By Ronald Wortel, MBA, P. Eng.

NYSE:TRX | TSX:TRX.TO

READ THE FULL TRX RESEARCH REPORT

Self-funded dual circuits position Buckreef for scalable production.

TRX Gold Corporation (NYSE:TRX) (TSX:TRX.TO) entered fiscal 2026 with clear momentum, underpinned by record operational performance, a fully funded plant expansion, and a valuation reset driven by higher gold prices. The Buckreef Gold Project in Tanzania is transitioning from proof‑of‑concept into a scalable, cash-generative operation, positioning the company for meaningful growth and potential market re-rating.

Plant Upgrade – Dual Circuits Drive Growth

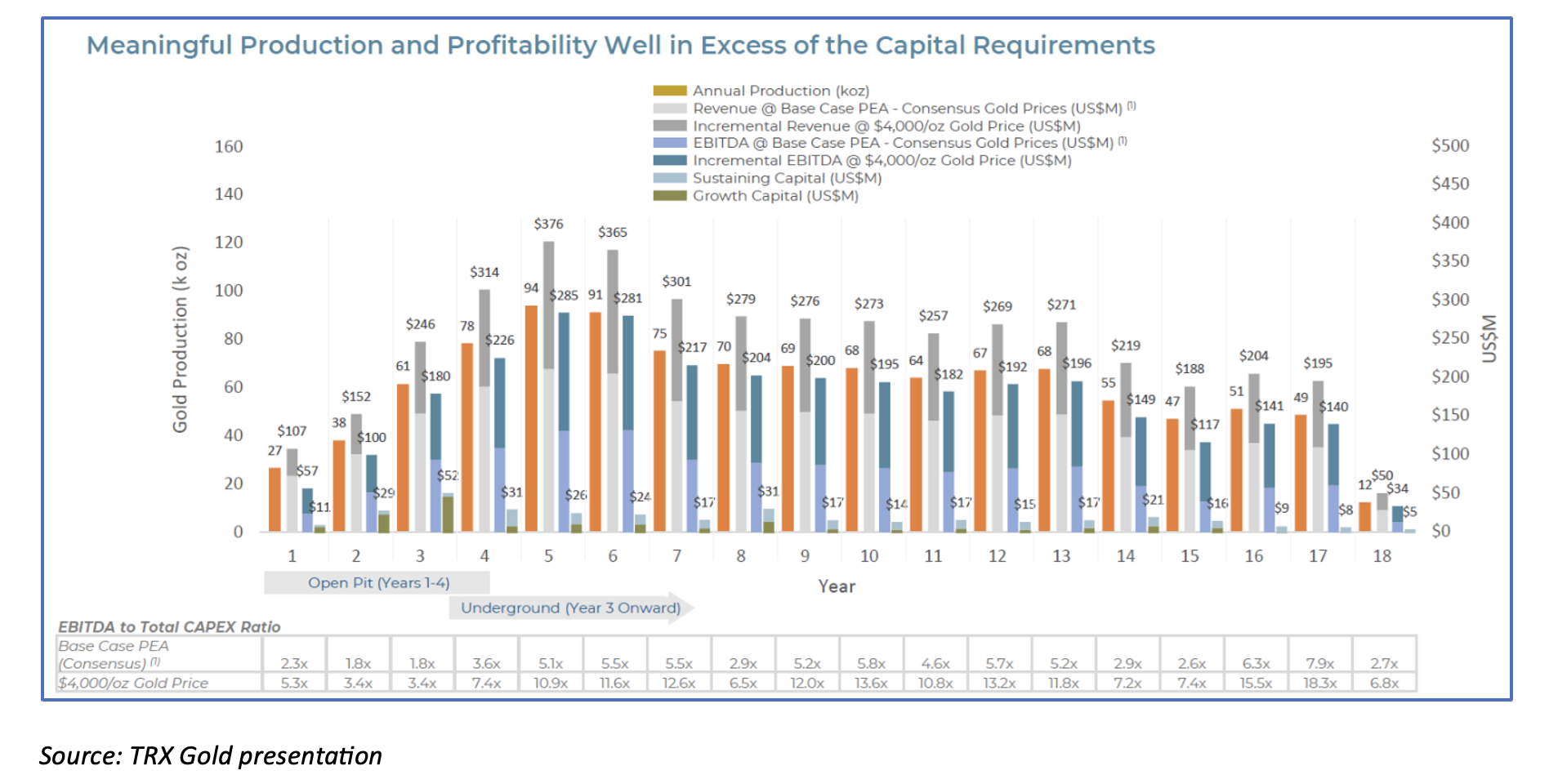

The centerpiece of TRX’s strategy is the expansion of Buckreef’s processing capacity. Management is executing a US$30 million program, fully funded from operating cash flow, to build a 3,000+ tpd sulphide circuit alongside a 1,000 tpd oxide/transition circuit. This dual‑circuit design lifts throughput beyond 4,000 tpd, exceeds the PEA baseline, and targets recoveries of 87–90%. Phased over 18–24 months, the expansion leverages existing equipment and onsite expertise, minimizing execution risk. Once complete, annual production is expected to surpass 62,000 ounces, with incremental upside from repurposed equipment contributing an additional ~10,000 ounces annually by FY2027. Peak production is expected in F2029, exceeding 100,000 ounces.

Financial Results – Record Margins and Recapitalization

Fiscal 2025 delivered record revenue of US$57.6 million, gross profit of US$23.9 million, and EBITDA of US$22.0 million, all at margins near 54%. The balance sheet was recapitalized, with short-term debt repaid and working capital turning positive. Operational momentum continued into Q1 2026, with ~6,550 ounces produced at higher realized gold prices, supported by a growing ROM stockpile of over 20,000 ounces.

Valuation – Reset on Gold Price Strength

Our updated model reflects both the expanded production profile and a reset in gold price assumptions. With spot holding above US$4,000/oz, versus US$3,300/oz at initiation, fair value rises to US$1.90/share (from US$1.00), using a P/NAV multiple of 0.8x. TRX remains highly leveraged to gold, with a self-funded, low-capex growth model that reduces dilution risk.

TRX Gold’s combination of operational delivery, disciplined expansion, and valuation upside makes this update report essential reading for investors seeking exposure to a scalable, growth-oriented gold producer.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.