By M. Marin

NASDAQ:GMGI

READ THE FULL GMGI RESEARCH REPORT

iGaming group Golden Matrix Group (NASDAQ:GMGI) announced a leadership transition expected to support the execution of its growth strategy. Effective December 12, 2025, at the latest, Brian Goodman will step down as CEO and member of the board, and board Chairman William Scott will step in as interim CEO and lead the search for the next CEO. He has extensive experience in the global gaming space, with previous executive positions at GTECH/Lottomatica. We believe operational profitability could see improvements, depending on the new CEO GMGI appoints, coupled with recent measures. Moreover, Meridianbet’s founder opting for a debt-to-equity conversion on funds GMGI owed him following its acquisition of Meridianbet arguably helps enhance GMGI’s financial flexibility and further aligns insiders’ interests with those of public shareholders.

Recently attained record quarterly revenue, with multiple upcoming potential growth drivers.

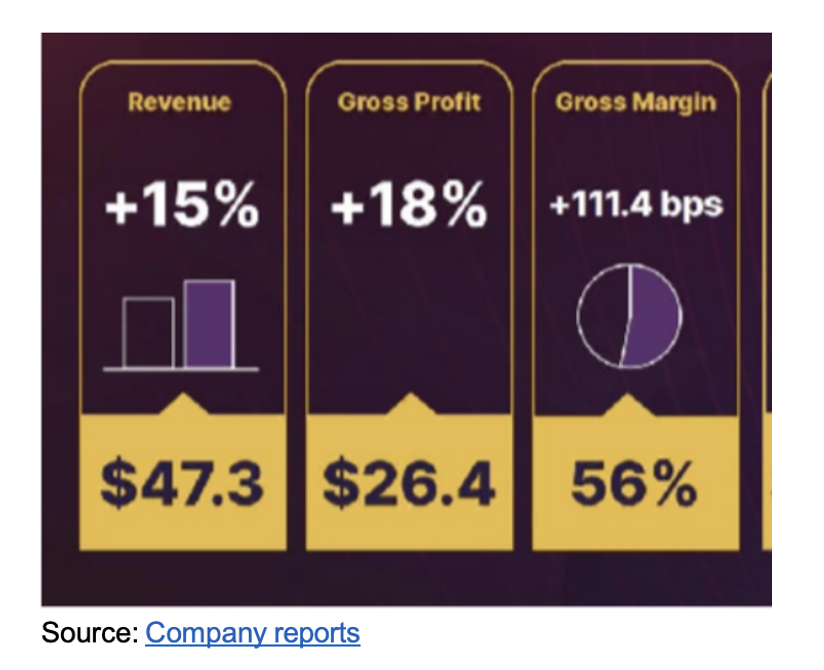

As GMGI executes its growth strategy, the company achieved record quarterly revenue of $47.3 million in 3Q25, up 15.4% year-over-year, and gross profit of $26.4 million, up 18% year-over-year. These improvements reflect a shift in the product mix, as well as optimization of the company’s marketing spend, among other factors, as GMGI leverages the infrastructure it has developed, including integrating and scaling subsidiary Meridianbet.

For full year 2025 guidance, revenue is expected in the range of $186 million to $187 million, which would represent annual growth of 23% to 24% compared to 2024. The company expects to continue to benefit from growing scale, and geographic and product diversification.

In addition, GMGI has also added new gaming licenses, expanding its geographic footprint significantly and growing its gaming content library, among other growth initiatives. The company also cites the optimistic benefits of its AI-driven technology as a key factor contributing to lowering its acquisition costs and extending customer lifetime value. To further boost unit economics, GMGI just launched Meridian Missions, a proprietary player engagement and reward system designed to increase user retention and drive long-term player profitability, leveraging points-based gamification.

Stronger balance sheet enhances financial flexibility; debt-to-equity transaction

GMGI continues to strengthen its balance through debt repayments and other measures. Meridianbet’s founder and largest shareholder has opted for a debt-to-equity conversion on $8 million that GMGI owed him following its acquisition of Meridianbet. By eliminating $8 million in short-term debt, it arguably helps enhance GMGI’s financial flexibility to support its growth measures and further aligns insiders’ interests with that of public shareholders.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.