By Thomas Kerr, CFA

OTCQX:TLGRF

READ THE FULL TLGRF RESEARCH REPORT

Second Quarter (December 2025) Report

On January 30, 2026, Talga Group (OTCQX:TLGRF) released its quarterly business update and cash flow report. Talga reports full financial earnings on a six-month basis but provides cash balances and cash flow statements every quarter.

Talga ended the quarter with A$28.4 million in cash, which includes A$13.35 million in restricted funds from the Industry Leap grant (see below). The company also had conditional financing facilities totaling A$125 million from the EU Innovation Fund and Environmental Bonds. The company has 510 million shares outstanding, 14.8 million unlisted options, and the market capitalization is approximately US$163.2 million currently.

Recent Equity Capital Funding

At the end of the 2nd quarter, Talga successfully raised A$14.5 million from new and existing institutional and sophisticated investors through a placement of 35.4 million new ordinary shares at A$0.41 per share. The price reflected a 7.2% discount on the 10-day VWAP average price on the last trading day prior to issuance.

In addition, the company launched a Share Purchase Plan (SPP) for eligible shareholders in Australia, New Zealand, and Singapore. On January 28, 2026, the company announced it had raised A$7.3 million from the oversubscribed SPP (original target was to raise A$5.0 million). 17,738,987 new shares have been allocated to SPP applicants.

Industrial Leap Program

During the quarter, Talga was awarded a A$13.35 million grant under the Swedish Energy Agency’s Industrial Leap program, which is part of the EU Recovery and Resilience Facility (RRF) and Next Generation EU initiative. The grant is partially funding the A$30.8 million study for the final engineering design for a staged 5,000 tonnes per year ramp-up in graphite anode commercial production.

Also during the quarter, the company progressed the nine work packages which make up the Industrial Leap Project. Pilot test work is now well advanced, at more than 50% complete. Recently, the company scaled up activities for the beneficiation, purification and spheronizing of graphite as well as the scale up of processing for recycled graphite and production of Talnode®-R. Engineers commenced work on the Front-End Engineering Design for the commercial-scale facility. Work on the Industrial Leap Project will continue to intensify and is expected to be completed by the end of June 2026.

Nunasvaara South Graphite Mine Update

On January 27, 2026, the company announced that Sweden’s Government approved the detailed zoning plan for the Nunasvaara South Graphite Mine. This approval paves the way for the company to proceed with detailed design and securing building permits before project development.

The detailed plan regulates how the land can be used and developed in compliance with Sweden’s land use and environmental regulations. It designates zones on site for infrastructure, buildings, and mining activities.

Other key permits for this mine are already in force, primarily the Environmental Permit and Exploitation Concession. The graphite deposit at Vittangi is designated as a mineral deposit of national interest, while the Vittangi Anode Project, encompassing the Luleå Anode Refinery, is a designated EU Strategic Project under the Critical Raw Materials Act and the Net-Zero Industry Act.

Aero Project in Sweden

On January 15, 2026, the company announced that recent rock chip sampling programs, field mapping, and evaluation have confirmed evidence of high-grade gallium and other critical elements at the 100% owned Aero Project in northern Sweden. The Aero Project covers 270 km², located 20 km southeast of Gällivare, a major mining hub in Sweden's Norrbotten region. Previous exploration activity at Aero has identified lithium oxide over a 50 km total strike with surface sample grades of up to 1.9% Li2O.

Talga recently completed field mapping and geochemical rock outcrop sampling and re-evaluated the project through the application of the Exploration Information System (EIS) digital tool. The company plans on refining and updating this model as exploration activities progress and new data is made available. The surface rock exposures have returned high-grade and anomalous concentrations of gallium, other rare earth elements (REEs), including yttrium, and other critical minerals and elements which statistically exceed bulk crustal abundances. These results are considered significant for a first pass exploration such as this.

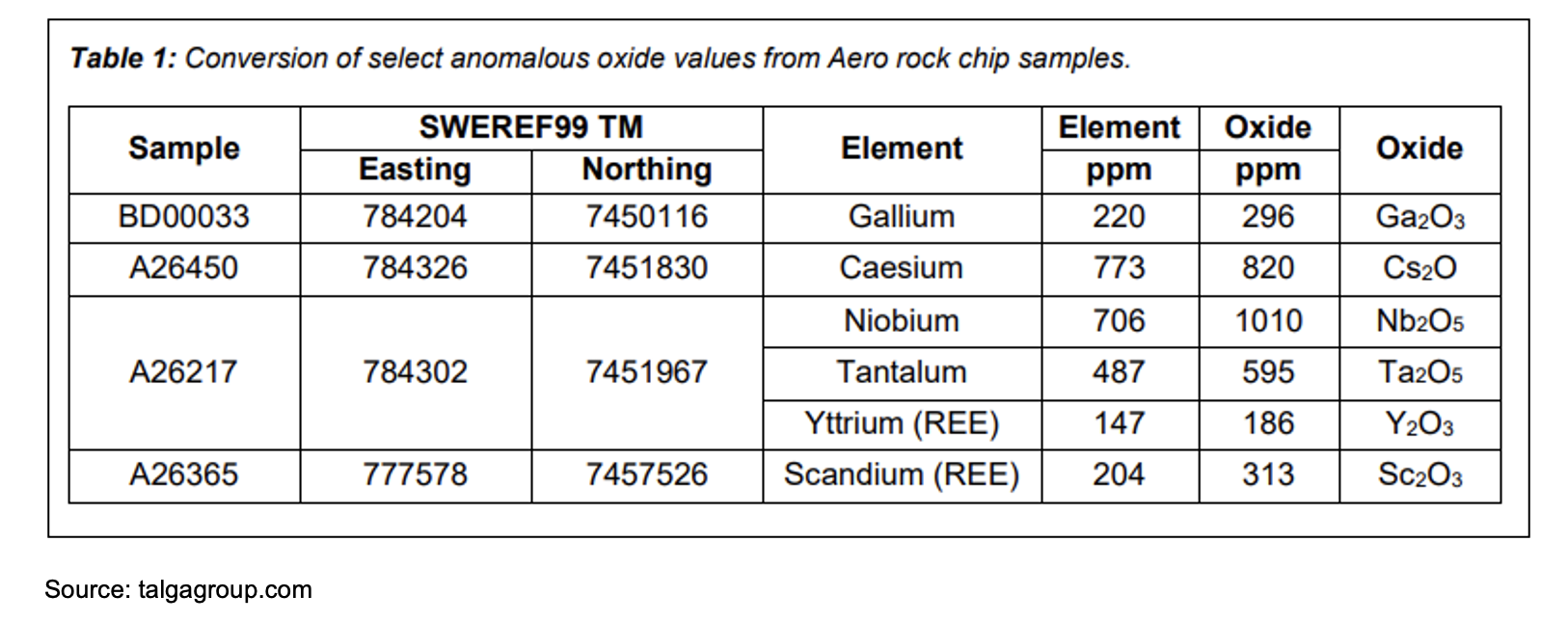

These very impressive highlight assay results include:

This collection of critical minerals and elements is gaining importance in global supply chains as governments such as the US, UK, Japan, Europe, South Korea, Australia, and Canada collaborate to build strategic reserves. Gallium and cesium are used in semiconductors, which drive advanced telecommunications among other applications. Niobium, scandium, tantalum, and yttrium are commonly used in alloys for lightweight applications that are crucial in the aerospace, defense, and automotive industries. Yttrium is also used in lasers.

We believe the potential of Aero will be greater than previously recognized due to recent exploration results. Although still in the exploration phase, the company is pursuing US and EU funding opportunities, including applications under DOE critical minerals programs and EU CRMA strategic project calls, to accelerate development of the project. In addition, Talga is engaging with major strategic partners for joint ventures targeting global companies in mining, technology, and defense sectors. This approach will allow Talga to unlock Aero's value while prioritizing the company’s core graphite battery anode business.

Current Graphite Business

Talga made solid commercial and technical progress during the quarter which was highlighted by the delivery of two tonnes of Talnode®-C (the largest shipment to date) under an existing offtake agreement. Customer material revenues quadrupled to A$71,000 compared to the prior quarter, which was driven by advancing product qualification programs with several new major battery cell makers. We believe customer feedback was positive, particularly around fast-charge performance, lifecycle results, and electrode compatibility.

Also during the 2nd quarter, the company expanded its product portfolio to capture emerging opportunities from shifting global supply chains and market conditions. New offerings include conductive additives for industrial metal powder applications, specialty coatings, and advanced manufacturing markets. Talga’s high-purity graphite has also attracted interest as a performance-enhancing additive across the defense, aviation, and consumer goods sectors.

Talga and V4Smart Agreement

On January 19, 2026, the company announced the execution of a development agreement with V4Smart, a German-based innovator in high performance batteries co-owned by Porsche AG and VARTA AG Group.

Under the agreement, Talga and V4Smart will jointly develop and qualify Talga's high-performance graphite anode for integration into next-generation fast-charging battery cells. This non-binding agreement represents an important step towards establishing a secure, commercial European supply chain, with the parties intending to progress to binding offtake and volume agreements upon achieving key technical milestones.

The project aligns with Talga’s commercial ramp-up plans and targets completion prior to December 31, 2027. It includes mutually agreed anode specifications, qualification volumes, and indicative commercial volumes, with potential to extend to material recycling.

Acquired by Porsche AG in March 2025 from the VARTA AG Group, V4Smart focuses on innovative ultra-high-performance lithium-ion battery cylindrical cells made in Germany.

Research & Development

During the 2nd quarter, the company consolidated and rationalized its R&D department to centralize operations in the U.K., which reduced the team in Germany. Current activities which the R&D team are involved with include:

NoVOC: Talga supplies innovative high-performance graphite and silicon-graphene composite anodes tailored for both wet and dry electrode manufacturing processes, targeting volatile-free lithium-ion battery manufacturing. They are a key partner in this €5.4 million Horizon Europe initiative which has a total project cost €10.1 million. The 17-partner consortium (including Varta and FIAT), coordinated by RISE (Research Institute of Sweden) and spanning 10 countries, focuses on reducing costs, energy use and emissions while promoting European production independence.

HiSpin: Talga contributes specialized silicon-graphite/graphene composite anodes to this project, targeting high-performance battery cells for automotive and aeronautic applications, with high-voltage spinel LNMO/SiC active material with goals of 390 Wh/kg energy density, high-power, over 2,000 cycle life, and at a lower cost. This project is coordinated by AIT (Australia), the 14-partner consortium across 8 countries (including Saft and Topsoe) which emphasizes performance and cost through novel active materials, high-voltage electrolytes and innovative electrode structuring.

GRAPHiREC: Talga is leading the graphite post-processing in a €7.5 million EU LIFE initiative focused on recycling graphite from lithium-ion and alkaline battery waste at industrial pilot scale. The project deploys Europe’s first industrial pilot plants using dry mechanical and hydrometallurgical processes, targeting 90% recovery at battery-grade purity. It will produce prototype button cells, EV cells, and AA batteries while cutting CO₂ emissions, reducing waste and import reliance, and supporting a circular battery economy.

Within the project, Talga purifies recycled graphite to battery-grade quality and applies proprietary carbon coatings to manufacture high-performance anode materials that match virgin graphite performance. The eight-partner consortium includes recyclers, battery makers, and universities, with VARTA validating full-cell performance. Separately, Talga participates in two Swedish competence centers: 2DTech, focused on advanced 2-D materials with partners like GKN Aerospace and Volvo, and Batteries Sweden (BASE), which involves the full battery value chain from materials and components to end users and recyclers.

We believe the company’s R&D investments drive benefits through product innovations that expand market opportunities and secure customer validations, while attracting substantial grant funding, developing IP, as well as developing commercial partnerships.

February Investor Webinar

Talga will hold an open investment webinar on Monday, February 9, at 2:00 pm AWST / 5:00 pm AEDT.

The company’s Managing Director, Mark Thompson, will provide an update on the Vittangi Anode Project and other recent corporate activities, followed by a Q&A session. Questions can be asked online during the webinar or submitted ahead of time by email at info@talgagroup.com.

Registration for the webinar can be found here.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.