By John Vandermosten, CFA

NASDAQ:RVPH

READ THE FULL RVPH RESEARCH REPORT

Reviva Pharmaceutical Holdings, Inc. (NASDAQ:RVPH) reported 3Q:25 results, confirming the pre-new drug application (NDA) meeting with the FDA in 4Q:25 to see if an NDA can be accepted using existing data. It reiterated the possibility of an NDA submission to the FDA in 2Q:26 if the agency indicates the application is acceptable with existing data. Success in this endeavor would be a material positive and would provide a faster and less costly pathway to approval. In other news, Reviva was granted a European brilaroxazine patent for the treatment of pulmonary fibrosis, it executed a $9 million public offering, and presented at several medical and investor meetings.

Operational and Financial Results

On November 13th, 2025, Reviva reported 3Q:25 financial and operational results and filed its Form 10-Q with the SEC. Reviva generated no revenues in the quarter and posted an operational loss of ($4.0) million with expenses primarily related to RECOVER’s OLE. For the quarter ending September 30th, 2025, and versus the same, prior year period:

- Research & development expense totaled $2.1 million, down 69% from $6.9 million, with the change attributable to a lower cost for external research and development, non-clinical safety, non-clinical manufacturing and stock-based compensation. This was partially offset by slightly higher payroll;

- General & administrative expenses totaled $1.9 million, rising 18% from $1.6 million on account of higher stock-based compensation, legal expenses, employee related expenses partially offset by lower consultant and professional expenses with other expense categories such as directors’ and officers’ insurance remaining relatively flat;

- Other income of $22,000 compared to $97,000 with the difference almost entirely attributable to a loss rather than a gain on remeasurement of warrant liabilities. Net interest income is $56,000 vs. $48,000;

- Provision for taxes was $3,000 compared to $0 related to payment of state and foreign taxes;

- Net loss was ($4.0) million vs ($8.4) million, or ($0.06) and ($0.25) per share, respectively.

As of September 30th, 2025, Reviva held $13.2 million in cash on its balance sheet. Cash burn for the first nine months of 2025 was ($18.8) million while cash flows from financing were $18.5 million. Financing transactions from a public offering, an at-the-market facility and warrant exercise contributed to the total. We anticipate further capital raises over the remainder of the year.

Poster Presentations

Reviva continues to analyze and evaluate the data generated from its RECOVER trials and present it to medical audiences. In November, the company presented two posters, one at the CNS Summit and the other at Neuroscience 2025. The most recent releases emphasize brilaroxazine’s effect on negative symptoms, its impact on brain-derived neurotrophic factor (BDNF) and inflammatory cytokines. Much of this data reiterates previously shared information with new audiences.

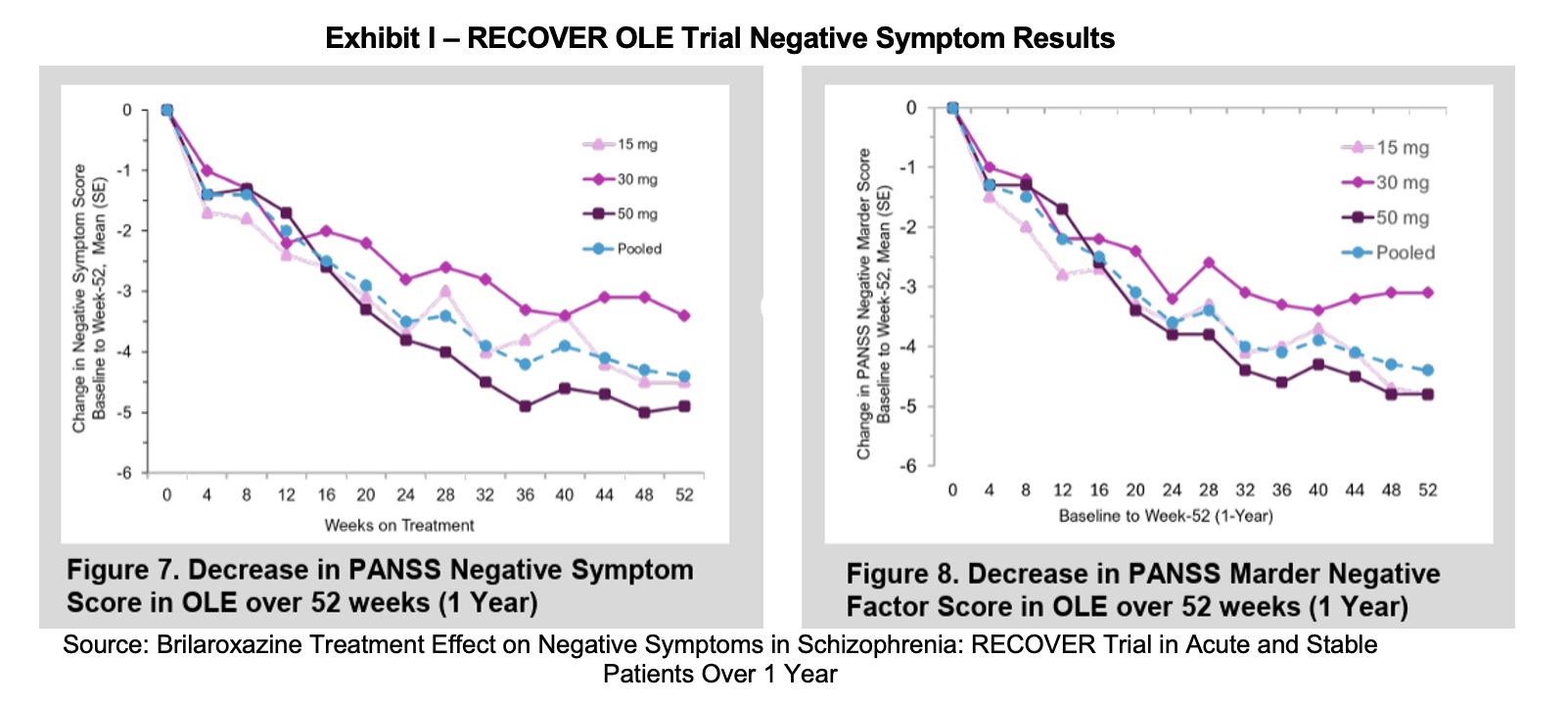

Reviva presented a poster at the CNS Summit in Boston, Massachusetts, in early November. The poster, entitled Brilaroxazine Treatment Effect on Negative Symptoms in Schizophrenia: RECOVER Trial in Acute and Stable Patients Over 1 Year examined brilaroxazine’s short and long-term effectiveness in addressing negative symptoms. Much of the poster reiterated RECOVER and RECOVER open label extension (OLE) data that had already been presented in other materials. This data showed a statistically significant improvement in negative symptoms over 28 days for patients administered 50 mg brilaroxazine compared to placebo. Brilaroxazine was also able to demonstrate persistent improvement over the 52 weeks where patients were evaluated in the OLE trial. Reviva developed an exploratory speech latency biomarker which was positively correlated with the magnitude of negative symptoms.

The poster concluded that brilaroxazine significantly improves negative symptoms in schizophrenia over a 28-day and 52-week period. Effect sizes were material and statistically significant. The presence of a speech latency biomarker allows for improved treatment response. The authors believe that the data supports a differentiated role for brilaroxazine in schizophrenia treatment, allowing providers to employ precision psychiatry.

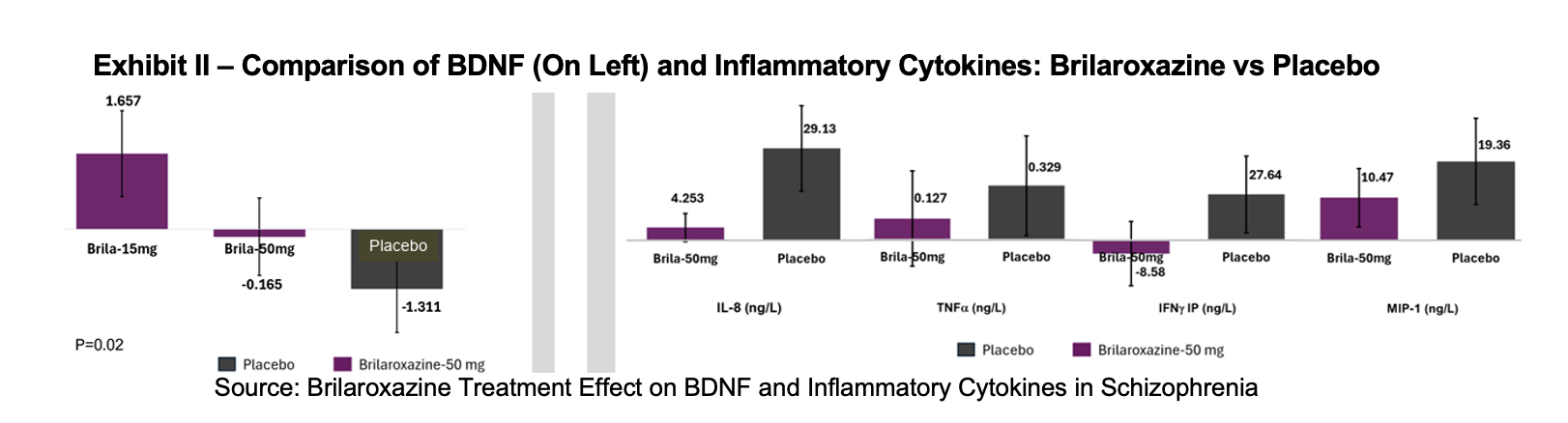

Reviva’s second poster presentation in November was given at Neuroscience 2025 in San Diego, California. It was called Brilaroxazine treatment effects on BDNF and inflammatory cytokines in schizophrenia: RECOVER trial in acute and stable patients over 1 year.

BDNF and Inflammation

In the various RECOVER trials, data has shown that brilaroxazine treatment increases BDNF levels and reduces interleukin (IL)-6, IL-8, TNF-α, interferon (INF)-γ, and MIP-1. In schizophrenia patients BDNF levels are commonly low, and inflammatory markers, including IL-6, IL-8, TNF-α, INF-γ, and Macrophage Inflammatory Protein (MIP)-1 are too high. Brilaroxazine appears to bring these markers closer to homeostasis.

In the OLE, brilaroxazine increased BDNF by 1.83 μg/L over 52 weeks, providing durable neurotrophic support. Proinflammatory cytokines declined from baseline. In the 50 mg cohort, IL-8 fell from 29.13 to 4.25 ng/L, TNF-α from 0.33 to 0.13 ng/L, IFN-γ-IP from 27.64 to -8.58 ng/L, and MIP-1 declined from 19.36 to 10.47 ng/L.

Results from the RECOVER trials showed that brilaroxazine reduced pro-inflammatory cytokines and increased BDNF over both four weeks and one year. The change in biomarker levels are aligned with clinical benefits and their known relationships with schizophrenia symptoms. The findings support a dual mechanism model that combines modulation of neurotransmission and attenuation of neuroinflammation as a basis for improved outcomes in schizophrenia.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.