By John Vandermosten, CFA

NASDAQ:LNTH

READ THE FULL LNTH RESEARCH REPORT

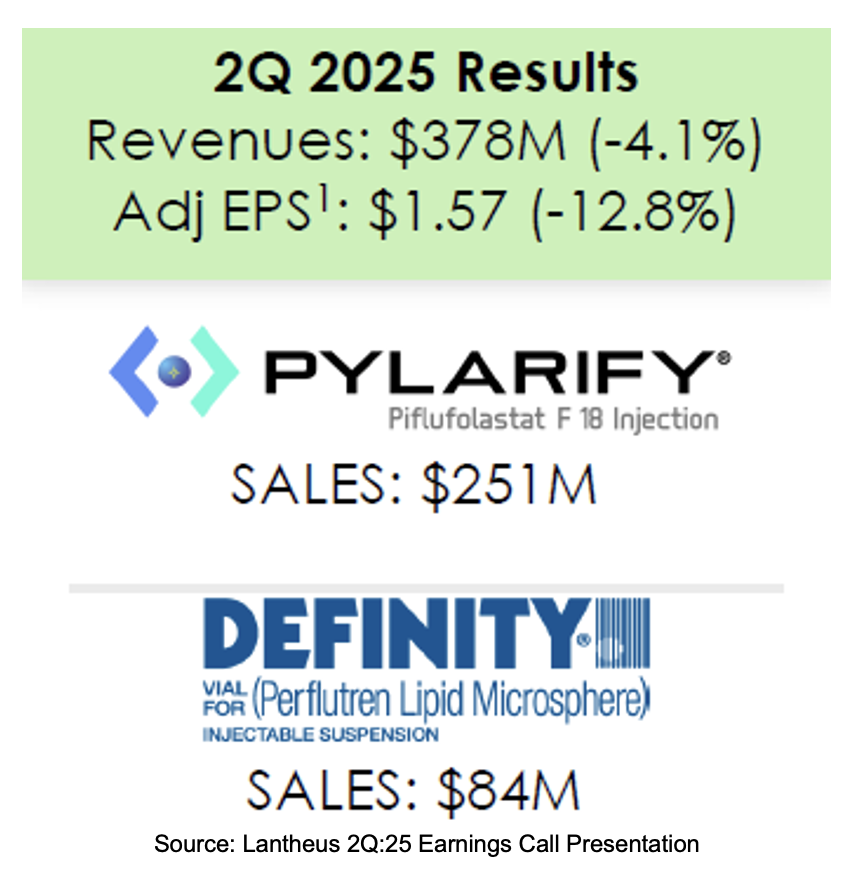

Lantheus Holdings, Inc. (NASDAQ:LNTH) reported second quarter 2025 financial and operational results on August 6th, producing sales of $378 million, a 4% decrease compared to 2Q:24 levels. Pylarify and TechneLite saw a year over year decline which was partially offset by an increase in revenue from Other Precision Diagnostics, Strategic Partnerships and Definity sales. Free cash flow generation was $79 million in 2Q:25; however, the cash balance decreased sequentially due to payments for the Evergreen acquisition and repurchase of common stock. Other notable events since our previous update include participation at several investment conferences, consummation of the Life Molecular Imaging acquisition, a new head of research and development and FDA acceptance of a new drug application (NDA) for a reformulated Pylarify.

Along with its 2Q:25 report, the company reduced its revenue and earnings guidance. Competition intensified in PSMA PET imaging as lower pricing impacted Multiple Unit of Comparison (MUC) based reimbursements. This reduced reference prices thereby forcing providers to demand price reductions. Lantheus accepted some reductions and walked away from others with the goal of maintaining the long-term premium for Pylarify. This led to lower-than-expected second quarter Pylarify revenues. The change in the pricing environment led management to reduce full year revenue guidance by about 4.8% and lower EPS estimates by about $1.00 to a range of $5.50 to $5.70.

Despite a reduction in our target price, we see substantial value in Lantheus’ development pipeline. We think the management team has correctly identified neuroimaging as a substantial growth area and its investment into four assets in this space along with a commercialization team provides the company a head start when it obtains approval for its neuro-imaging assets. Beyond anticipated launch of four new products over the next 18 months, the company has relationships with other R&D companies providing an early look at innovative radiopharmaceuticals moving to approval. Strong cash flow provides the funds needed to advance Lantheus’ pipeline in a financial environment where other development companies are having trouble raising capital and established companies are facing patent cliffs.

2Q:25 Financial and Operational Results

Lantheus announced second quarter 2025 results in an August 8th press release followed by a conference call before the market open. A slide deck was provided to guide investors through the event. The company subsequently filed Form 10-Q with the SEC. Second quarter revenues totaled $378 million down 4% vs. prior year levels producing GAAP earnings of $1.12 per share and adjusted earnings of $1.57 per share.

For the quarter ending June 30th, 2025 relative to the same prior year period:

- Net sales were $378 million down 4% from $394 million recorded in the same prior year period. The decrease was driven by an 8.3% fall in Pylarify revenues due to lower pricing. The TechneLite segment, which is expected to be divested by year end, fell 11.4%. Other segments partially offset the fall as Definity rose 7.5% on difficult prior year comparisons. Other Precision Diagnostics rose 18.3% with help from Neuraceq and Strategic Partnerships and Other increased 32.8%;

- Cost of goods sold fell 1% to $137 million and gross margin was impacted by a decrease in Pylarify price partially offset by a reduction in vendor costs. Product gross profit margin fell to 62.6% from 64.1%[1];

- Sales and marketing expenses were $41.0 million, down 9% from $45.0 million resulting from a reduction in employee-related costs and a decrease in third party vendor and other marketing spend;

- General and administrative expenses were $66.5 million vs. $47.4 million, increasing 40%. The change was attributable to the acquisition of Evergreen, related increases in headcount and settlement of Evergreen stock awards generating higher stock-based compensation and professional fees;

- Research and development expenses were $45.5 million, down 25% from $60.6 million. The decrease was related to prior year option payments to Life Molecular and Radiopharm Theranostics for development rights which did not recur in 2Q:25. This decline was partially offset by a payment to AstraZeneca to reduce future royalty obligations for NAV-4694, expenses related to the Evergreen acquisition and increases in project costs in 2Q:25. R&D was 12% of revenues;

- Interest expense was $4.9 million, essentially flat with prior year levels of $4.9 million and related to the 2.625% convertible senior notes due in 2027 and cost of maintaining access to the 2022 revolving facility;

- Investment in equity securities was a net unrealized gain of $14.6 million related to the carrying value of Perspective and Radiopharm’s common stock;

- Other income was ($6.9) million vs. ($9.0) million due to lower contributions from cash balance interest;

- Income tax of $25.8 million represents a 24.6% tax rate with deferred and state income taxes explaining the difference between it and the US statutory rate;

- GAAP net income was $78.8 million or $1.12 per diluted share. Adjusted net income as presented by Lantheus was $110.6 million or $1.57 per diluted share. The difference between the two is explained in part by the removal of stock and incentive plan compensation, strategic collaboration and license costs, amortization of acquired intangible assets, acquisition, integration and divestiture-related costs partially offset by unrealized gain in investment securities and income tax effect of non-GAAP adjustments.

On June 30th, 2025, Lantheus held $696 million in cash and equivalents compared to $913 million at the end of 2024. Free cash flow for 2Q:25 was $79 million vs. $20 million in the same prior year quarter. Material items contributing to the quarter over quarter decline in the cash balance include a $100 million repurchase of Lantheus stock and a $269 million payment for Evergreen. After the end of the second quarter, Lantheus paid $355 million to close its acquisition with Life Molecular Imaging. Also following the end of the quarter, the board approved a $400 million share repurchase program. Due to severe pricing competition for PSMA imaging products, Lantheus lowered its 2025 guidance. The 2025 revenue range was reduced almost 5% to $1.475 billion to $1.51 billion and the earnings per share range was decreasedan by $1.00 to $5.50 to $5.70. There was no modification to previous free cash flow guidance of $550 to $600 million which was provided in the 4Q:24 slide deck.

New Pylarify Formulation NDA Submission

Prior to the second quarter earnings report, Lantheus announced that the FDA had accepted its new drug application (NDA) submission of a new formulation of its F-18 prostate-specific membrane antigen (PSMA) imaging agent through its affiliate, Aphelion. The agency has set the applications’ target action date on March 6th, 2026. The new formulation increases batch size allowing wider effective distribution. The higher radioactive concentration will allow the product to reach new geographic locations. Based on management comments, we anticipate approval by March 2026, coding coverage in the following months and a transitional pass through (TPT) payment application by June 2026. The company estimates that TPT pricing could be available between October 2026 to January 2027. In parallel, Lantheus will need to modify its PET manufacturing facilities (PMFs) and have them approved to manufacture the new formulation.

Oral Presentations at SNMMI

Lantheus representatives made several presentations at the Society of Nuclear Medicine and Molecular Imaging (SNMMI) Annual Meeting in June. The event was held in New Orleans, Louisiana June 21st to 24th, 2025 and is further described in a press release.

- Oral presentation by Gengyang Yuan of Lantheus on LNTH-1363S

- Poster Presentation by Amir Iravani, University of Washington on Pylarify

- Poster presentation by Ida Sonni of the University of California Los Angeles on LNTH-1363S

- Poster presentation by Gyu Seong Heo of Washington University on LNTH-1363S

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

[1] We calculate gross margin as 1-COGS/(revenues from Pylarify, Definity, TechneLite and Other Precision Diagnostics) as reported in company filings. We exclude revenues from Strategic Partnerships and Other from the calculation.