard Club in New York City. The morning presentations highlighted the company’s achievements for 2025 and looked ahead to 2026, providing financial guidance for the next year. Details of the event are included in a press release and slide deck provided on Ligand’s website.

Guidance for 2026 calls for revenue of $245 to $285 million, representing a 15% year-over-year increase at the midpoint. Earnings per share is estimated to be from $8.00 to $9.00, calling for a 13% increase at the midpoint. Primary drivers of the year-over-year guidance increase are a rise in royalty revenues from Filspari, Ohtuvayre, and Zelsuvmi. The company also lifts its five-year outlook by one percentage point to a compound annual growth rate (CAGR) of 23%. The driver of the higher expectations comes from a two-percentage point increase in existing commercial programs to 15% partially offset by a 1% reduction in the contribution of future investments to 3%.

The Event

Company representatives included CEO Todd Davis; CFO Tavo Espinoza; SVP of Investments Paul Hadden and Rich Baxter; VP of Strategic Planning Lauren Hay; and SVP of the Captisol business Dr. Karen Reeves. The presentation began with a CEO overview of 2025 and new investments made over the prior year, which described Ligand’s four investment categories: Royalty Monetization, Project Finance, Special Situations, and Platforms.

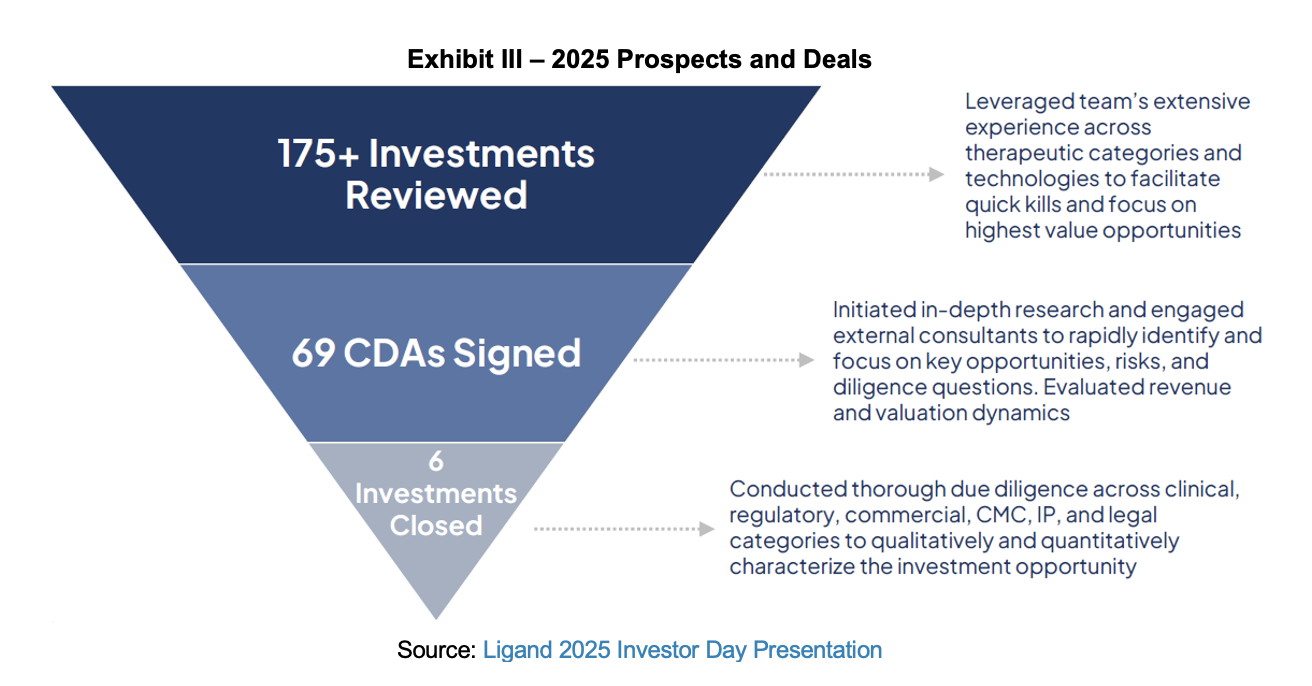

CFO Tavo Espinoza took the podium next to review 2025 results to date and to present 2026 guidance and longer-term forecasts. Optimism over long-term opportunities is enhanced by the $460 million capital raise executed in August and strong performance from key commercial products. Tavo handed the baton to Paul Hadden, who reviewed the growth of the investment team, Ligand’s investment process, and key transactions that took place in 2025. Paul was followed by Rich Baxter, who provided a deep dive on the company’s approach to special situations and its investment in Pelthos Therapeutics.

Rich invited the CEO of the recently spun out Pelthos to speak to the assembled group. Scott Plesha ascended to the dais to share recent accomplishments for the company and its commercialized indications. As a reminder, Ligand owns about half of Pelthos, has participated in its recent convertible capital raise and receives a royalty from its products.

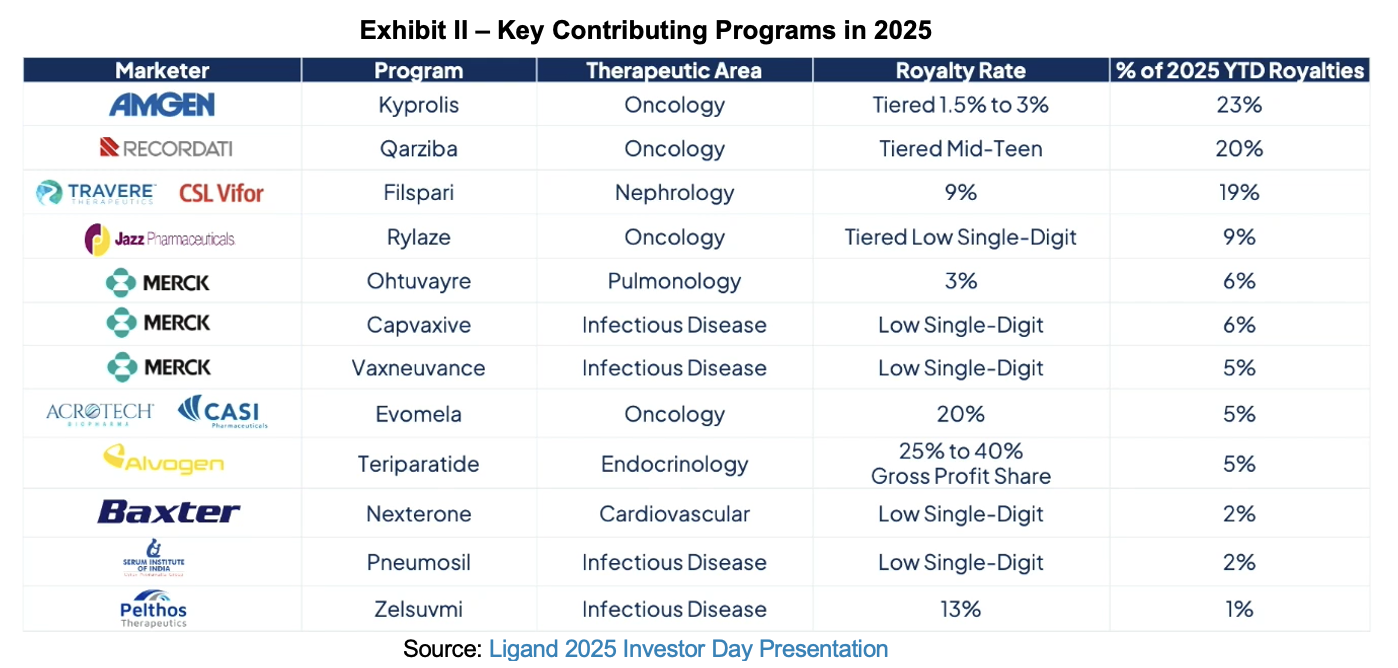

Lauren Hay followed with an update of primary contributors to Ligand’s portfolio and some of the upcoming milestones, which can drive higher than expected growth if successful. Captisol’s chief, Dr. Karen Reeves, then gave a review of the Captisol technology platform. In closing, she enumerated the 17 underlying approved products using the solubility, stability, and bioavailability agent. As the formal presentation concluded, CEO Todd Davis again took the podium, reviewed the business model and the presented content, then opened up the floor for questions. Analyst questions were predominantly focused on Ligand’s newly issued guidance and future opportunities for Pelthos.

Looking Ahead

Ligand is conservative in its estimates, and its estimation model heavily discounts the probability of success for development programs. There are several catalysts and emerging opportunities that may lift 2026 results above guidance. This includes an additional $500 million investment by Merck in Ohtuvayre commercialization and its new bronchiectasis indication. Filspari may have the most additional potential with a new indication in Focal Segmental Glomerulosclerosis (FSGS), up for FDA approval in January. An important consideration for FSGS is that it offers the same number of patients as IgA nephropathy, but at twice the dose. Filspari also has new geographical opportunities in Japan. Zelsuvmi growth from a small base could be another surprise, and in addition to strong anticipated sequential growth, there will be a full year of sales in 2026 for this molluscum contagiosum treatment.

Other opportunities further down the road apply to other Ligand partner development products. Qarziba has two impending catalysts which can expand the addressable market. The first is a new indication in Ewing sarcoma, and the second is a submission to the FDA for relapsed neuroblastoma with data from the BEACON 2 trial. Qtorin Rapamycin is being evaluated in multiple indications, including microcystic lymphatic malformations (MLM), where clinical and regulatory milestones are expected over the next two quarters.

Ligand has increased the upper end of its target investment range from $20 to perhaps as much as $60 million per transaction. With the additional capital from the August convertible issuance and a material increase in expected future cash flows, Ligand is in a dominant position to execute on the 69 active Confidential Disclosure Agreements (CDAs) that have been signed.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.