By M. Marin

NYSE:TRC

READ THE FULL TRC RESEARCH REPORT

Tejon Ranch Company (NYSE:TRC) recently announced that a Los Angeles Superior court has approved the majority of its Environmental Impact Report (EIR) for the Centennial master planned mixed use community. In addition, objections raised in a lawsuit challenging the development of Grapevine were rejected earlier this year by a court ruling in TRC’s favor.

TRC also has received approval to develop multi-family apartments within the Tejon Ranch Commerce Center (TRCC). Recently granted Kern County approvals authorize TRC to develop up to 495 multi-family residences in thirteen apartment buildings just north of the Outlets at Tejon.

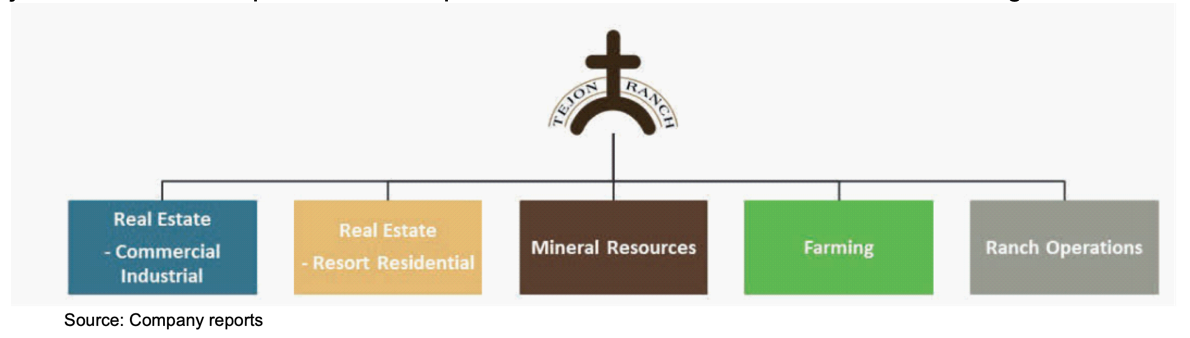

TRC is a real estate-development company that aims to monetize its land-based assets, In addition to three planned master developments and other real estate projects, the company currently derives revenue from the Tejon Ranch Commercial Center (TRCC), farming and ranching, among other activities. Management believes that its development plans fulfill important needs, including addressing the need for more housing in California, job creation and responsible development that is coordinated with conservationist goals.

The company expects its development efforts to create both permanent and development-related jobs. Centennial, for instance, is expected to create more than 23,000 permanent jobs on site and nearly 25,000 construction jobs. TRC also expects its master planned mixed-use residential communities to include measures to conserve water and minimize carbon footprints.

The company's 2020 operating results were impacted by the economic downturn and business disruptions caused by the COVID-19 pandemic. Total revenue declined 24% year-over-year to $37.8 million. TRC reported a 2020 net loss attributable to common stockholders of $747,000 or ($0.03) per share compared to net income of $10.6 million or EPS of $0.40 in 2019.

With cash and equivalents of $55.3 million plus marketable securities of $2.8 million at year-end 2020 and a commitment to conserving capital if the pandemic continues to constrain revenue, the company remains well-capitalized. The company also reduced long-term debt to $52.6 million from $57.5 million at year-end 2019.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks provides and Zacks receives quarterly payments totaling a maximum fee of $40,000 annually for these services. Full Disclaimer HERE.