By John Vandermosten, CFA

NASDAQ:RADX

READ THE FULL RADX RESEARCH REPORT

On October 28th, Radiopharm Theranostics Limited (NASDAQ:RADX) announced its first quarter cash flows in its Activities and Cash Flow Report, disclosing a cash balance of A$19.0 million as of September 30th, 2025. During the quarter, the company received an R&D tax refund of A$4.6 million, producing a net cash burn of (A$10.1) million. After the end of the reporting period, Radiopharm completed an equity placement raising A$35 million and opened up another A$5 million in opportunity for small investors. Contributors to the funding included long-term partner Lantheus and other institutional investors.

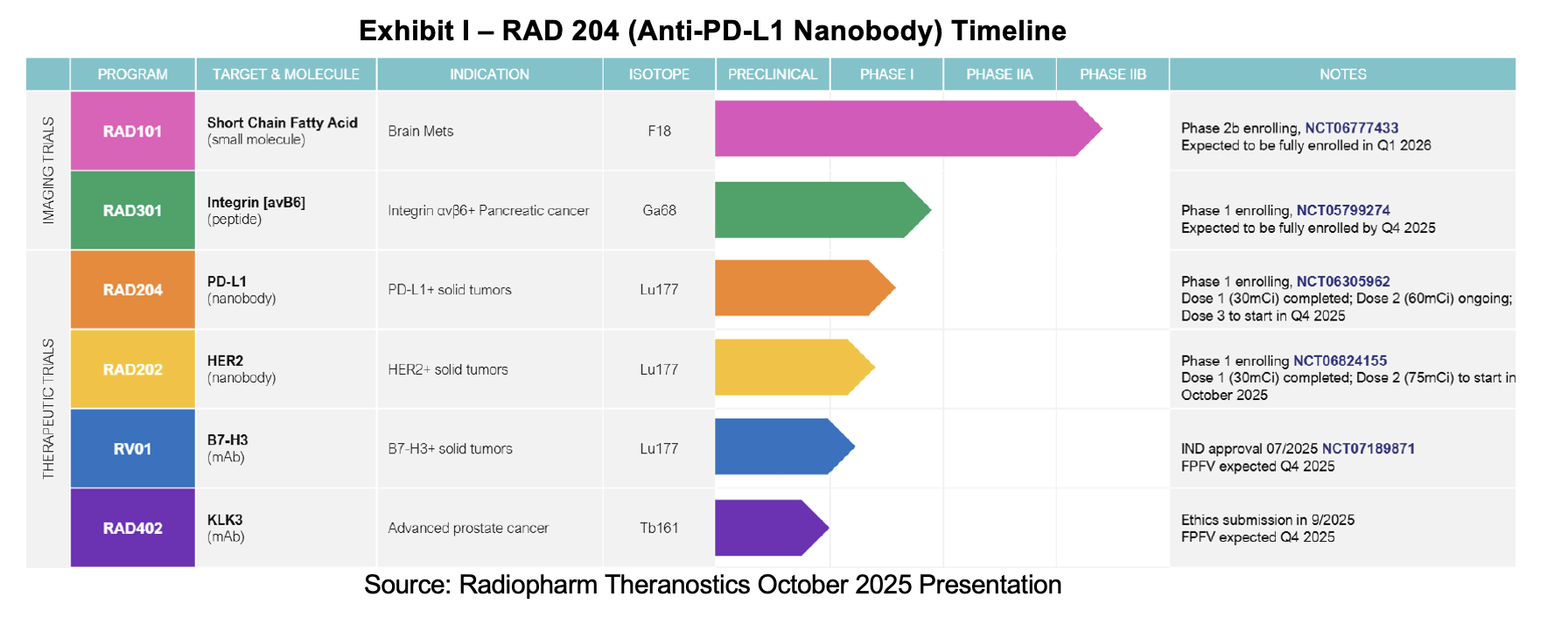

Along with the financial refresh, Radiopharm supplied clinical updates on RAD 101, RAD 202, RAD204, RAD 301 and RV01. The candidates have made progress in the areas of drug uptake, dose escalation and regulatory clearance. Further details are provided in our report. Radiopharm’s goal has been to tread new ground in the radiopharmaceutical space, seeking new targets and underappreciated radioisotopes to improve on-target activity and efficacy. The company recently held multiple KOL events providing further detail on the indications and isotopes being developed.. Additionally, future milestones are updated by management and summarized in our report.

Activities and Cash Report, Fiscal First Quarter 2026

Radiopharm Theranostics provided a financial review of cash balances and allocation of cash expenditures for the three months period ending September 30th, 2025. The details are included in the Quarterly Activities and Cash Report.

As of September 30th, 2025, the company’s cash balance was A$19.0 million, a decrease from fiscal year end 2025’s cash balance of A$29.1 million. Cash inflows of A$4.6 million from government tax rebates were offset by general and administrative costs of (A$5.0) million and research and development costs of (A$8.9) million. After the end of the reporting period, Radiopharm completed an equity raise of A$35 million before financing expenses.

October 2025 Placement and Share Purchase Plan

On October 20th, Radiopharm announced that it had completed a A$35 million placement with existing and new institutional investors. It also opened a A$5 million share purchase plan for eligible shareholders in Australia and New Zealand. Lantheus continues to support Radiopharm and placed A$7.6 million of the A$35 million total bringing its ownership in the company to 14.5%. Each share will be sold at A$0.03[1] and will include an attached option (warrant) with an exercise price of A$0.039 and a duration of two years. Another A$5 million will be available for eligible shareholders, through a Share Purchase Plan (SPP). These retail investors will receive the same terms as the institutional investors and can apply for purchases up to A$30,000.

Approximately 1.167 billion shares will be issued as part of the A$35 million tranche, which is equivalent to 3.89 million American Depository Shares (ADS). Each share will include one attached option (warrant) with an exercise price of A$0.039 or A$11.70 per ADS, which is ~$7.61 based on recent USD Australian Dollar exchange rates.

Bell Potter Securities Limited acted as Lead Manager. Leerink Partners and B. Riley acted as US Placement Agent to the offer. Proceeds from the capital raise will be used to fund drug manufacturing, clinical trials and working capital. Management estimates that the funding will extend the runway into 2027.

The anticipated net proceeds and remaining cash on the balance sheet will be allocated towards three primary areas. A$6 million is expected to be allocated to drug manufacturing for Phase II candidates RAD 204 and RAD202 and Phase I candidates RAD 302, RAD 402 and RV01. A$34 million will be allocated to clinical trials for each of the candidates in the pipeline and A$19 million will go to administration, working capital and offering costs.

Clinical Updates

On October 20th, Radiopharm provided clinical updates for its RAD 101, RAD 202, RAD 204 and RAD 301 programs. All of the studies have generated interim or preliminary data supportive of further advancement of the respective assets either in the ongoing trial or the next phased trial. Management also voiced its intent to launch Phase I trials for RV01 and RAD 402 by year end. Below we provide refreshed milestones shared in the press release. See our report dated November 3rd, 2025 for program updates.

Corporate Milestones[2]

- Oliver Sartor appointed to Scientific Advisory Board – July 2025

- FDA clears IND for Phase I RV01 study – July 2025

- Request for ethics approval for Phase I RAD 402 trial - 3Q:25

- Filing of FY:25 Annual Report – September 2025

- RAD 204 data from first two cohorts – 2H:25

- RAD 101 patient recruitment – 2H:25

- Launch of Phase I RV01 (Betabart) trial – 4Q:25

- Begin dosing patients in Phase I RAD402 trial – 4Q:25

- RAD 301 Phase I last patient dosed – 4Q:25

- RAD 202 report data from first two cohorts - end of 2025

- RAD 101 Phase III trial launch – 4Q:26

- RAD 101 trial fully enrolled – February 2026

- RAD 101 Phase II readout – 1H:26

- RAD 202 Phase I data release (2 cohorts) – 1H:26

- RAD 204 Phase I dose escalation complete – 1H:26

- RAD 202 Phase I last patient dosed – 2H:26

- RAD 301 Phase II trial start – 2H:26

- RAD 101 Phase III launch – 2H:26

- RAD 204 start Phase II study - 2027

- RAD 301 Phase II trial complete – 2H:27

- RAD 204 complete Phase II study – 4Q:27

- RAD 101 NDA submission - 2028

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

[1] To convert to ADS in USD, we apply the following: A$0.03/share x 300 shares/ADS x $0.65/A$1 = $5.85/ADS

[2] Quarters and halves listed in the milestones section are calendar quarters and halves in contrast to Radiopharm’s June 30 fiscal year end.