By John Vandermosten, CFA

NASDAQ:LGND

READ THE FULL LGND RESEARCH REPORT

In the wake of the December analyst day, Ligand Pharmaceuticals, Inc.’s (NASDAQ:LGND) partners have seen meaningful activity with another acquisition for Pelthos, a delay in Filspari’s Target Action Date, a drug application acceptance for Ohtuvayre in China, positive results for Palvella’s portfolio, and a strategic collaboration for BOT/ BAL. Ligand also made an investment in Athira (now LeonaBio) as part of a consortium in support of the acquisition of lasofoxifene. In this report, we will update investors on each of these and provide our updated thoughts on the company.

Pelthos

Ligand owns about half of the equity in Pelthos Therapeutics, and it is entitled to a royalty from Zelsuvmi and Xepi, the latter of which was acquired in November 2025. A January 2026 press release announced that Pelthos had acquired Xeglyze, which is a topical treatment for head lice. The drug was approved by the FDA in July 2020, and Pelthos plans to relaunch Xeglyze in 1H:27. Oriented towards children, the product is complementary to Pelthos’ other two products that treat molluscum contagiosum and impetigo. While Ligand does not earn a royalty on Xeglyze sales, it owns a substantial equity interest that will benefit from the company’s overall performance.

Filspari

Ligand has received $25.8 million of royalty revenues over the trailing twelve months from the sale of Travere’s Filspari. The drug is approved for use to slow kidney function decline in adults with primary immunoglobulin A nephropathy (IgAN) who are at risk for disease progression. Ligand’s partner, Travere, has sought to obtain approval for Filspari in a new indication called Focal Segmental Glomerulosclerosis (FSGS) over several years. Since 2023, Travere had been working on a submission of a supplemental NDA for Filspari for use in FSGS. In May 2025, the FDA accepted the application and assigned a Target Action Date of January 13th, 2026.

In the weeks prior to the anticipated approval, the FDA made a series of information requests to clarify the benefit of Filspari in FSGS. While the responses were submitted prior to the agency’s decision, there was not sufficient time for the agency to properly review the data. As a result, the FDA delayed the Target Action Date by three months, classifying the additional data submission as a Major Amendment. Travere management clarified that the data requested did not include anything related to safety or manufacturing of the drug.

It stands to reason that the agency would need additional time to review the responses to its questions; however, the risk of a complete response letter remains. Some analysts have cited historical data showing a better than even chance related to delays such as this that the candidate in question will be approved.

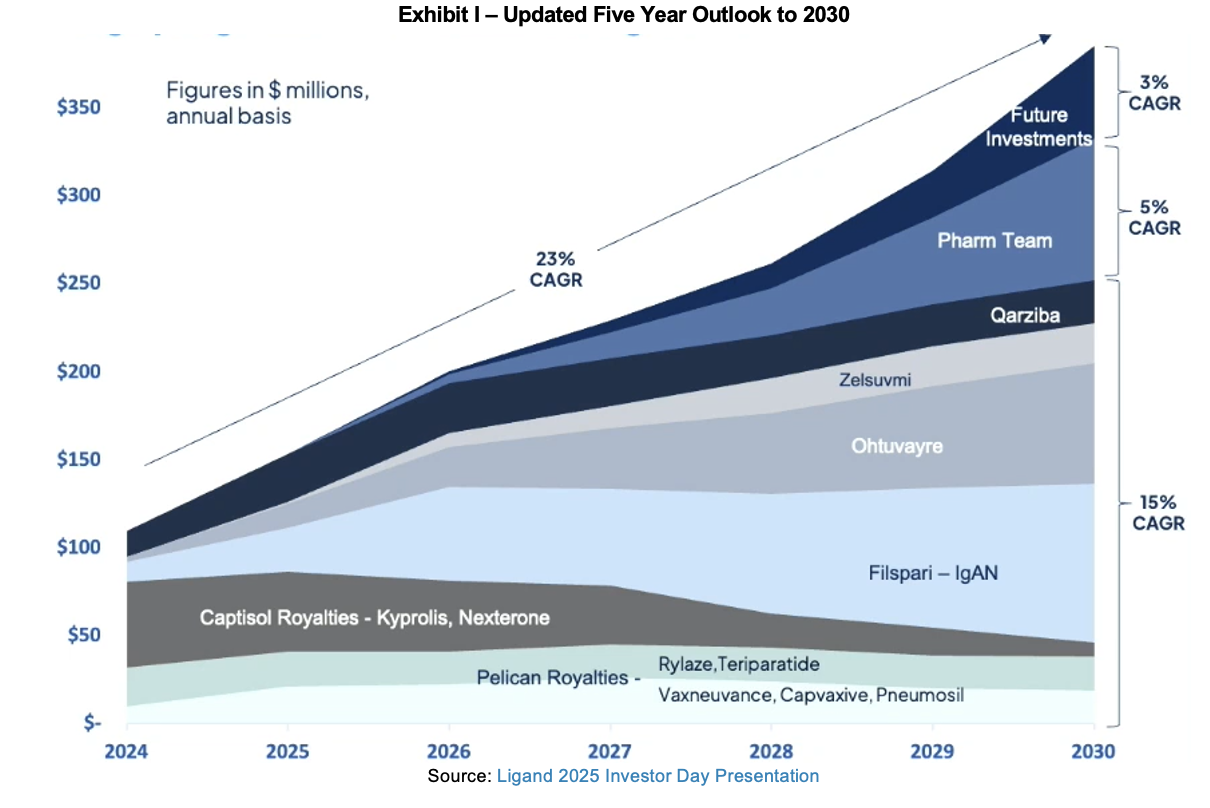

We have not explicitly forecasted FSGS revenues in our model, but Ligand does include a component for FSGS revenues in their Pharm Team segment. In its Analyst Day presentation last December, Ligand notes that contribution from Filspari for FSGS is an estimated $4 million in 2026, rising to $40-$45 million in 2030.

Lasofoxifene

Lasofoxifene was first discovered in 1992 through a research collaboration between Ligand and Pfizer. It is a type of endocrine and a selective estrogen receptor modulator (SERM). In breast cancer, SERMs work by sitting in the estrogen receptors in breast cells, thus blocking the effects of estrogen in the breast tissue. They also function as estrogens in bone and protect against osteoporosis. Ligand is eligible for milestones and royalties from lasofoxifene that range from 6% to 10%.

On December 18th, 2025, Athira Pharma (now doing business as LeonaBio) announced that it had acquired an exclusive license to develop lasofoxifene for metastatic breast cancer in a Phase III program. The company executed a financing for $236 million, which included $90 million upfront and another $146 million if associated warrants are exercised. Ligand participated as a minor investor in the financing, along with leadership from Commodore Capital, Perceptive Advisors, and TCGX. The ongoing Phase III trial is over half enrolled and is expected to generate data in 2027.

QTORIN Rapamycin

Ligand holds a royalty interest in Palvella Therapeutics’ lead program, QTORIN rapamycin, a topical mTOR inhibitor for rare, serious dermatologic conditions like pachyonychia congenita and microcystic lymphatic malformations. The royalty was increased to a tiered range of 8.0 to 9.8% in 2023 as Ligand expanded its interest in Qtorin rapamycin to include other derivatives of the platform. Ligand also holds preferred stock in Palvella.

In January, Palvella provided an update on its portfolio, noting that its Phase III SELVA study is on track for a March 2026 report of topline data. Assuming that the data are positive, a New Drug Application (NDA) submission is expected in 2H:26 for the indication of microcystic lymphatic malformations. Phase II results for Qtorin were announced in December 2025 for clinically significant angiokeratomas, following which, management requested a Preliminary Breakthrough Therapy Designation Advice meeting with the FDA. The meeting is expected in 1Q:26.

Ohtuvayre

Nuance Pharm announced that the National Medical Products Administration (NMPA) of China has officially accepted for review the NDA for Ohtuvayre (ensifentrine) for the maintenance treatment of chronic obstructive pulmonary disease. In 2021, Nuance Pharma entered into an agreement with Verona Pharma for the exclusive rights to develop and commercialize Ohtuvayre in Greater China (mainland China, Hong Kong, Macau, and Taiwan). According to the NMPA website, the review timeline for drug marketing authorization applications is 200 days.

Botensilimab and Balstilimab (BOT+BAL)

Agenus closed on its planned strategic collaboration with Zydus Lifesciences to commercialize BOT/BAL in India and Sri Lanka. The deal included upfront monies, an equity investment in Agenus, future milestones, and royalties that will support the development of manufacturing capacity in the United States.

Summary

With a large portfolio of assets, Ligand investment companies are bound to have material news at a regular cadence. Since mid-December, we have seen a number of updates for Pelthos, Filspari, lasofoxifene, Qtorin rapamycin, and Ohtuvayre. With the exception of the delay in the Target Action Date for Filspari, the other updates were positive. Pelthos continues to expand its portfolio of offerings and now has a treatment for head lice, while a drug developed during Ligand’s earliest days is pursuing a new indication in metastatic breast cancer. Palvella is advancing Qtorin rapamycin in multiple indications, all of which will pay royalties to Ligand on revenues generated. Ohtuvayre has made great strides in China and has already been approved in several Pilot Zones and is now being put in front of the NMPA for approval in mainland China. Agenus has closed its planned collaboration with Zydus for the latter to commercialize in India and Sri Lanka.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.