By M. Marin

NASDAQ:SBC

READ THE FULL SBC RESEARCH REPORT

Strategies Aimed at Expanding Services & Footprint, Boosting Customer Average Revenue

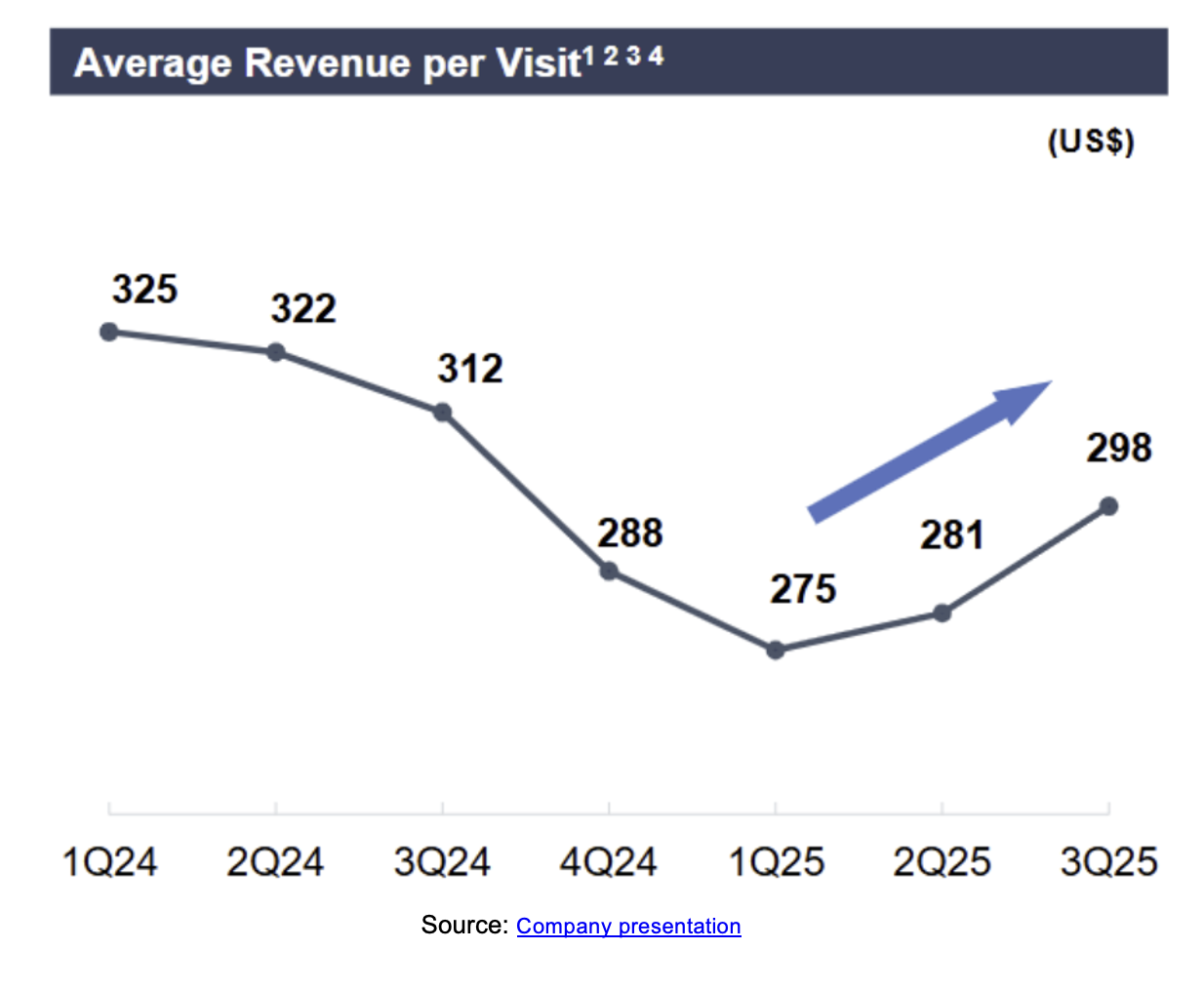

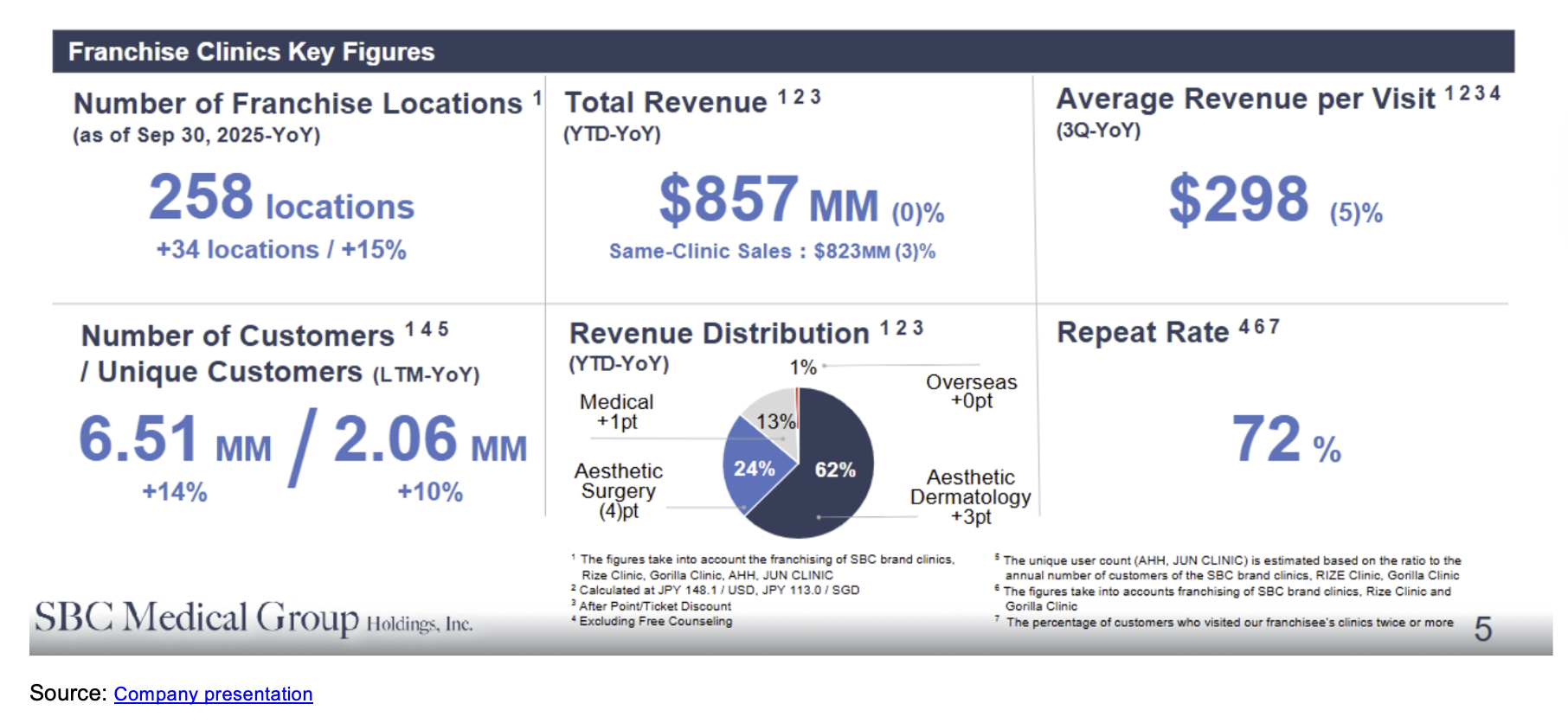

SBC Medical Group Holdings (NASDAQ:SBC), which provides end-to-end solutions enabling aesthetics clinics to launch, expand, and/or operate their businesses, reported 3Q25 results last week. Revenue of $43.4 million declined from $53.1 million in 3Q24, which was not unexpected as management has previously remarked on ongoing headwinds that SBC is working to overcome. Conversely, average revenue per customer increased 5% in 3Q25, fueled by pricing adjustments and adding higher revenue-generating customers through its multi-brand strategy.

SBC has launched multiple organic strategies to counter intensifying competition in Japan's aesthetic medicine market and also completing strategic M&A to complement these measures. SBC launched a multi-brand strategy to address the increasingly diverse needs of its growing customer base, for example, to customize services across multiple brands, segment the market, and garner more market share overall.

The company adjusted pricing upward for certain services characterized by high demand and maintains some discounting on certain services in order to remain competitive. A growing number of men increasingly are interested in aesthetic procedures, particularly for hair replenishment. The company also revised the franchise fee structure to make it easier financially for franchisees to join its network and, as they ramp services and customer bases, pay fees based on a tiered fee system that aligns with the scale.

The company is also offering a broader range of franchisee services, which SBC expects will strengthen its position and market share within the aesthetic and specialized medical care areas. Clinics in the SBC franchise network have expanded their offerings to encompass a broad range of specialized medical services, including plastic surgery and infertility treatment.

Strategic initiatives to drive growth

SBC has launched multiple organic strategies to counter the headwinds it has encountered, including intensifying competition in Japan's aesthetic medicine market as new competitors have entered the market. Among the many initiatives, the company has launched a multi-brand strategy to address the increasingly diverse needs of its growing customer base. By customizing services across multiple brands, the company expects to segment the market and garner more market share overall.

- Revised pricing

- New services

- International expansion

- Multiple brands

- New products

- Strategic M&A

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.