By M. Marin

OTC:ABVC

READ THE FULL ABVC RESEARCH REPORT

Expanding Asset Portfolio; Clinical Trials Moving Forward

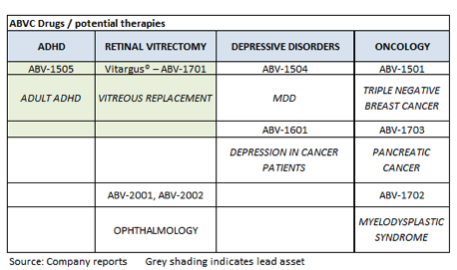

ABVC BioPharma (OTC:ABVC) is a biopharma and medical device company developing therapies for a range of conditions focused on oncology/hematology, central nervous system (CNS) and ophthalmology. The company continues to advance its diversified drug asset portfolio, which includes ABV-1505 and Vitargus, which are in advanced stages of development and also have the potential for multiple programs, as well as several assets in earlier stages of development.

Addressing a Growing Problem – Depression

The active ingredient in ABV-1505 (and in ABV-1504 and ABV-1601) is PDC-1421, a botanical investigational new drug (IND). ABVC is evaluating PDC-1421’s efficacy in treating major depressive disorder (MDD). Depression in general is a growing problem globally.

ABVC's clinical trial for the treatment of MDD in cancer patients studying ABV-1601 at Cedars-Sinai Medical Center (CSMC) in Los Angeles has been posted on the CSMC website. ABVC hopes to finalize the CSR by year-end 2021.

ABVC also expects to form a commercial partnership in the U.S. to collaborate the development of ABV-1504 for the treatment of MDD and believes that plant-derived medicines can have substantial therapeutic benefits while simultaneously minimizing potential side-effects compared to current standard of care therapies. Side-effects can include anxiety, sleep disruptions and weight gain, among others.

Introducing proven therapies internationally

Overall, ABVC’s strategy is to find new products that have already shown efficacy in the Asia-Pacific region and introduce them to other international markets via licensing arrangements. The company is developing several clinical and business initiatives that management believes hold the potential for important milestones and catalysts.

As of the end of 1Q21, the company had about $2.6 million of cash and equivalents plus about $0.7 million of restricted cash. To strengthen the balance sheet and raise funds to support its growth efforts including expanding its asset and IP portfolio, the company filed a prospectus for an offering and expects proceeds of up to about $6 million to advance its growth strategy. The offering is also expected to advance the company's goal of uplisting its shares.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $40,000 annually for these services. Full Disclaimer HERE.