By David Bautz, PhD Zacks Small Cap Research

NASDAQ:TNXP

READ THE FULL TNXP RESEARCH REPORT

Business Update

Tonmya™ Commercial Launch Underway

Following the approval of Tonmya™ (cyclobenzaprine HCl sublingual tablets) for the treatment of fibromyalgia in adults, Tonix Pharmaceuticals Holding Corp. (NASDAQ:TNXP) announced the drug is now commercially available as of November 17, 2025. The wholesale acquisition cost (WAC) for Tonmya for adults is $1,860 per month for the 60-count supply and the WAC is $930 per month for the 30-count supply for geriatric patients and adult patients with mild hepatic impairment. The company has 90 sales representatives that have been in the field for over a month prior to the launch.

Tonix’s commercialization unit currently markets Zembrace and Tosymra, which are both indicated for the treatment of acute migraine in adults. Thus, Tonix is not establishing commercial operations for Tonmya from scratch but is building upon the infrastructure that already exists. Tonix has identified the health care practitioners (HCPs) that have made the diagnosis of fibromyalgia in the past year, which they refer to as “fibromyalgia diagnosing HCPs”. Data shows that approximately 5% of these fibromyalgia diagnosing HCPs write approximately 70% of fibromyalgia prescriptions, thus this is the initial cohort of physicians that the company will be targeting. In addition to the traditional sales representatives, Tonix is using an omnichannel approach that includes KOL engagement, corporate communications, and various social media campaigns. In addition, at launch the company already had patient access and support services in place, including payer education and engagement, a digital pharmacy experience, and traditional pharmacy savings programs.

To further strengthen the commercial leadership team, Tonix recruited Ganesh Kamath as Head of Market Access in September 2025. Mr. Kamath has more than 25 years of market access, pricing, and commercial operations experience. Most recently, he was Vice President of FP&A, Business Development, and Sales Operations at CuriaGlobal, where he led strategic initiatives to strengthen business development and operational performance. Mr. Kamath also served as Senior Vice President and Chief Financial Officer at Hutchmed International along with senior leadership roles at Bayer HealthCare within Finance and Market Access, where he oversaw strategic pricing, contracting, reimbursement, and gross-to-net management across a portfolio of more than 25 brands.

IND Clearance for Phase 2 Study of TNX-102 SL in MDD

On November 24, 2025, Tonix announced that the U.S. Food and Drug Administration (FDA) cleared the Investigational New Drug (IND) application for the development of TNX-102 SL 5.6 mg for the treatment of major depressive disorder (MDD) in adults. The company is planning to conduct a potentially pivotal Phase 2 trial that will be a six-week, randomized, double blind, placebo controlled study of TNX-102 SL as a first-line monotherapy. Approximately 360 patients will be enrolled across 30 sites in the U.S. The primary endpoint of the study will be the MADRS total score change from baseline at Week 6 with secondary endpoints that include global impression scores, anxiety ratings, and measures of sleep disturbance. Startup activities have begun and we expect the trial to initiate enrollment in mid-2026.

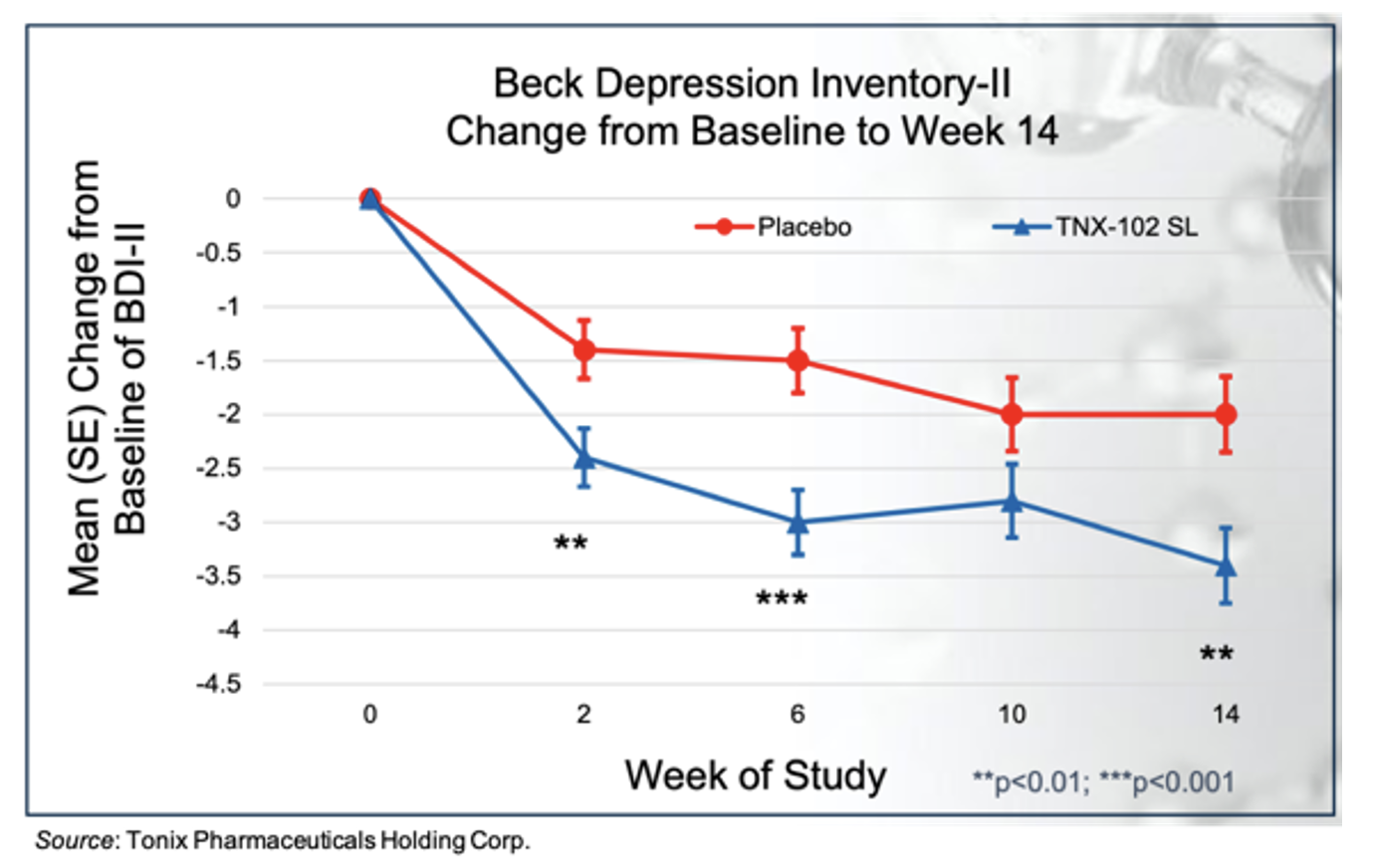

The support for evaluating TNX-102 SL as a treatment for depression stems from results of TNX-102 SL in fibromyalgia and post-traumatic stress disorder (PTSD) clinical trials. For example, in the RESILIENT Phase 3 trial, there was a greater reduction in the total Beck Depression Inventory-II score in the TNX-102 SL cohort compared to placebo at Week 14 with an effect size of 0.27, as shown in the following figure.

Multiple Collaborative Studies with Massachusetts General Hospital

Tonix recently announced two investigator-initiated trials will be conducted at Massachusetts General Hospital (MGH) with Tonix development products:

- On November 4, 2025, Tonix announced a collaboration with MGH to conduct an investigator-initiated Phase 2 clinical trial of TNX-1500 in kidney transplant recipients. The trial is being led by Dr. Ayman Al Jurdi and will assess the safety, tolerability, and activity of TNX-1500 in preventing kidney transplant rejection while significantly minimizing the dose of conventional immunosuppressive drugs. The single-center study will enroll five adult kidney transplant recipients. TNX-1500 will be administered for 12 months (the primary endpoint of the trial) with an option to continue treatment beyond 12 months. The primary endpoint of the trial is the incidence of adverse and serious adverse events at 12 months. Secondary endpoints include graft survival, renal function, biopsy proven acute rejection, and incidence of donor-specific antibodies. We anticipate the trial initiating in the first half of 2026.

- On October 22, 2025, Tonix announced the first patient was dosed in the investigator-initiated FOCUS (Feasibility of Oxytocin for Clinical Use and Socioemotional wellbeing) study that is evaluating single-dose intranasal potentiated oxytocin product at two different doses (6 IU, TNX-2900 and 24 IU, TNX-1900) on markets of anxiety, depression, and socioemotional functioning in patients with arginine-vasopressin deficiency (AVP-D), a rare endocrine disorder associated with oxytocin deficiency and adverse mental health outcomes. This pilot study is intended to generate preliminary data to inform future potential clinical trials of oxytocin replacement therapy in AVP-D patients.

Financial Update

On November 10, 2025, Tonix Pharmaceuticals Holding Corp. (TNXP) announced financial results for the third quarter of 2025. Net revenue from product sales for the quarter ended September 30, 2025 was approximately $3.3 million, compared to $2.8 million for the quarter ended September 30, 2024. The increase was primarily due to increased demand for the products along with additional sales representatives. Cost of sales was $1.4 million for the third quarter of 2025 compared to $1.6 million for the third quarter of 2024. R&D expenses for the third quarter of 2025 were $9.3 million, compared to $9.1 million for the third quarter of 2024. The increase was primarily due to increased manufacturing expenses, non-clinical expenses, and employee-related expenses partially offset by a reduction in clinical expenses, regulatory expenses, and professional fees. SG&A expenses in the third quarter of 2025 were $25.7 million compared to $7.7 million for the third quarter of 2024. The increase was primarily due to an increase in sales and marketing, employee-related expenses, professional expenses, and legal expenses related to the preparations for the commercial launch of Tonmya in November 2025.

Tonix exited the third quarter of 2025 with approximately $190.1 million in cash and cash equivalents. Subsequent to the end of the quarter, the company received $34.7 million in net proceeds from equity offerings during the fourth quarter of 2025. We estimate the company has sufficient capital to fund operations into the first quarter of 2027. As of November 10, 2025, the company had approximately 11.8 million shares outstanding and, when factoring in stock options and warrants, a fully diluted share count of approximately 13.0 million shares.

Conclusion

The commercial launch of Tonmya is underway and we look forward to updates from the company, with the first impactful updates likely not until mid-2026. We have made a slight modification to our model in that we are only estimating approximately $0.1 million in sales of Tonmya in the fourth quarter of 2025 to account for the usual slowdown in pharmaceutical sales during the holiday season. However, for 2026 we currently estimate for $21.0 million in revenue as payer negotiations and awareness increase, particularly into the second half of the year. While the company is not currently providing revenue guidance, we are confident that the demand for Tonmya will accelerate relatively quickly given the positive clinical results, the unhappiness among fibromyalgia patients and doctors with the currently available therapies, and the fact that fibromyalgia patients have not had a new treatment option for 15 years. Based on the increased share count from the most recent 10-Q, our valuation has slightly decreased to $64 per share, however our enthusiasm for the potential of Tonmya remains strong.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.