By M. Marin

NYSE:CXW

READ THE FULL CXW RESEARCH REPORT

Shares do not seem to reflect recent business momentum

CoreCivic (NYSE:CXW) has recorded strong momentum to date in 2025, with higher federal and state populations and higher average per diem rates at many locations and new contracts closing at a pace the company has not experienced in some time. For example, CXW has been awarded contracts at five idle facilities in 2025 and is in discussions with ICE and other government partners to reactivate others. We believe the facility reactivations and multiple new contracts position CXW for strong performance going forward. Reactivation activities at one – the Midwest Regional Reception Center – have been paused by a lawsuit. Once the other four reach stabilized occupancy, they are expected to generate roughly $320 million of annual revenue. Of these, California City and West Tennessee are expected to reach stabilized occupancy in early 2026. CXW still has five additional idle facilities containing over 7,000 beds that it can bring back online.

- Last week, CXW announced that its board has authorized an increase to its existing share repurchase plan.

- We view this increased authorization as a positive and believe it reflects the company’s positive outlook on its business and goal to deliver shareholder value.

- We believe reactivation of idled facilities & multiple new contracts position CXW for strong performance ahead.

- CXW has five additional idle facilities and is in discussions to bring some back online.

- CXW has a strong balance sheet and liquidity to support operations, growth measures, share buybacks, and other capital allocations.

- Revenue from ICE was up 54.6% in 3Q25 & average occupancy was 76.7% vs. 75.2%.

Share repurchases are a capital allocation priority

Despite the high level of activity, year-to-date CXW shares are down about 22.5%. CXW shares trade well below historical multiple levels, and we continue to view the company’s recent momentum, growth, and balance sheet measures as catalysts for ongoing multiple expansion over time. The company believes its shares are undervalued and has been aggressively repurchasing shares in 2025. In fact, share repurchases are a capital allocation priority with the shares at these levels.

We expect the trend of CXW actively repurchasing its shares to continue and potentially accelerate. The company repurchased 5.9 million shares at an aggregate cost of $121.0 million, or $20.60 per share, year-to-date through September 30, 2025, under its share repurchase plan. In 3Q25 alone, CXW bought 1.9 million shares at an aggregate cost of $40.0 million. Since the share repurchase program was authorized in May 2022, through September 30, 2025, CXW has repurchased an aggregate 20.4 million shares at $302.1 million, or $14.81 per share, and 21.5 million shares at an aggregate $322.1 million cost, or $14.98 per share, through November 7, 2025.

View increased authorization as a positive that reflects CXW’s positive business outlook

Last week, the company announced that its board has authorized an increase to the existing share repurchase plan. This authorizes the company to purchase up to an additional $200 million in CXW shares. As a result of the increase, the aggregate authorization increased from up to $500.0 million shares to up to $700.0 million shares. As of November 7, 2025, CXW had $377.9 million of repurchase authorization available under the share repurchase program, with the added authorization. We view this increased authorization as a positive and believe it reflects the company’s positive outlook on its business and goal to deliver shareholder value.

CXW has a strong balance sheet and liquidity to support buybacks and growth measures

CXW has a strong balance sheet and liquidity to support operations, buybacks, and growth measures. CXW had $56.6 million of cash at the end of 3Q25 and $191.4 million available under its revolver, for liquidity of about $248 million. The company expects to receive full payment and interest payments accrued during the shutdown post shutdown.

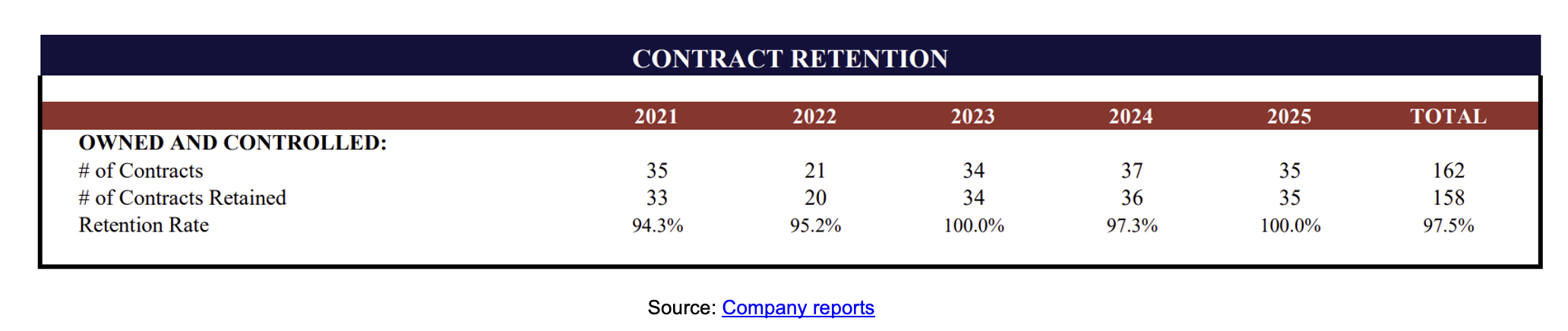

Moreover, the company has had a high and stable retention rate, which we believe underscores the strength of its relationships with government partners, strong track record of delivering services and more modern state of its facilities compared to alternative solutions, among other factors. Over the past 5-years, renewal rates on owned and controlled facilities is 97.5%. Management also believes renewal rates remain high, reflecting the limited supply of and older state of many government-owned correctional facilities, as noted, and the programs the company offers inmates and the cost-effectiveness of its services. We believe this high retention augers well for continued business momentum going forward, particularly given the needs of ICE and other government partners.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives payments totaling a maximum fee of up to $50,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.