By M. Marin

NASDAQ:ORMP

READ THE FULL ORMP RESEARCH REPORT

ADVANCING ORMD-0801 THROUGH CLINICAL STUDIES

Trial will focus on key patient subpopulations that have responded to ORMD-0801 following analysis of earlier trial data

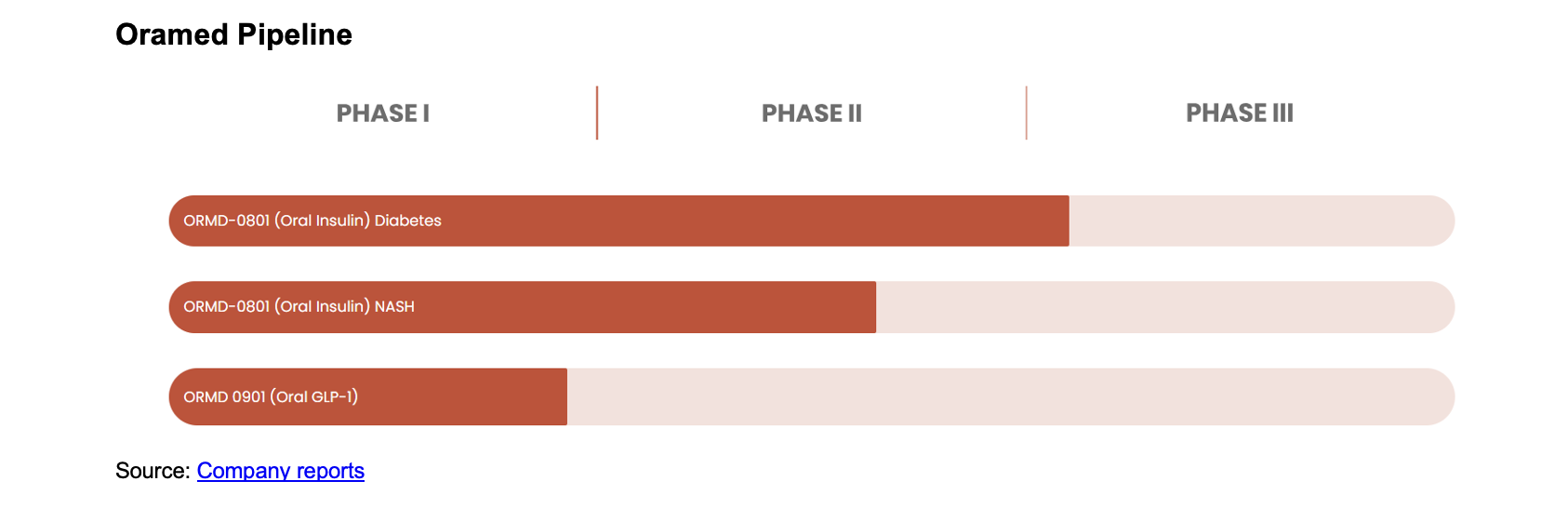

Oramed Pharmaceuticals (NASDAQ:ORMP) is leveraging its balance sheet to make investments in multiple early stage companies, while concurrently advancing its strategy to move its assets forward. Oramed plans to continue its oral insulin development program independently, which it believes will allow the company to retain full control and build a database in support of its oral insulin formulation to move ahead towards potential regulatory approval and for potential commercialization partners. The company believes the trial was designed to maximize cost-efficiency, minimize trial enrollment, and shorten the timeline. As noted, ORMP is initiating a 60-patient, US-based trial following its analysis of earlier Phase 2 and Phase 3 data that identified high-responder subgroups demonstrating encouraging results.

In prior clinical activities, a subpopulation of patients with specific parameters such as body mass index (BMI), baseline HbA1c, age, gender, and body weight appeared to respond positively to the company’s oral insulin. These subsets exhibited an over 1% placebo-adjusted, statistically significant reduction in HbA1c. As a result, a differentiated protocol that is aligned with the positive subpopulation data and informed by feedback from discussions with the FDA is expected to guide the design of the planned Phase 3 trial. Participants, including those with lower BMI and within older demographics, showed the possibility of achieving over 1% reduction in HbA1c, which ORMP notes is a clinically meaningful outcome that might strengthen the regulatory and commercial prospects of ORMD-0801.

The clinical trial in the U.S. will be designed to incorporate takeaways from previous clinical studies in order to focus on key patient subpopulations that have responded in prior activities, as mentioned above. ORMP hopes to leverage its analysis in order to optimize the potential for successful outcomes to advance its oral insulin therapy in diabetes management.

Rights agreement designed to help fight prospective hostile takeover attempt

Last week, the company announced that it has adopted a Rights Agreement, dated November 17, 2025, and declared a dividend of one common stock purchase right on each outstanding ORMP share. The rights are designed to help the company fight a prospective hostile takeover attempt. Existing stockholders retain rights to purchase one share at $10.00, in the event the rights become exercisable following the beneficial acquisition and/or tender offer for 15% or more of outstanding shares by a person or group.

INVESTMENT PORTFOLIO YIELDING APPRECIATION

Principal on Scilex investment has been fully repaid

In terms of its investment strategy, one of the investments ORMP made was in Scilex Holding Company (NASDAQ:SCLX), a biopharma company focused on acquiring, developing, and commercializing non-opioid management products to treat acute and chronic pain, with collateralized financing. Scilex had issued ORMP a promissory note collateralized by most of its assets, plus penny warrants to purchase Scilex shares. Last week, ORMP announced that the principal on its Scilex investment has been fully repaid. The company received roughly $27 million during 3Q25, resulting in total repayment from Scilex of $100 million principal.

Since ORMP’s strategic investment in DRTS, DRTS shares have appreciated

Earlier this year, ORMP made a $36.9 million investment in and formed a strategic collaboration with Alpha Tau Medical (NASDAQ:DRTS), an Israeli oncology therapeutics company developing an innovative alpha-radiation cancer therapy called Alpha DaRT™ (which stands for Diffusing Alpha-emitters Radiation Therapy). Alpha DaRT represents a novel approach to cancer treatment that leverages the use of alpha radiation to treat solid tumors. It is localized alpha particle radiotherapy designed to destroy solid tumors with precision, while minimizing damage to surrounding healthy tissue. Conventional gamma/beta radiation relies on oxygen-dependent, single-strand DNA breaks. Conversely, Alpha DaRT directly damages the cell DNA, inducing irreparable double-strand DNA breaks that are known to be highly destructive to cancerous cells regardless of the cell’s lifecycle stage or level of oxygenation. In this way, Alpha DaRT delivers more precise alpha radiation that minimizes damage to healthy tissue around the tumor. Alpha Tau’s technology platform can be used alone or in conjunction with other cancer treatment modalities.

Thus far, the investment has appreciated. Oramed initially purchased about 14.1 million Alpha Tau shares at $2.612 per share. Subsequently, ORMP purchased roughly 259,000 additional shares through September 30, 2025, in the open market at an average $3.27 per share for an aggregate $846,000, raising the total investment to $37.7 million. DRTS shares closed at $3.82 in the latest trading session. Unrealized gains from the Alpha Tau position and other investments, combined with the complete $100 million cash repayment from Scilex contributed to $65 million in net income in 3Q25. Oramed had cash of $52.2 million the end of September 2025, compared to $54.4 million at year-end 2024, plus $82.5 million of short-term deposits, marketable securities and investments. ORMP has substantial liquidity as it advances its oral drug delivery platform and pursues strategic opportunities, including its portfolio of strategic investments.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.