By David Bautz, PhD

NASDAQ:MTVA

READ THE FULL MTVA RESEARCH REPORT

Business Update

Positive Results for 8-week 48 mg Cohort in Phase 1b Trial of DA-1726

On January 5, 2026, MetaVia, Inc. (NASDAQ:MTVA) announced positive and statistically significant results from the 8-week 48 mg cohort from the Phase 1b trial of DA-1726, the company’s dual oxyntomodulin analog that functions as a glucagon-like peptide-1 receptor (GLP1R) and glucagon receptor (GCGR) agonist. The results showed a robust reduction in weight and waist circumference, along with large improvements in glucose control and reductions in liver stiffness. The drug also continued to be safe and well tolerated.

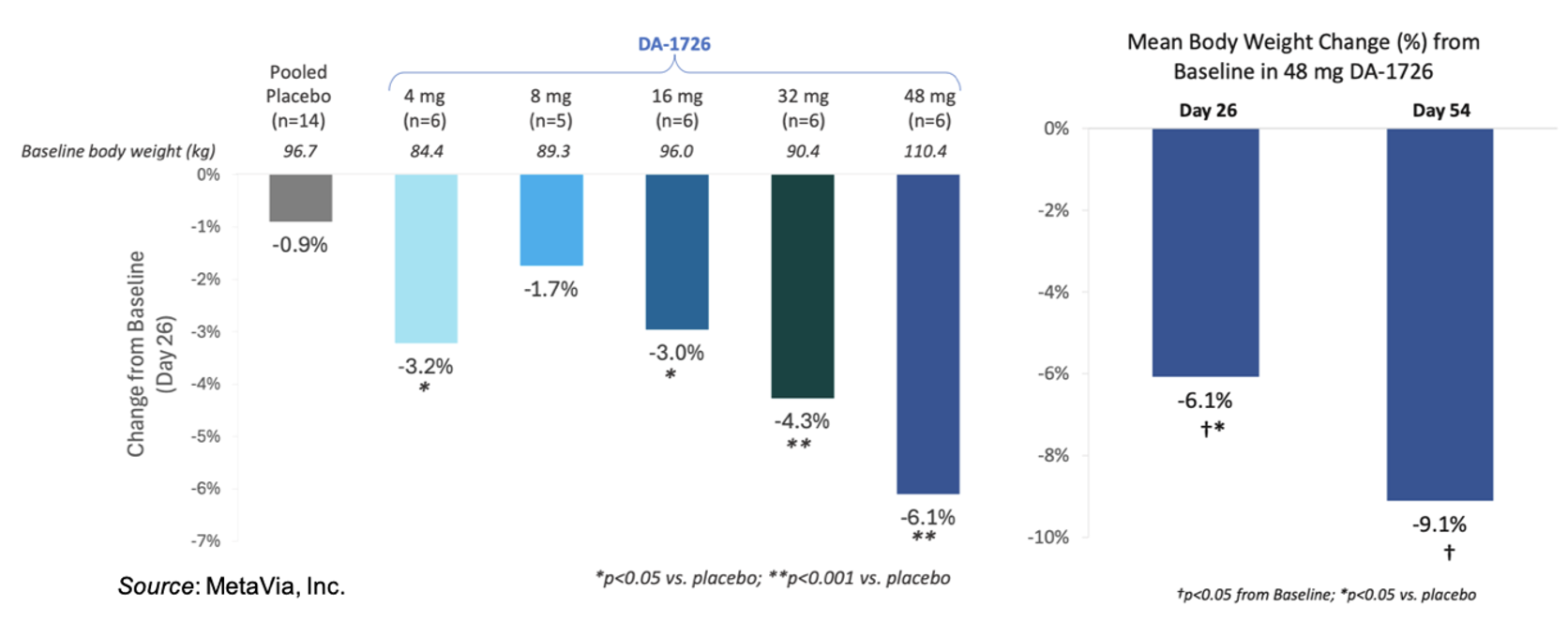

The following figure on the left shows the weight loss seen thus far for the different cohorts from the Phase 1 study that were treated for four weeks. There is a clear dose response starting from the 8mg dose through the 48 mg dose. The figure on the right compares the 4-week data to the 8-week data for the 48 mg cohort.

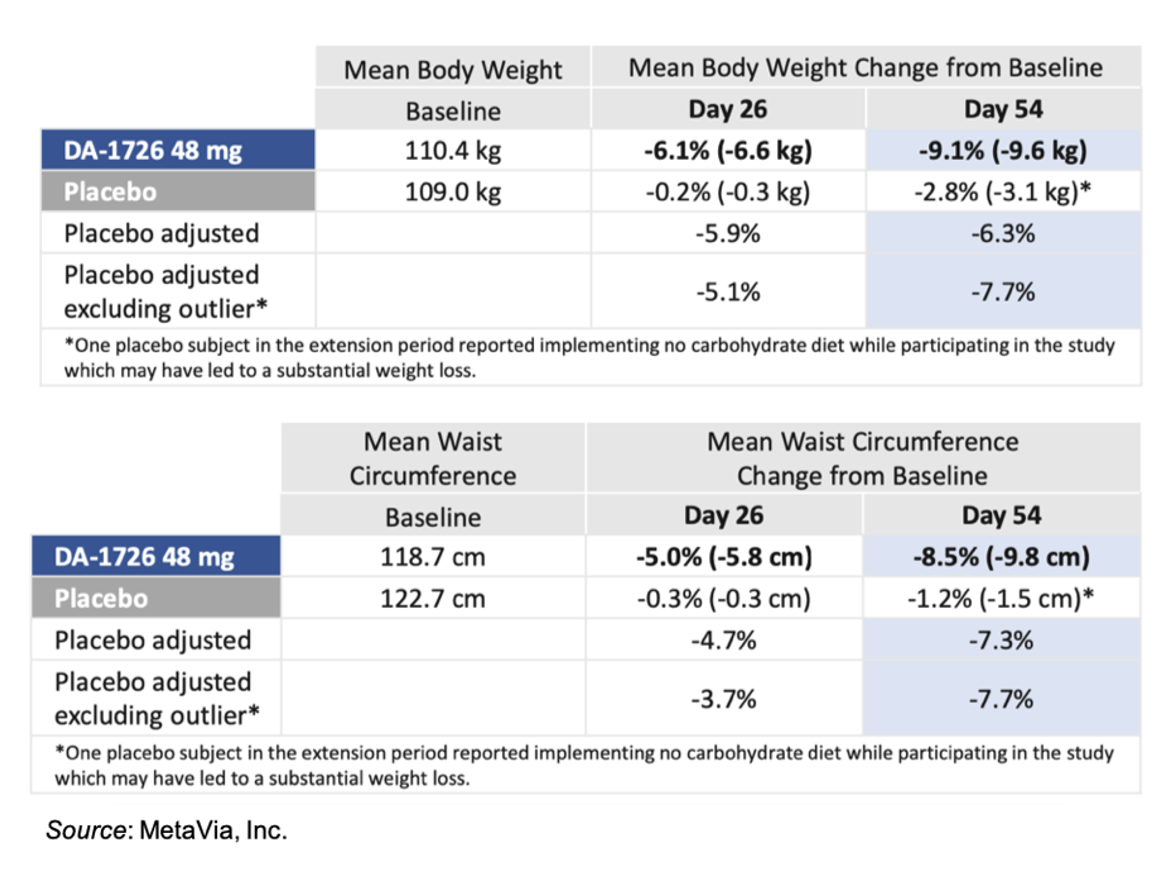

The following tables give the placebo adjusted results for body weight and waist circumference for the 48 mg cohort. One of the subjects in the placebo group reported implementing a “no carbohydrate” diet while participating in the study, which may have led to a substantial weight loss. Thus, the company performed a placebo adjusted analysis with and without that individual. For waist circumference, the placebo outlier did not have a substantial reduction in waist circumference, which further supports DA-1726’s direct effect on waist circumference.

DA-1726 also showed positive effects on glucose control and liver health. Fasting glucose decreased from a mean baseline of 105.3 mg/dL to a mean of 93 mg/dL after eight weeks of treatment. Mean HbA1c was also controlled in this non-diabetic population, with a mean change of -0.22% after eight weeks of DA-1726 therapy. One pre-diabetic patient began the study with an HbA1c of 6% at baseline, and that was reduced to 5.5% after eight weeks of treatment. For liver health, the mean VCTE (FibroScan®) was 5.9 kPa at baseline, and that decreased to a mean 4.5 kPa after eight weeks of treatment with DA-1726. This is in contrast to placebo-treated patients that had a mean baseline VCTE of 5.1 kPa that increased to a mean 6 kPa after eight weeks. These results show that DA-1726 is having a positive effect on liver inflammation and stiffness.

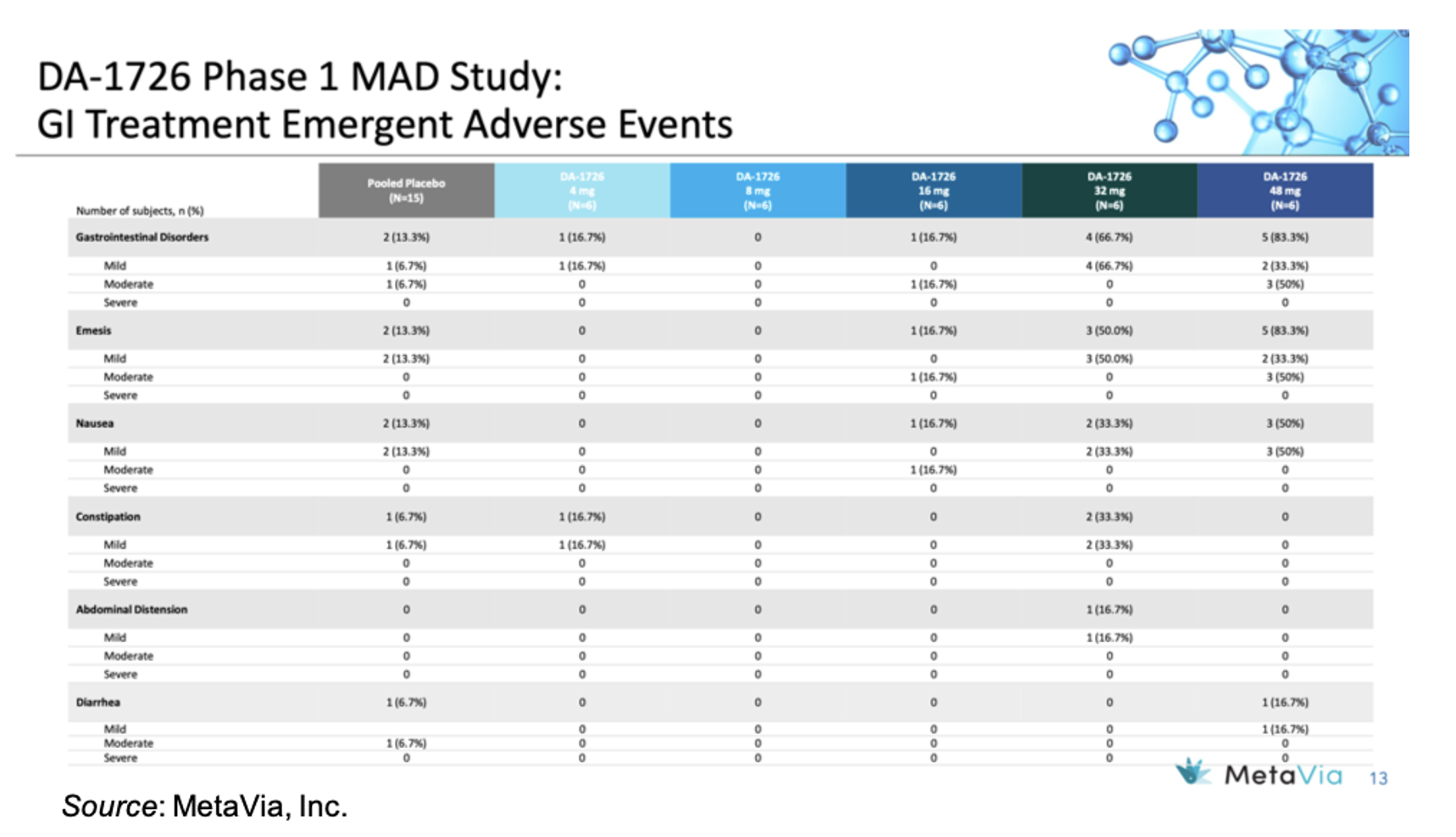

In regard to safety and tolerability, there was only one DA-1726-treated subject who discontinued from the study, which was due to being in the hospital as the result of a car accident while riding in a passenger seat. The following table gives an overview of the GI treatment emergent adverse events, which show an increase in mild to moderate events in the 48 mg cohort. However, there was no titration with that cohort, thus we believe the incidence of GI events will likely decrease in Part 3 of the trial when titration is introduced.

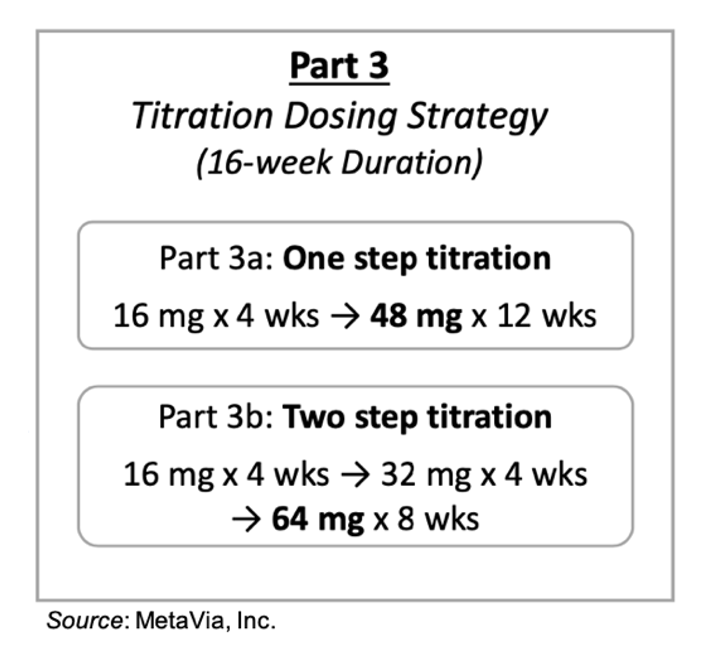

The final stage of the Phase 1 trial will evaluate DA-1726 in two titration dosing regimens. The cohort in Part 3a will receive four weeks of 16 mg DA-1726 followed by twelve weeks of 48 mg DA-1726. The cohort in Part 3b will follow a two-step titration: subjects will receive 16 mg DA-1726 for four weeks, followed by 32 mg DA-1726 for four weeks, and then 64 mg DA-1726 for eight weeks. The company is attempting to mitigate the GI AE profile through titration to the target dose. Part 3 of the Phase 1 trial is expected to begin in the first quarter of 2026, and we anticipate topline results in the fourth quarter of 2026.

DA-1726 Competitive Analysis

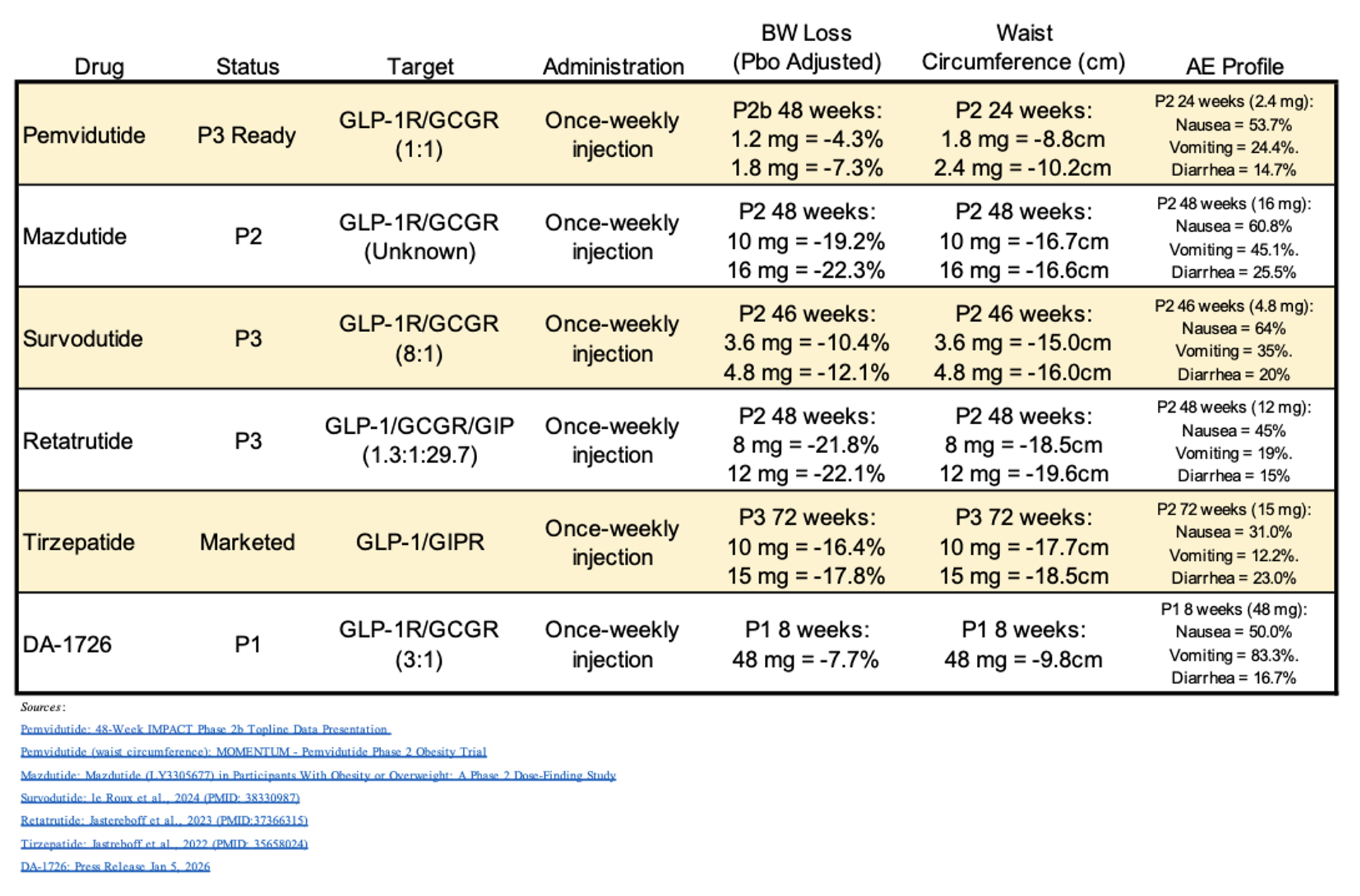

At this point, we believe the most informative comparisons of DA-1726’s early data are with other weight loss drugs that also target the glucagon receptor. The following table provides efficacy and tolerability data for different glucagon receptor-targeting therapies and tirzepatide, which is a GLP-1R/GIPR co-agonist. While a direct comparison between the various compounds is not possible due to differences in titration, inclusion/exclusion criteria, and study length, this table is provided as a means to show potential trends in the data. In addition, the competitor compounds are further along in development than DA-1726, but their results give a good indication of the type of activity DA-1726 will need to show in longer term trials. Lastly, while AE rates for nausea, vomiting, and diarrhea are provided, investors should keep in mind that DA-1726 did not titrate up to 48 mg, while the competitor compounds’ results were obtained following titration to the target dose.

Based upon the early data for DA-1726, we believe the drug could potentially match or even exceed the efficacy results for the other glucagon-targeted therapies in a long-term trial, and if the Phase 1b Part 3 titration results show decreased GI AEs (which is typical for this class of drugs that implement a titration strategy), DA-1726 could represent a fully differentiated asset with a best-in-class efficacy and tolerability profile.

Financial Update

On January 16, 2026, MetaVia announced the closing of a $9.3 million underwritten public offering that included the full exercise of the underwriter’s overallotment option to purchase additional shares and warrants. The company sold 3,005,574 shares of common stock, 4,508,361 Series C warrants, and 4,508,361 Series D warrants at a combined price of $3.10 per share of common stock and accompanying Series C and Series D warrants. The Series C and D warrants are both immediately exercisable and have an exercise price of $3.10; the Series C warrants expire in five years, while the Series D warrants expire in two years. The series D warrants are also callable by MetaVia following the release of a positive data readout for Part 3 of the Phase 1b trial of DA-1726. Lastly, both the Series C and D warrants are fixed price, and there is no variable pricing feature or alternative exercise provisions. If the full allotment of both the Series C and D warrants are exercised for cash, it would yield approximately $28 million in future gross proceeds.

Conclusion

The 48 mg 8-week data for DA-1726 provided additional evidence for the drug’s potential; weight loss continued to increase with no sign of plateauing, waist circumference decreases are showing signs of potential best-in-class efficacy, and the compound is seeming to have a positive effect on liver inflammation and stiffness. The AE profile showing increased incidences of GI effects should not alarm investors, as the company was essentially testing how high it could push the dosage without needing to titrate. We fully expect the GI AEs to decrease in Part 3 of the Phase 1 trial following implementation of a titration schedule. However, we don’t expect this to decrease the efficacy results. We look forward to the topline data from Part 3 of the Phase 1b trial in the fourth quarter of 2026. These results will mark the end of the Phase 1b trial and will be used to design Phase 2 trials. Following the company’s recent financing, our valuation is now $60 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.