By M. Marin

NYSE:CXW

READ THE FULL CXW RESEARCH REPORT

OCCUPANCY WILL CONTINUE TO RISE WITH REACTIVATED CAPACITY COMING ONLINE

Strong momentum continues with new contract, potentially others

CoreCivic (NYSE:CXW) recently made two significant announcements. Last week CXW announced that it has been awarded a new contract under an intergovernmental services agreement (IGSA) between the City of Mason, Tennessee, and ICE (U.S. Immigration and Customs Enforcement) to resume operations at its West Tennessee Detention Facility through August 2030 with an option to extend. The 600-bed facility has been idle since September 2021.

The agreement provides for a fixed monthly payment plus an incremental per diem payment based on detainee populations. Once the facility is fully activated, it is expected to produce about $30 million to $35 million total annual revenue for CXW at margins that are consistent with the CoreCivic Safety segment.

The new contract is not expected to have a meaningful impact on 3Q25 earnings but be accretive to earnings beginning in 4Q25, although we are not modifying our model at this point. Full ramp is currently expected to be complete by the end of 1Q26. With this latest contract award, CXW has reactivated four idle facilities containing an aggregate roughly 6,600 beds, and made more than 1,000 additional detention beds available to ICE. The company previously indicated that it was in discussion to re-activate other idled facilities, in addition to four announced earlier, reflecting the additional capacity required by ICE.

Between reactivating idled facilities & M&A, CXW has added capacity to meet growing ICE demand

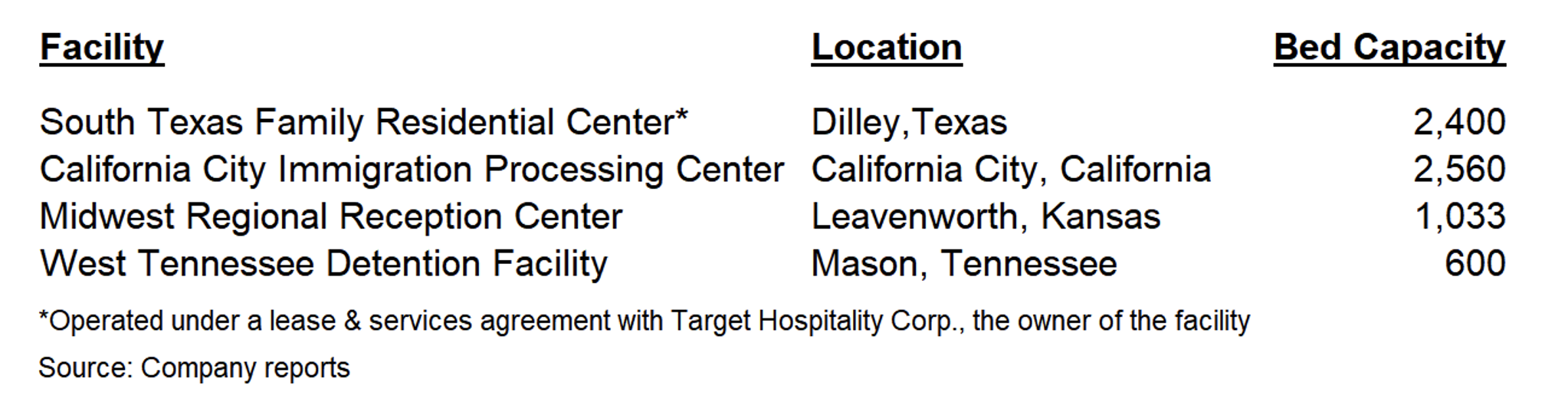

CXW is in the process of reactivating the following idled facilities:

- In March, the company started re-activating a facility operated previously in Dilley, Texas. Following expiration of an earlier contract, CXW entered into an amended intergovernmental services agreement (IGSA) with ICE and the City of Dilley, Texas to resume operations at the South Texas Family Residential Center in Dilley and care for up to 2,400 people. The amended contract runs through March 2030 and may be further extended. The company has also entered into a new lease agreement with Target Hospitality Corporation, which owns the facility. The agreement is expected to contribute about $180 million in annual revenue to CXW once it is completely active.

- The company entered into a Letter Contract with ICE effective April 1, 2025, to re-active the 2,560-bed California City Immigration Processing Center. Initial funding authorized is $10.0 million to $31.2 million for a six-month period to help cover start-up costs as CXW and ICE negotiate a long-term contract.

- The company entered into a Letter Contract with ICE effective March 7, 2025, to re-activate the 1,033-bed Midwest Regional Reception Center, with initial funding of up to $5.0 million to $22.6 million for a six-month period to help cover start-up costs while CXW and ICE negotiate and a long-term contract. Activities have been paused by a lawsuit the City of Leavenworth filed alleging that a Special Use Permit (SUP) is required to operate the facility. As the legal process to resolve this proceeds, CXW remains confident that ICE intends to using this facility.

- Last week CXW announced that it has been awarded a new contract under an intergovernmental services agreement (IGSA) between the City of Mason, Tennessee, and ICE (U.S. Immigration and Customs Enforcement) to resume operations at its West Tennessee Detention Facility through August 2030 with an option to extend. The 600-bed facility has been idle since September 2021.

We view CEO appointment positively

Yesterday CXW announced that its board has appointed Patrick D. Swindle to President and Chief Executive Officer, effective January 1, 2026, to succeed Damon T. Hininger, who has served as CEO since August 17, 2009. He was appointed President and Chief Operating Officer on January 1, 2025. We view this appointment positively, as he has extensive industry experience and has served in various executive roles at CoreCivic.

He has overseen significant growth and momentum at CXW, having joined the company in 2007 as Managing Director, Treasury and has held numerous positions, including VP, Strategic Development; SVP Operations; Executive Vice President and Chief Corrections Officer; and Executive Vice President and COO.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.