By Ronald Wortel, MBA, P. Eng.

NYSE:TRX | TSX:TRX.TO

READ THE FULL TRX RESEARCH REPORT

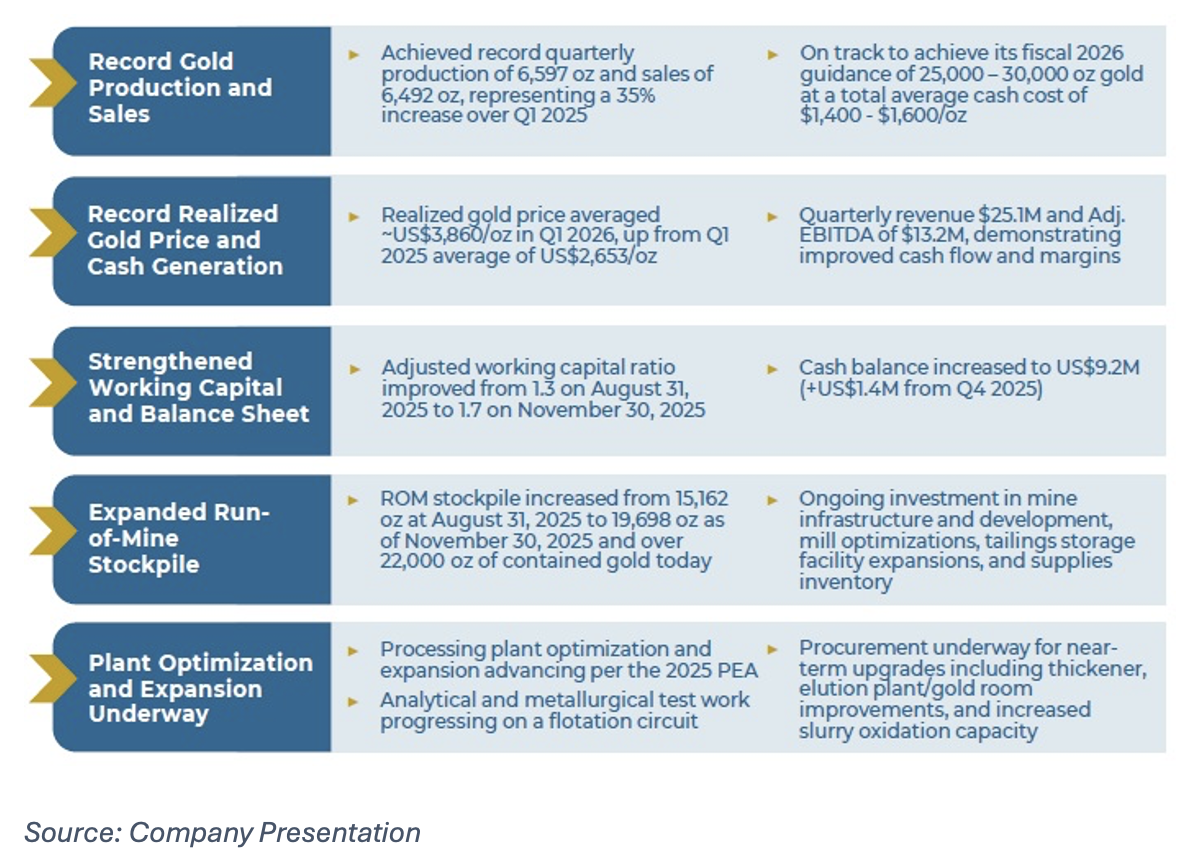

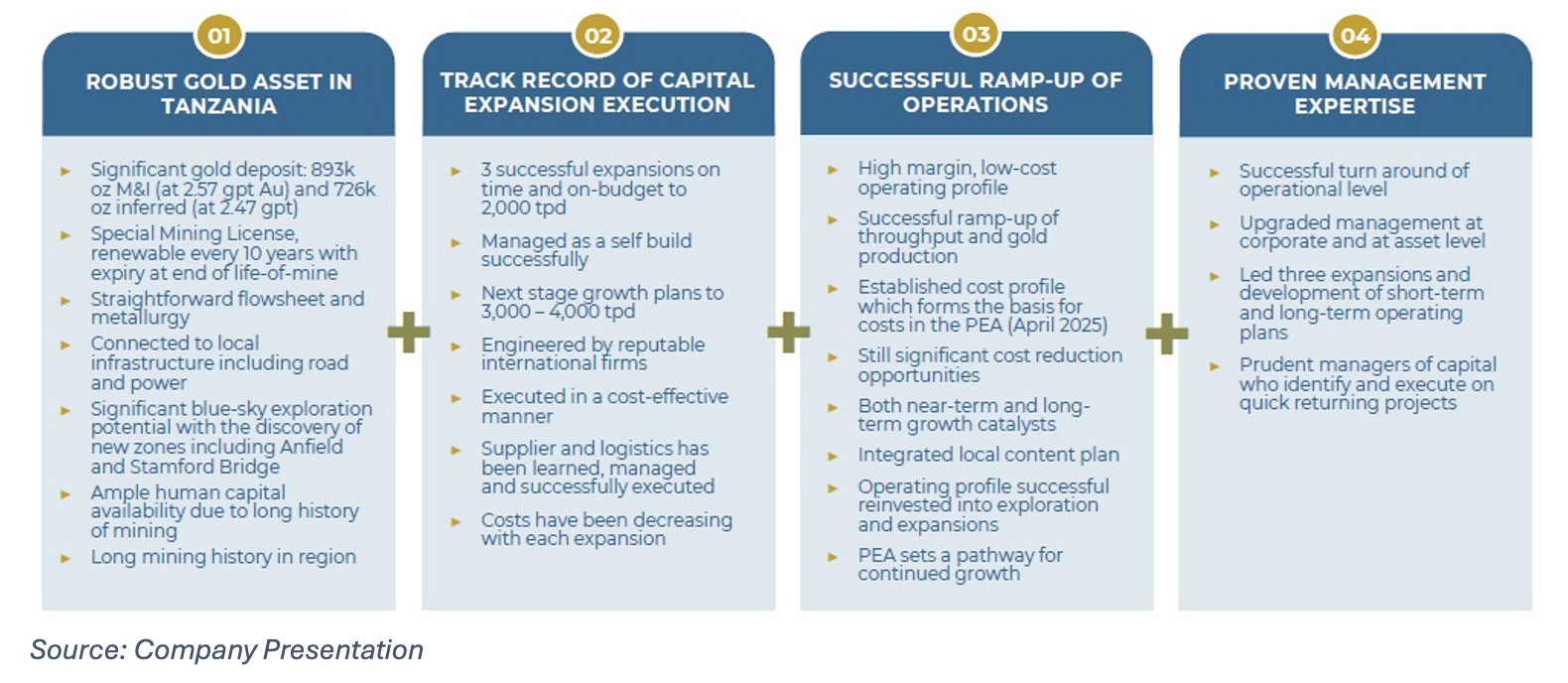

TRX Gold Corporation (NYSE:TRX) (TSX:TRX.TO) delivered another quarter of record operational and financial performance in Q1 2026, reinforcing the company’s transition into a consistently higher‑margin, cash-generative gold producer. Results for the period ended November 30, 2025, showcased rising production scale, expanding margins, and continued progress on the multi-year expansion of the Buckreef processing plant. With realized gold prices averaging $3,860 per ounce, TRX demonstrated strong leverage to the macro environment while maintaining disciplined execution across operations, development, and balance‑sheet management.

Quarterly production reached a new high of 6,597 ounces, supported by sustained access to higher-grade ore and stable plant performance. Revenue increased to $25.1 million, gross profit rose to $14.2 million (57% margin), and EBITDA reached $13.2 million (53% margin). Year‑over‑year comparisons highlight the scale of improvement: revenue more than doubled, EBITDA tripled, and margins expanded sharply. Sequentially, TRX also improved across most key metrics relative to Q4 2025, including higher pours, stronger margins, and increased revenue. Management reaffirmed fiscal 2026 production guidance of 25,000–30,000 ounces.

Development work advanced meaningfully during the quarter. The company is now executing on a dual‑circuit expansion—3,000+ tpd sulphide and 1,000 tpd oxide/transition—that exceeds the 2025 PEA design and is expected to lift annual production above 62,000 ounces. Major long‑lead components were procured, and upgrades to the existing 2,000 tpd plant progressed on schedule. Tailings capacity remains a critical path item, with TSF 2.2 nearing completion and TSF 3 expected online by late FY2026.

Liquidity strengthened further, with the current ratio improving to ~1.7x and the ROM stockpile rising to 22,891 ounces post‑quarter. Additional upside stems from a mine‑plan reassessment under record gold prices, which could materially lower cut-off grades and expand resources and reserves.

Overall, Q1 2026 confirms TRX Gold’s strong operational momentum and reinforces the company’s path toward a 60,000+ ounce annual production profile. We have revised our target price to US$1.80/share, reflecting updated dilution, expanded production profile, and higher long term gold price assumptions.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.