By David Bautz, PhD

NASDAQ:IMNN

READ THE FULL IMNN RESEARCH REPORT

Business Update

Fully Focused on Rapid Advancement of OVATION 3 Trial

Imunon (NASDAQ:IMNN) ended 2025 with continued momentum across its clinical and translational programs, highlighted by ongoing enrollment in the pivotal Phase 3 OVATION 3 Study evaluating IMNN-001 in newly diagnosed advanced ovarian cancer patients. We believe 2025 was a transformative year for the company, with presentations at major scientific meetings regarding the unprecedented overall survival results seen in the Phase 2 OVATION 2 trial and the initiation of the OVATION 3 study. This has translated into sustained investigator engagement and growing clinical interest that the company hopes to capitalize on as enrollment in the OVATION 3 study ramps up.

The OVATION 3 trial remains the company’s top priority, designed to confirm the overall survival benefit observed in the Phase 2 OVATION 2 Study. In support of this, the company recently announced a strategic reorganization to concentrate resources on trial execution, including eliminating non-essential roles and redefining responsibilities to support enrollment and site expansion. In addition, Chief Scientific Officer Dr. Khursheed Anwer will retire effective Feb. 20, transitioning leadership during this critical development phase for the company.

The company continues to highlight the robust dataset from the OVATION 2 trial. That study demonstrated a 13-month improvement in median overall survival versus standard of care, with particularly strong outcomes observed in patients receiving PARP inhibitor therapy. For that patient population, the median overall survival had not been reached compared to 37 months for those in the control arm. Increases in progression-free survival were also seen. For women positive for homologous recombination deficiency (HRD+), the hazard ratio was 0.42. These results, reinforced through a peer-reviewed publication in the journal Gynecologic Oncology and presentations at major oncology meetings, continue to underpin confidence in IMNN-001’s mechanism and clinical relevance.

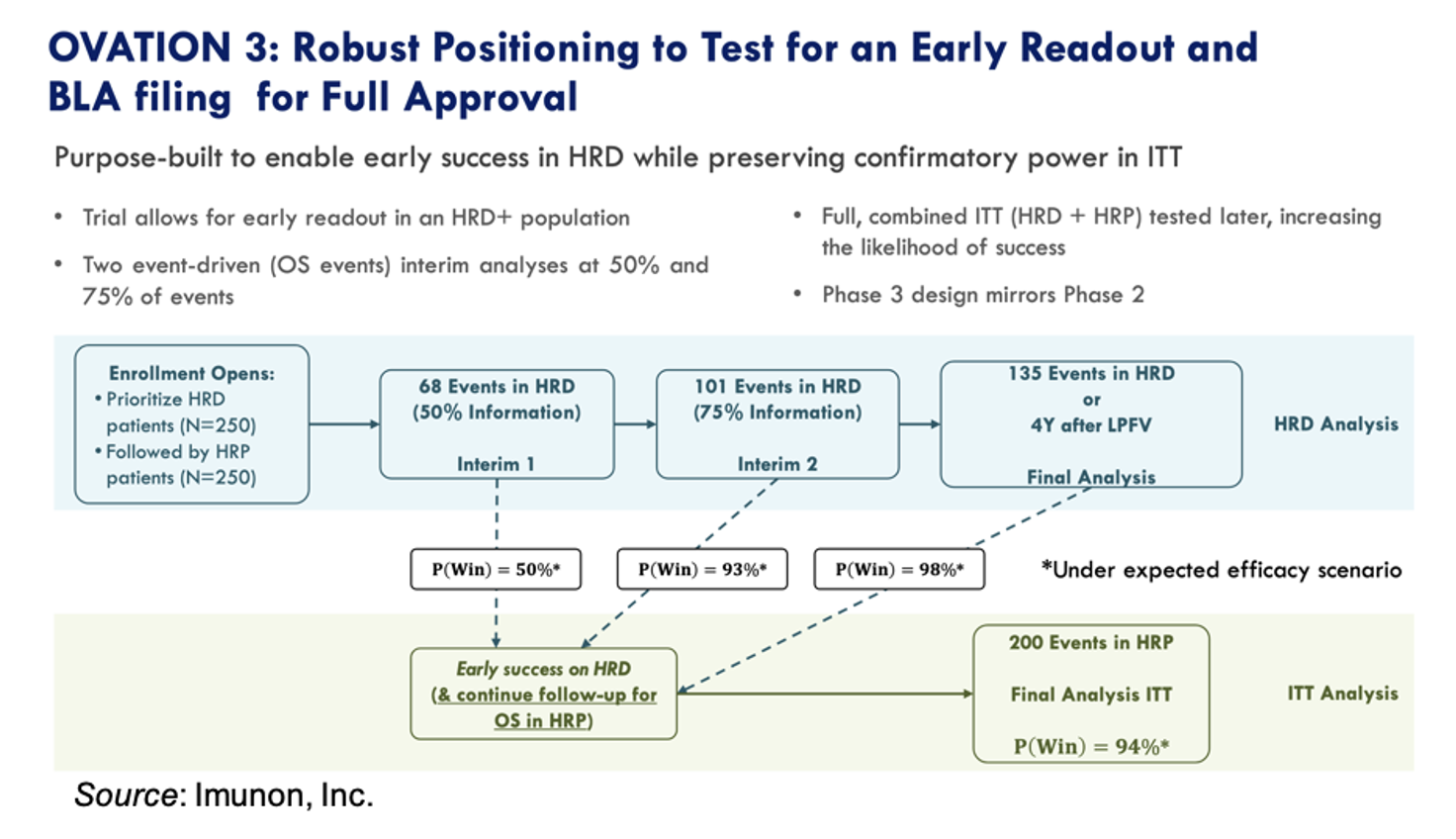

The OVATION 3 trial has been designed to prioritize the enrollment of HRD+ patients and has two interim analyses at 50% and 75% of events. The trial has 98% power to detect a statistically significant increase in overall survival in the HRD+ population, with a probability for stopping early for success at the interim readout of >90%.

Beyond top-line survival outcomes, Imunon has emphasized accumulating translational data supporting localized IL-12 expression and immune activation within the tumor microenvironment and we anticipate additional translational data to be presented in 2026. Data from the company’s minimal residual disease (MRD) study suggests biologically meaningful macrophage-driven immune engagement, reinforcing the potential differentiation of IMNN-001 versus systemic immunotherapies that have historically been limited by toxicity.

Financial Update

On December 30, 2025, Imunon announced a registered direct offering with a single healthcare-focused institutional investor for the purchase and sale of 1,939,114 shares of common stock (or pre-funded warrants in-lieu thereof) along with warrants to purchase up to an aggregate of 1,939,114 shares of common stock for a combined purchase price of $3.61 (or $3.6099 per pre-funded warrant and warrant). The warrants will have an exercise price of $3.482 per share and will expire five years from the date of issuance.

Imunon continues to evaluate various options for long-term funding intended to get the OVATION 3 program to meaningful inflection points. While this process is ongoing, management indicated that one or two bridge financings may be required to ensure uninterrupted execution of the OVATION 3 study. These financings are intended to support near-term clinical operations and are not expected to alter the company’s strategic focus on advancing IMNN-001 toward potential regulatory milestones.

Conclusion

Imunon enters 2026 with a lot of momentum, including the highly encouraging survival data from OVATION 2 and advancing the execution of its pivotal Phase 3 program. The recent financing provides incremental runway and supports continued trial enrollment while different long-term financing solutions are evaluated. The realignment of resources and leadership transition supports the company’s prioritization of trial execution and site activation as it moves to complete the study as quickly as possible. We have accounted for the recent financing and the potential for additional raises in our model, and our valuation is now $33 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.