By David Bautz, PhD

NASDAQ:TNXP

READ THE FULL TNXP RESEARCH REPORT

Business Update

Tonmya™ Approved by the FDA

On August 15, 2025, Tonix Pharmaceuticals Holding Corp. (NASDAQ:TNXP) announced that the U.S. Food and Drug Administration (FDA) approved Tonmya™ (cyclobenzaprine HCl sublingual tablets) for the treatment of fibromyalgia in adults. Tonmya is the first fibromyalgia treatment approved by the FDA in over 15 years. Tonix is not ready to announce the wholesale acquisition cost (WAC) at this time as it continues its market analysis. We anticipate that Tonmya will become commercially available in the fourth quarter of 2025.

The approval of Tonmya was based in part on the positive results from the Phase 3 RELIEF and RESILIENT trials. For a full overview of the results from the RELIEF trial, see our previous report here. Briefly, the following graph shows the results for the primary efficacy endpoint of the trial, the mean change from baseline in weekly averages of the daily diary pain numerical rating scale (NRS) scores. At week 14, participants on TNX-102 SL had a LS mean change from baseline of -1.9 units compared to -1.5 units for participants on placebo (P=0.01). The graph shows separation between TNX-102 SL-treated and placebo-treated participants at Week 14 and shows separation (P<0.05) at Week 5, Week 8, and Week 10, and continues consistently from Week 12 to Week 14.

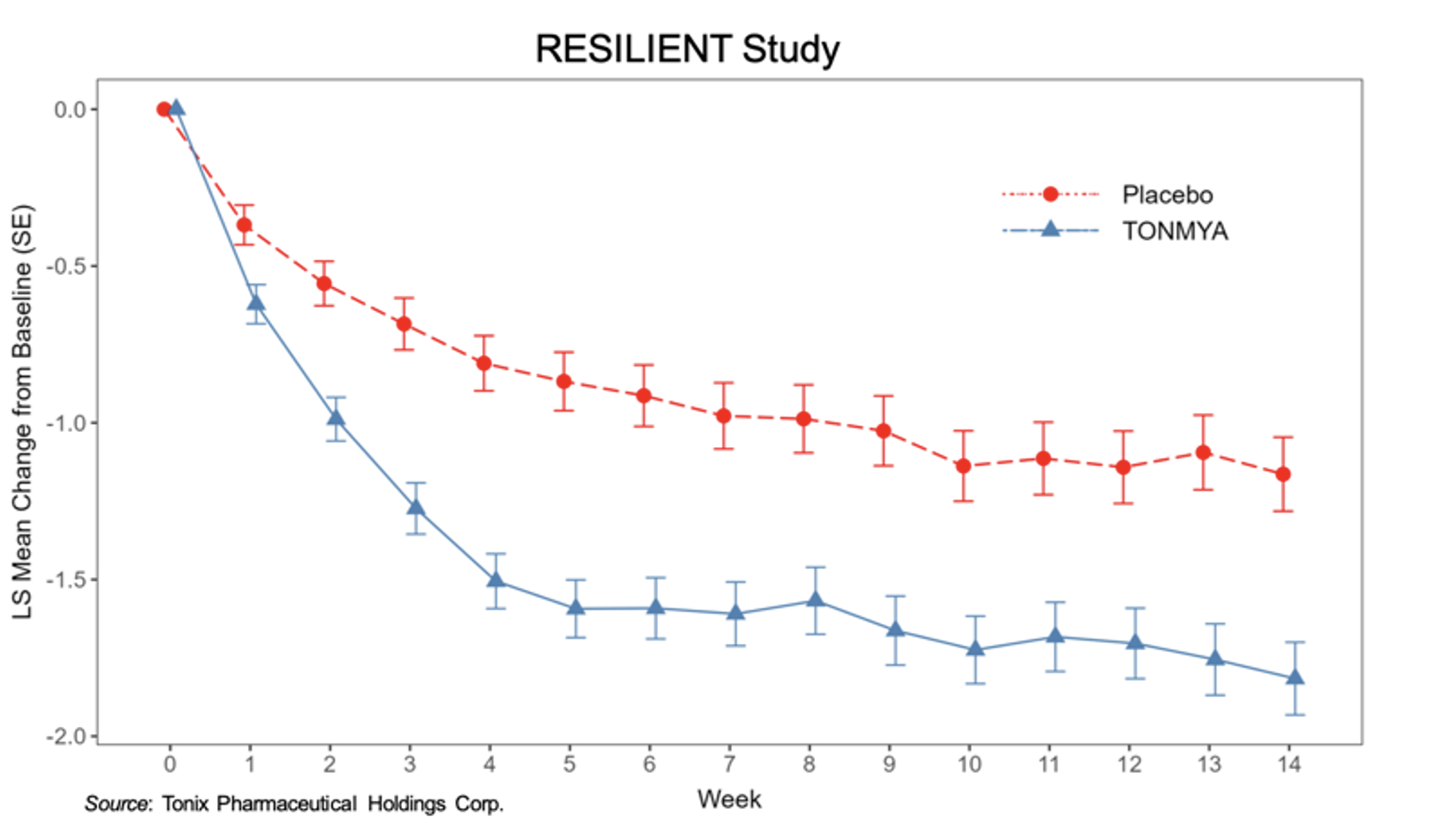

For a full overview of results from the RESILIENT trial, see our previous report here. Briefly, the following graph shows the primary outcome measure of reduction in pain over the 14 weeks of the RESILIENT trial. TNX-102 SL showed a rapid onset of action and separated from placebo for each week of the study. It exhibited a robust effect size of 0.38. The Week 14 least square (LS) mean (SE) change from baseline for TNX-102 SL was -1.82 (0.12) and for placebo -1.16 (0.12), with a least square mean difference from placebo of -0.65 (0.16) (P=0.00005).

While it is tempting to try to compare the mean change in pain for the RELIEF and RESILIENT studies with previous fibromyalgia trials, this is a futile exercise. The patients evaluated in the RELIEF and RESLIENT studies were a different population of fibromyalgia patients than those evaluated in previous studies. Tonix’s studies enrolled patients based on the ACR 2016 criteria for fibromyalgia, while other approved products’ studies used the ACR 1990 criteria. Two important differences between the ACR 1990 and ACR 2016 criteria are that the ACR 1990 criteria required a physical exam and presence of tender points, while the ACR 2016 criteria eliminated both of those requirements (Wolfe et al., 2016). Thus, the patient populations in the RELIEF and RESILIENT studies are more representative of how fibromyalgia is diagnosed presently.

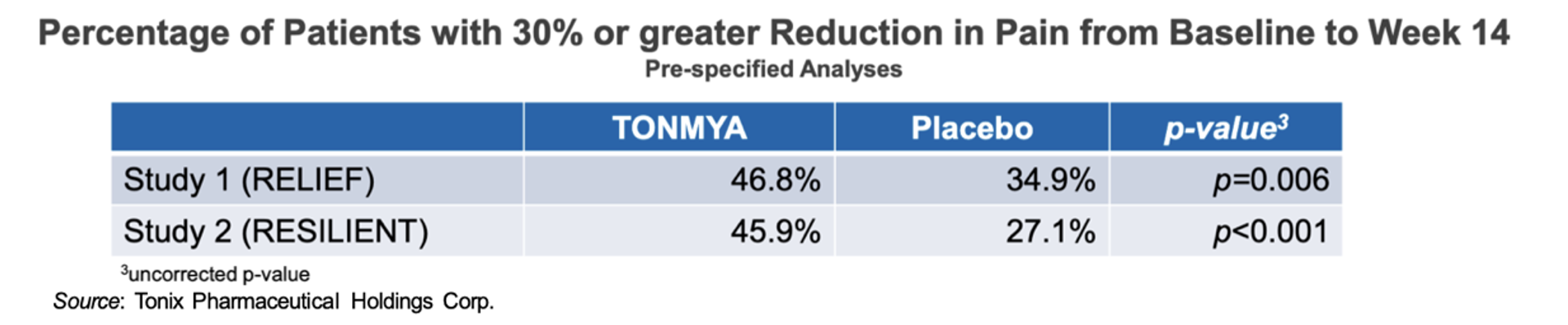

In addition to the above data, both the RELIEF and RESILIENT studies showed a difference in the number of “30% responders” between treated and untreated patients, which are those that experience a 30% or greater reduction in pain from baseline, and which was a pre-specified analysis for both studies. The following chart shows the percentage of patients who were 30% responders in the two trials. The difference in 30% responders between those treated with Tonmya and placebo had P values below 0.05 for both studies. This is important as fibromyalgia experts believe that a 30% reduction or greater in pain from baseline is a “clinically meaningful” change (Dworkin et al., 2008).

Commercialization Strategy

Tonix’s commercialization unit currently markets Zembrace and Tosymra, which are both indicated for the treatment of acute migraine in adults. Thus, Tonix will not be establishing commercial operations for Tonmya from scratch but will be building upon the infrastructure that already exists. The company is planning to initially start with approximately 90 sales representatives. Tonix has identified the healthcare practitioners (HCPs) that have made the diagnosis of fibromyalgia in the past year, which they refer to as “fibromyalgia diagnosers”. Data shows that approximately 5% of these fibromyalgia diagnosers write approximately 70% of fibromyalgia prescriptions; thus, this is the initial cohort of physicians that the company will be targeting. In addition to the traditional sales representatives, Tonix is using an omnichannel approach that includes KOL engagement, corporate communications, and various social media campaigns. As a start, Tonix recently launched Fibro Forward, which is a disease awareness campaign that has experienced >36,000 unique visitors in the first three weeks, had an average session >5 minutes, and ~15% of users either downloaded a Patient Discussion Guide or signed up for more information.

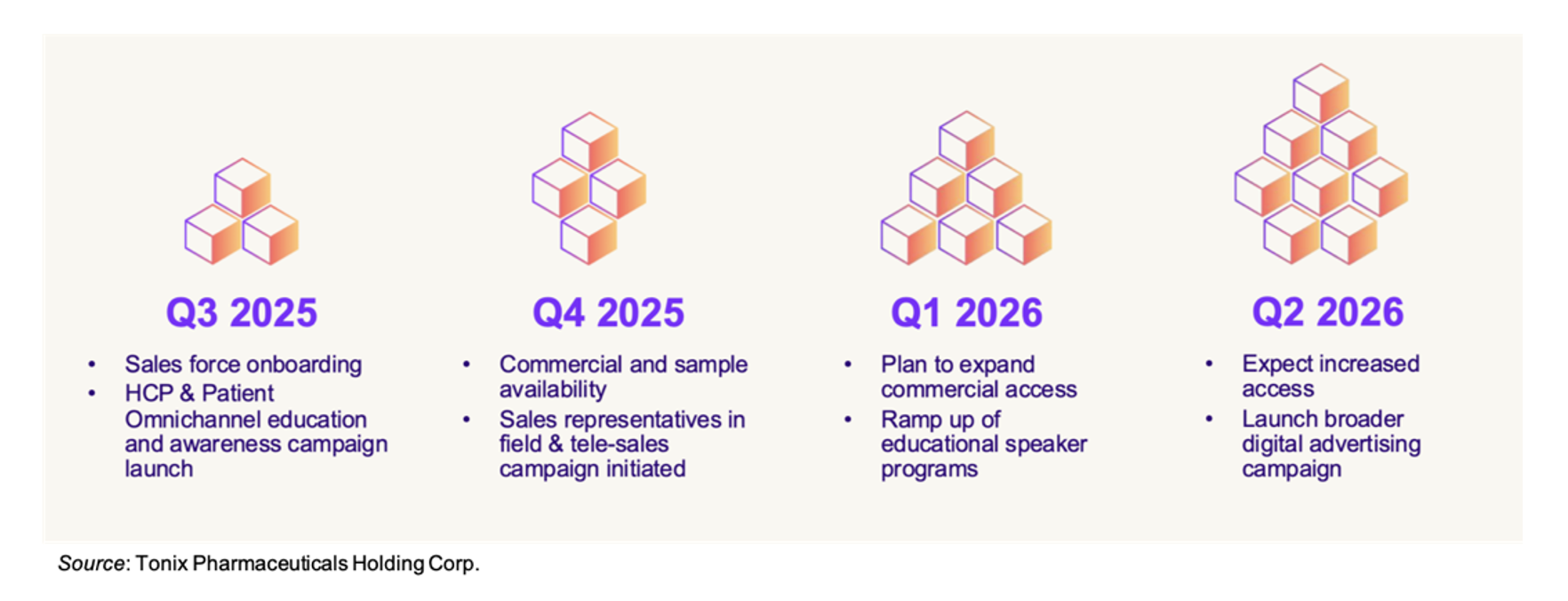

A rough outline of the anticipated launch activities is given below. During the third quarter of 2025, Tonix will continue onboarding its sales force while simultaneously launching the HCP and patient education and awareness campaign. Tonmya is expected to be commercially available in the fourth quarter of 2025, at which time the sales representatives will enter the field and the tele-sales campaign will be initiated. By the first quarter of 2026, Tonix expects payer discussions will reach the point that commercial access begins to expand, which should ramp up by mid-2026. The company is not giving any guidance on revenue expectations at this point, but anticipates by mid-2026 to hopefully be in a position to begin offering guidance as Tonmya revenues increase.

In-Licenses Monoclonal Antibody for Prevention of Lyme Disease

On September 17, 2025, Tonix announced the in-licensing of worldwide rights to TNX-4800 (formerly mAb 2217LS), a long-acting human monoclonal antibody that targets outer surface protein A (OspA) of Borrelia burgdorferi, which is the cause of Lyme disease. The antibody was developed by researchers at the University of Massachusetts Chan Medical School.

Unlike a vaccine, which is dependent upon the host’s immune system to mount a response, TNX-4800 is a long-acting monoclonal antibody that is designed to remain active following administration in the Spring all the way through the Fall, which covers the entire tick season in the U.S. This is accomplished through modifications to the Fc domain binding (Schiller et al., 2021). This is expected to result in a sustained resistance to infection, as was shown in non-human primates challenged with B. burgdorferi-infected nymphs.

Tonix is planning to advance TNX-4800 through an adaptive Phase 2/3 study, which we anticipate initiating in the Spring of 2027. A Phase 1 study has already been conducted, which showed the antibody was safe, well tolerated, and had a linear pharmacokinetic/pharmacodynamic/efficacy relationship (1:1:1). There are currently no FDA approved vaccines for the prevention of Lyme disease, although Pfizer is currently evaluating VLA15 as a Lyme disease vaccine in two Phase 3 clinical trials (NCT05477524). A previously approved Lyme disease vaccine was voluntarily removed from the market over fears of an increased risk of autoimmune arthritis (Nigrovic et al., 2006).

Positive Pre-IND Meeting with FDA for TNX-102 SL for the Treatment of Major Depressive Disorder

On September 18, 2025, Tonix announced the successful completion of a Type B Pre-Investigation New Drug (Pre-IND) meeting with the U.S. FDA for the development of TNX-102 SL as a treatment for major depressive disorder (MDD). The company is planning to pursue a supplemental new drug application (sNDA) based on exploratory findings from the Phase 3 RESILIENT study of fibromyalgia patients, which showed that the TNX-102 SL-treated group had activity on improving depression over placebo by the Beck Depression Inventory (BDI), with an uncorrected P-value <0.05.

TNX-102 SL is a tertiary amine tricyclic, a class of drugs for which there are FDA-approved antidepressants. However, in contrast to those currently approved medications, TNX-102 SL is designed for transmucosal absorption to avoid first pass hepatic metabolism, while the FDA-approved drugs are swallowed pill formulations. In addition, those compounds are given at more than 10x the dose used for TNX-102 SL, which leads to adverse side effects such as weight gain, increased blood pressure, and decreased sexual function. We anticipate an IND filing for TNX-102 SL in the fourth quarter of 2025, which should allow for a Phase 2 trial to initiate shortly thereafter.

Financial Update

On August 11, 2025, Tonix Pharmaceuticals Holding Corp. (TNXP) announced financial results for the second quarter of 2025. Net revenue from product sales for the quarter ended June 30, 2025, was approximately $2.0 million, compared to $2.2 million for the quarter ended June 30, 2024. Cost of sales was $3.3 million for the second quarter of 2025 compared to $3.4 million for the second quarter of 2024. R&D expenses for the second quarter of 2025 were $10.8 million, compared to $9.7 million for the second quarter of 2024. The increase was primarily due to increased clinical expenses, non-clinical expenses, and manufacturing costs, partially offset by a reduction in employee-related expenses. G&A expenses in the second quarter of 2025 were $16.2 million compared to $7.5 million for the second quarter of 2024. The increase was primarily due to an increase in sales and marketing, employee-related expenses, professional medical expenses, and legal expenses.

Tonix exited the second quarter of 2025 with approximately $125.3 million in cash and cash equivalents. Subsequently, the company received $50.6 million in cash from equity offerings in July 2025. We estimate the company has sufficient capital to fund operations into the third quarter of 2026. Importantly, the company’s balance sheet also provides plenty of flexibility for the commercial launch of Tonmya. As of August 11, 2025, the company had approximately 8.8 million shares outstanding and, when factoring in stock options and warrants, a fully diluted share count of approximately 10.0 million shares.

Conclusion

We’re very excited to see the approval of Tonmya and are looking forward to its official commercial launch. Tonix will be launching with approximately 90 sales representatives in total, which we believe is adequate for a successful campaign. The company stated that the first few quarters of sales are likely to be modest, as payer negotiations and awareness increase, with mid-2026 marking a potential inflection point in sales. Following the approval of Tonmya, we have increased our valuation to $68 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.