By Ronald Wortel, MBA, P. Eng.

OTC:LFLRF

READ THE FULL LFLRF RESEARCH REPORT

Positioned in Québec’s Abitibi Gold Belt with a mill, mining lease and concession, and cash flow potential.

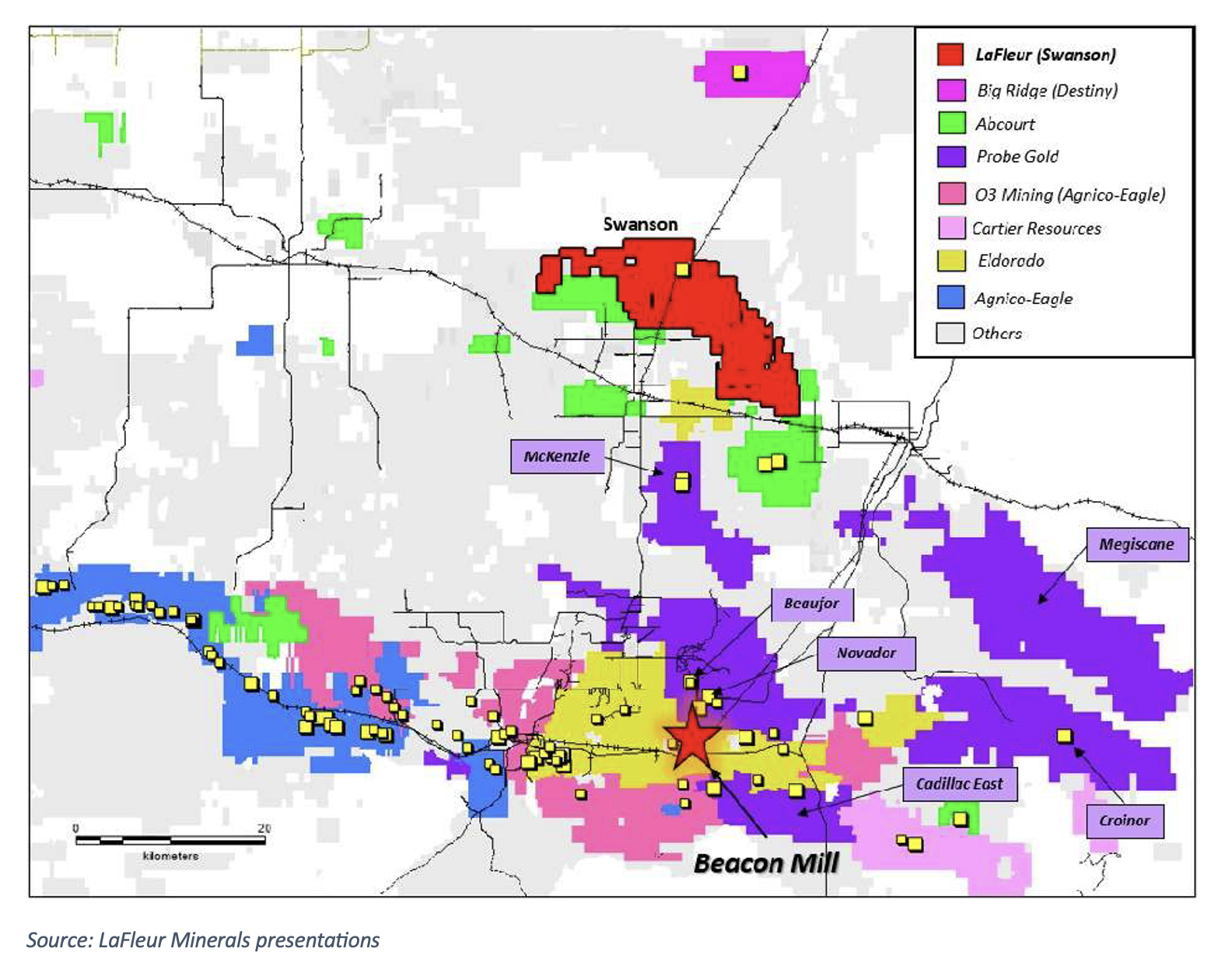

LaFleur Minerals (OTC:LFLRF) has emerged as one of the most intriguing junior mining stories in Québec’s Abitibi Gold Belt. In a market defined by record gold prices, the company has positioned itself with a rare combination of scale, permitted infrastructure, and near-term production potential. This sets Lafleur apart from peers who typically remain in the exploration stage.

At the core of LaFleur’s strategy is the Swanson Gold Project, a consolidated land package spanning more than 18,000 hectares and hosting multiple deposits. The company is advancing confirmation drilling, a new resource estimate, and a Preliminary Economic Assessment, all of which will underpin a bulk sample permit. With grades and recoveries that could generate more than $25 million in revenue from a 100,000-tonne sample, Swanson represents a credible path to cash flow.

Complementing Swanson is the Beacon Mill, acquired for just C$1.2 million yet carrying a replacement value estimated at C$70 million. Fully permitted and upgraded, the mill provides immediate processing capacity and a permitted tailings facility—assets that are exceptionally rare among juniors. Restart capital requirements are modest, estimated at C$4–6 million, and are now covered, offering investors a low-risk transition from explorer to producer.

Strategically, LaFleur sits adjacent to Fresnillo’s newly acquired Novador project, creating potential transaction value through consolidation or partnership. With catalysts including assay results, updated resource estimates, and the PEA expected in early 2026, LaFleur Minerals is positioned to surface significant value. Investors seeking leverage to gold prices and exposure to near-term production will find compelling reasons to read the full report.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.