By John Vandermosten, CFA

NASDAQ:LNTH

READ THE FULL LNTH RESEARCH REPORT

As 2026 begins, we are updating investors on Lantheus Holdings, Inc. (NASDAQ:LNTH), highlighting several recent developments. These include a summary of the poster presented at December’s Clinical Trials on Alzheimer’s Disease (CTAD) 2025 conference, confirmation of the single photon emission computed tomography (SPECT) business unit sale at the end of 2025 and an update to our financial estimates and valuation.

CTAD Poster

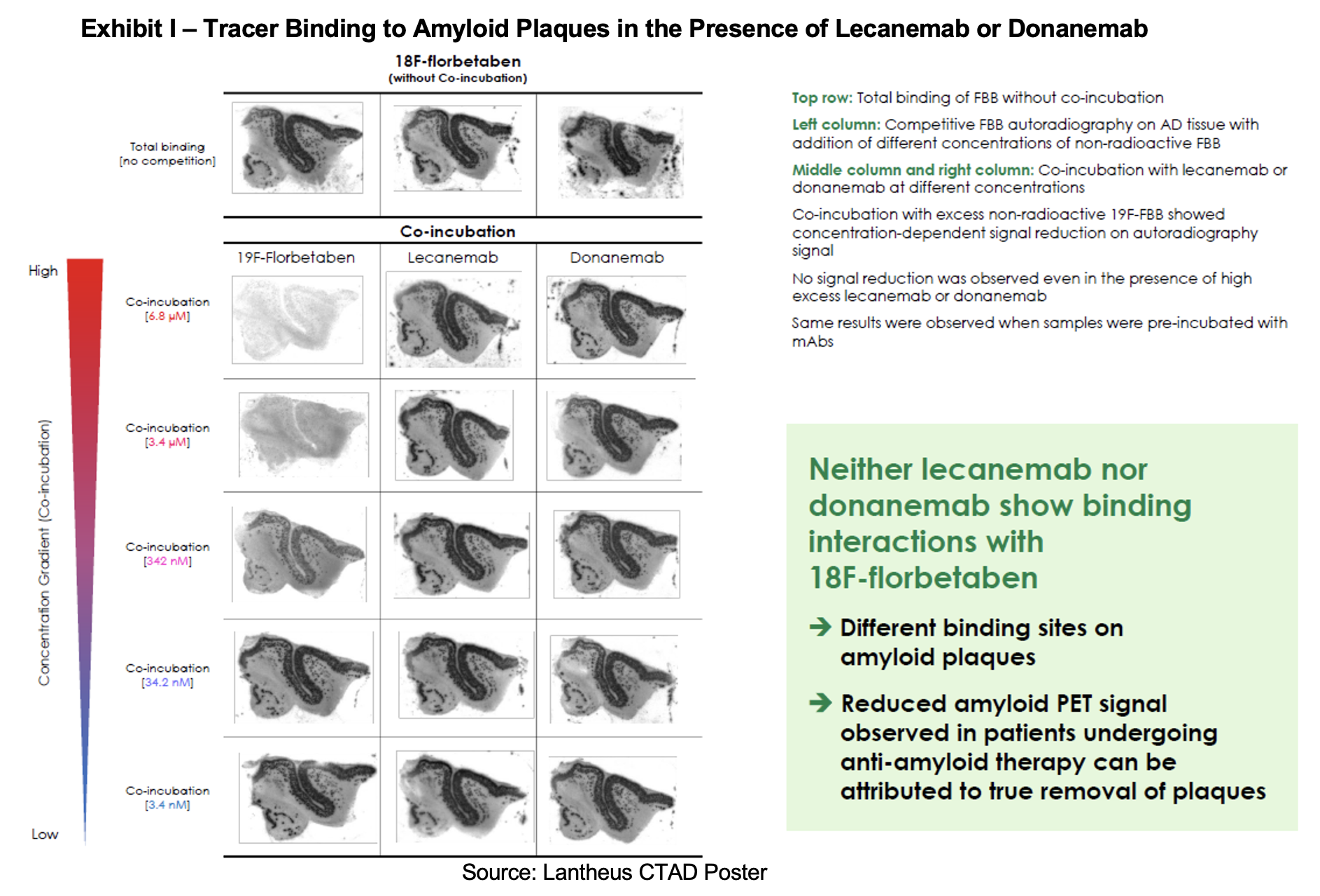

On December 3rd, 2025, Life Molecular Imaging’s[1] Marianne Chapleau presented a poster at the Clinical Trials on Alzheimer’s Disease (CTAD) 2025 conference held in San Diego, California. The poster sought to investigate whether excess lecanemab or donanemab in the brain shows any interference with the binding of the amyloid PET tracer 18F-florbetaben (Neuraceq) to aggregated amyloid-β deposits in vitro.

In the poster’s concluding exhibit, investigators demonstrated that co-incubation of Neuraceq with lecanemab or donanemab did not produce a signal reduction, even in the presence of excess anti-amyloid antibodies.

The poster concluded that lecanemab and donanemab do not competitively interfere with 18F‑florbetaben binding, as the anti‑amyloid antibodies bind to different epitopes on the amyloid plaques than Neuraceq. The study also found that anti‑amyloid antibodies do not mask plaques from PET imaging detection, and that reduced amyloid PET signals in treated patients can be attributed to plaque removal.

SPECT Business Sale

As its first announcement of 2026, Lantheus confirmed the sale of its single photon emission computed tomography (SPECT) business unit in a January 2nd press release. The intent to sell the unit including TechneLite, NeuroLite, Xenon Xe-133 gas and CardioLite to Illuminated Holdings, the parent company of SHINE Technologies was first reported on May 6th. In addition to the product sale, Lantheus also included related manufacturing assets from the North Billerica, Massachusetts campus and SPECT-related Canadian operations. The goal of the transaction was to free up Lantheus’ management and financial resources to support its remaining commercialized products and development portfolio. In return for the sale, Lantheus received an upfront cash payment, a note convertible into SHINE preferred stock and additional consideration to include earnout milestones.

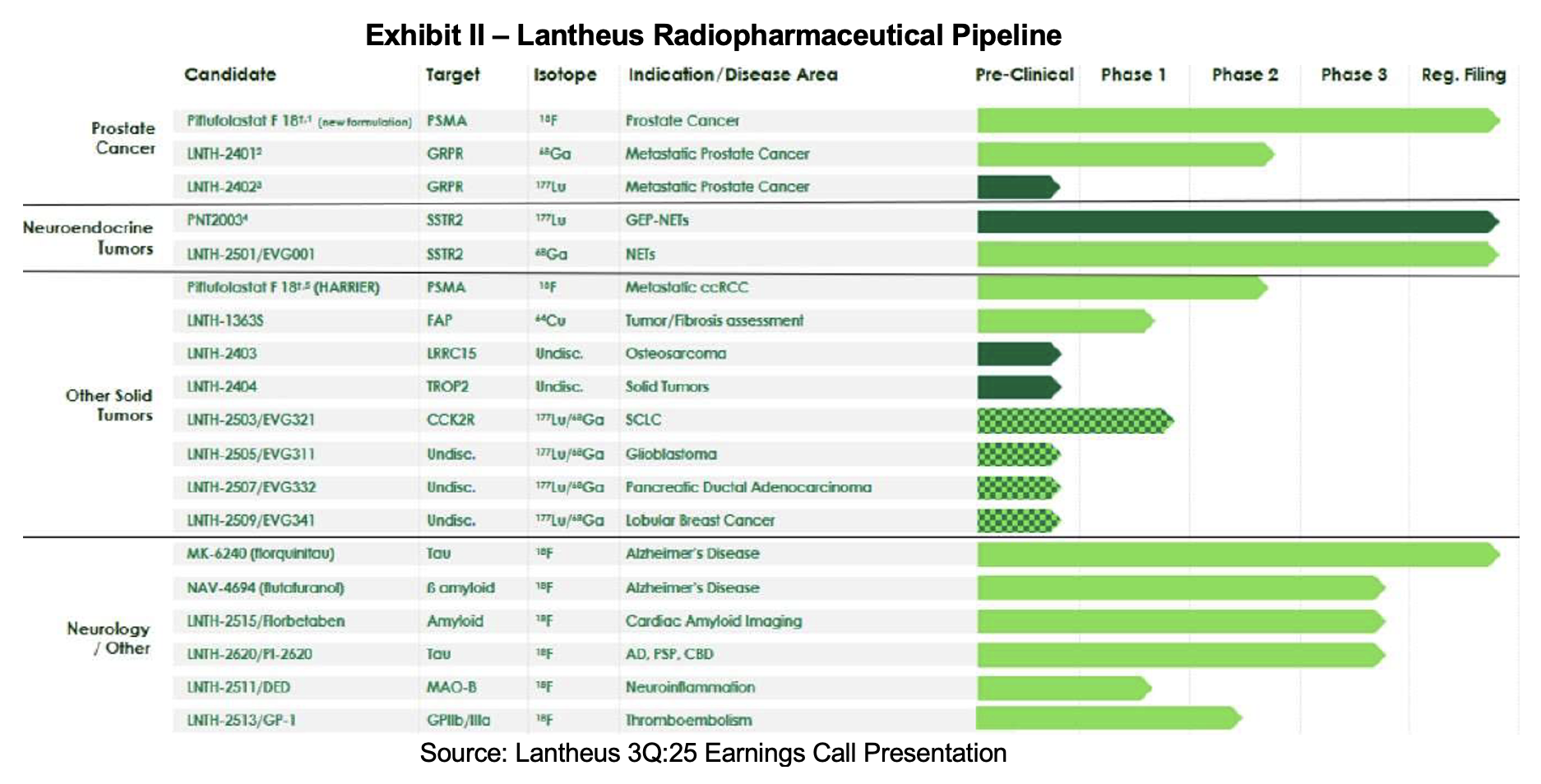

Lantheus Pipeline

Valuation and Estimates Update

We refine our 2026 estimates as we move into the new year. We believe that pricing pressure may continue into 2026 from renegotiated partnerships and the impact from 340B pricing for Pylarify. We anticipate that there will be a positive contribution from reformulated Pylarify, but now think this launch may come later than we initially anticipated on account of the time it takes for coding, coverage and payment efforts. Based on these changes, our Pylarify estimate moves from $983 million to $928 million for 2026. This results in a reduction of EPS from $5.51 to $5.13.

Our valuation blends a 15.0x EPS and 12.0x EBITDA multiple applied to 2026 estimates. Our model applies these changes and generates a valuation of $76 per share.

Corporate Milestones

- Close of Evergreen Theragnostics acquisition – April 2025

- Life Molecular Imaging acquisition completed – July 2025

- Initiate Phase I/IIa study for LNTH-2401/-2402 (RM2) – 2H:25

- Completion of SPECT business unit transfer to SHINE – year end 2025

- Reformulated Pylarify target action date – March 6th, 2026

- Target action date for LNTH-2501 (Octevy) in SSTR+ NETs – March 29th, 2026

- MK-6240 market launch – 2026

- NAV-4694 NDA market submission – 2026

- FDA approval and launch of PNT2003 - 2026

Summary

In contrast to most of us, Lantheus enters 2026 with a slimmer profile having divested its SPECT business. The sale frees resources to focus on returning Pylarify to growth and advance the development portfolio. The company’s work in neurodegenerative imaging progresses as new data is generated and shared in a poster presented at CTAD and multiple β-amyloid and Tau assets march towards regulatory approval. The recently acquired Neuraceq is generating $20 million in revenues per quarter and is growing at a rapid clip. Another neurology imaging asset is MK-6240 for Tau tangles. It is expected to be approved in 2026 and should be joined by other Tau and β-amyloid imaging agents. Neuroendocrine tumors are an exciting target where Lantheus is developing a theranostic pair to address the disease. The two agents are designated LNTH-2501 and PNT2003. This franchise could be generating revenues by late next year. Lantheus’ portfolio of assets has the potential to drive topline growth into the double digits by 2027[2] if regulatory and sales targets are achieved. GE HealthCare is another minor but positive contributor with anticipated royalty revenues from Flyrcado and commercialization of Pylarify in Japan.

Lantheus’ PSMA PET diagnostic has faced substantial competition this year along with 340B pricing pressure. Management believes that there will continue to be lower average unit prices in the fourth quarter and this may bleed into 2026. Despite the revenue declines for Pylarify, Lantheus offers many other assets to fill the void. A new formulation of the PSMA PET diagnostic is expected to be approved in March which will reset pricing and allow for transitional pass-through (TPT) status that could add several more years of price protection to the franchise.

We update our 2026 earnings estimate and valuation to reflect continued pressures on Pylarify volumes and a later start to sales of reformulated Pylarify. Our valuation now stands at $76.00 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

[1] Life Molecular Imaging was acquired by Lantheus in July 2025. The acquisition included Neuraceq (florbetaben F-18), its FDA-approved PET imaging agent used to detect β-amyloid plaques in patients evaluated for Alzheimer’s disease, along with Life Molecular’s commercial infrastructure and R&D assets.

[2] This removes the impact of the TechneLite and Xenon business which are expected to be fully divested by year end 2025.