By John Vandermosten, CFA

NASDAQ:RVPH

READ THE FULL RVPH RESEARCH REPORT

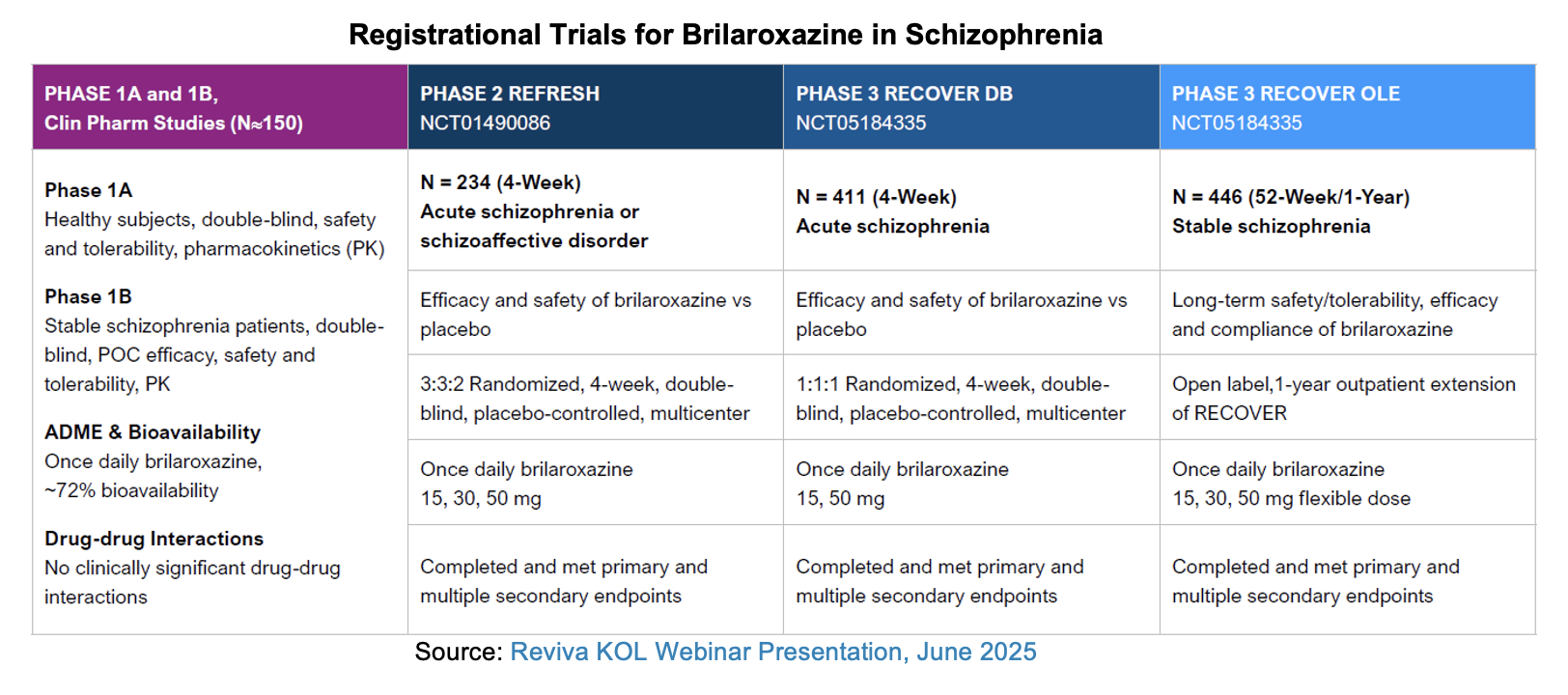

Reviva Pharmaceutical Holdings, Inc. (NASDAQ:RVPH) reported 2Q:25 results, highlighting the June release of the dataset for the open-label extension (OLE) RECOVER trial. In its second quarter report, Reviva announced the possibility of submitting its new drug application (NDA) to the FDA without conducting a second Phase III trial. The team will consult with the FDA in a meeting planned for 4Q:25 to see if an NDA application can be accepted using existing data. If the FDA gives Reviva a positive response, brilaroxazine could be submitted for approval in 2Q:26. Reviva is also developing another indication in schizophrenia focusing on negative symptoms which could provide extended protection for brilaroxazine and expand the market into an area with unmet need.

Reviva also plans to submit an investigational new drug (IND) application for a liposomal gel formulation of brilaroxazine in psoriasis expected by 2Q:26. This could provide alternate patent protection and pricing differentiation with the oral form of the drug if successful. Other notable events since our previous quarterly update include a poster presentation at American Society of Clinical Psychopharmacology (ASCP), execution of a $10 million capital raise and participation in several investor conferences.

Operational and Financial Results

On August 15th, 2025, Reviva reported 2Q:25 financial and operational results and filed its Form 10-Q with the SEC. Reviva generated no revenues in the quarter and posted an operational loss of ($6.1) million with expenses primarily related to RECOVER’s OLE. For the quarter ending June 30th, 2025 and versus the same prior year period:

- Research & development expense totaled $3.7 million, down 33% from $5.6 million, with the change attributable to a decrease in external clinical research and development costs, partially attributed to a decrease in costs associated with patient visits as the OLE trial proceeded toward completion with ongoing expenses consisting of post-data readout activities and trial conclusion;

- General & administrative expenses totaled $2.3 million, falling 8% from $2.5 million on account of lower professional expenses with other expense categories remaining relatively flat;

- Other income of $27,000 compared to $277,000 with the difference almost entirely attributable to a lower gain on remeasurement of warrant liabilities. Net interest income is lower due to lower cash balances generating less interest income and a lower magnitude of foreign currency loss related to the consolidation of the Indian subsidiary;

- Provision for taxes was $8,000 compared to $7,000 related to payment of state and foreign taxes;

- Net loss was ($6.4) million vs ($7.4) million, or ($0.13) and ($0.25) per share, respectively.

As of June 30th, 2025, Reviva held $10.4 million in cash on its balance sheet. 1H:25 cash burn was ($13.2) million while cash flows from financing were $10.0 million. Financing transactions from a public offering, an at the market facility and warrant exercise contributed to the total. We anticipate further capital raises over the remainder of the year.

$10 Million Public Offering

On June 25th, Reviva announced a public offering which was closed the next day. The company sold 20 million shares of common stock at $0.50 per share along with 40 million attached warrants with an exercise price of $0.50. The capital raise closed on June 27th generating net proceeds of $9.0 million which will be used to fund research and development activities and for working capital and other general corporate purposes. 20 million of the warrants will have a five-year life and the other 20 million will have a 12-month life.

Regulatory Path

Reviva is exploring the possibility of submitting a new drug application (NDA) with existing data. The company has conducted a Phase II, a Phase III and a safety study for brilaroxazine in schizophrenia. Previous schizophrenia drug developers have submitted to the FDA with only one Phase III including Minerva Neurosciences with roluperidone and Intra-Cellular Therapies with Caplyta. Reviva is seeking a meeting with the FDA in 4Q:25 to explore such a possibility. Skipping the second RECOVER trial would be a substantial positive for shareholders and would eliminate the overhang related to the near-term capital raise necessary to run RECOVER 2. Reviva is looking at other alternatives to extend brilaroxazine’s patent life including finding a closely related indication such as one centered on the negative symptoms of schizophrenia using a new, possibly more concentrated, formulation.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.